Crocs Inc (CROX) Reports Record Revenues and EPS for Q4 and Full Year 2023

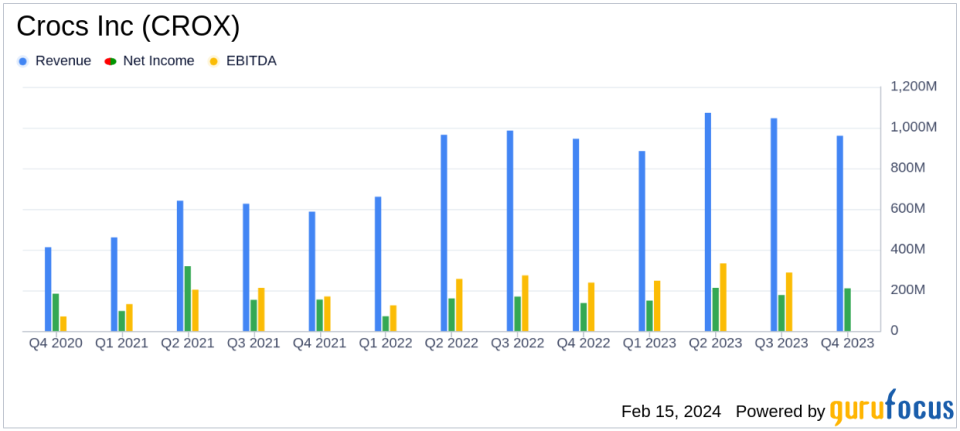

Revenue Growth: Crocs Inc (NASDAQ:CROX) reported an 11.5% increase in annual revenue, reaching nearly $4.0 billion.

Earnings Per Share: Diluted EPS saw a significant rise of 46.8% year-over-year, reaching $12.79 for the full year.

Gross Margin Improvement: Gross margin expanded by 350 basis points to 55.8% for the year.

Debt Reduction: The company repaid $666 million of debt in 2023, improving its leverage ratios.

Inventory Management: Inventories decreased by 18.3%, indicating efficient inventory management.

Cash Flow Strength: Cash provided by operating activities increased by 54.3% to $930 million.

Strategic Focus: Crocs Brand and HEYDUDE Brand are now the reportable operating segments, reflecting management's strategic focus.

On February 15, 2024, Crocs Inc (NASDAQ:CROX) released its 8-K filing, announcing record financial results for the fourth quarter and full year of 2023. Crocs Inc, a global leader in innovative casual footwear, has demonstrated resilience and strategic prowess in a challenging economic environment.

Company Overview

Crocs Inc is renowned for its distinctive range of casual lifestyle footwear and accessories catering to men, women, and children. The company operates through its reportable geographic segments: Americas, Asia Pacific, and EMEA, with a strategic focus on its Crocs Brand and HEYDUDE Brand segments.

Financial Performance and Challenges

The company's performance in 2023 was marked by an 11.5% increase in revenue, reaching nearly $4 billion. This growth was supported by a robust gross margin of 55.8%, a 350 basis point improvement over the previous year. Crocs Inc's disciplined execution and strategic investments have led to these impressive results, despite global supply chain challenges and cost inflation.

The challenges faced by Crocs Inc, such as the dynamic global economic conditions, underscore the importance of the company's agile business model and effective inventory management, which saw an 18.3% decrease in inventories. These challenges, if not navigated carefully, could impact future performance, making the company's strategic focus and execution crucial for sustained growth.

Financial Achievements and Industry Significance

Crocs Inc's financial achievements, particularly the expansion of its gross margin and the reduction of its debt, are testaments to its operational efficiency and prudent financial management. These achievements are significant in the Manufacturing - Apparel & Accessories industry, where margins are often pressured by fluctuating costs and consumer demand.

Key Financial Metrics

Key financial metrics for Crocs Inc include:

"Revenues were $960 million, an increase of 1.6% from the same period last year, or 1.5% on a constant currency basis. Direct-to-consumer ('DTC') revenues grew 6.8% and wholesale revenues contracted 4.6%. By brand, Crocs revenues were $732 million, an increase of 10.0% from the same period last year, or 9.9% on a constant currency basis. HEYDUDE revenues were $228 million, a decrease of 18.5% from the same period last year, or 18.7% on a constant currency basis."

The company's income from operations increased by 21.9% to $1,037 million, with an operating margin increase of 230 basis points to 26.2%. Cash provided by operating activities rose significantly by 54.3% to $930 million, indicating strong cash flow generation.

Analysis of Company's Performance

Crocs Inc's performance in 2023 reflects a company that is effectively balancing growth with profitability. The record revenues and EPS, combined with a strong balance sheet and cash flow, position Crocs Inc favorably for future investments and market share gains. The company's focus on strategic areas and the disciplined execution of its business model are likely to continue driving its success in the competitive apparel and accessories industry.

For a detailed view of Crocs Inc's financial statements and further insights into its performance, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Crocs Inc for further details.

This article first appeared on GuruFocus.