Crocs (NASDAQ:CROX) Posts Q4 Sales In Line With Estimates, Stock Soars

Footwear company Crocs (NASDAQ:CROX) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 1.6% year on year to $960.1 million. It made a non-GAAP profit of $2.58 per share, down from its profit of $2.65 per share in the same quarter last year.

Is now the time to buy Crocs? Find out by accessing our full research report, it's free.

Crocs (CROX) Q4 FY2023 Highlights:

Revenue: $960.1 million vs analyst estimates of $958.5 million (small beat)

EPS (non-GAAP): $2.58 vs analyst estimates of $2.37 (8.7% beat)

EPS (non-GAAP) Guidance for Q1 2024 is $2.20 at the midpoint, below analyst estimates of $2.26

Free Cash Flow of $320.5 million, up 48.8% from the previous quarter

Gross Margin (GAAP): 55.3%, up from 45.9% in the same quarter last year

Market Capitalization: $6.56 billion

"We delivered a record year for Crocs Inc. capped off by a strong fourth quarter that exceeded expectations across all metrics. Revenues of nearly $4 billion grew over 11% underpinned by industry-leading operating margins and double-digit earnings per share growth. Crocs Brand grew across all regions and channels, highlighting the power of our strategy and disciplined execution. We made good progress in the fourth quarter towards returning our HEYDUDE Brand to a pull-market position resulting in improved gross margins and healthy inventory levels exiting the year," said Andrew Rees, Chief Executive Officer.

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

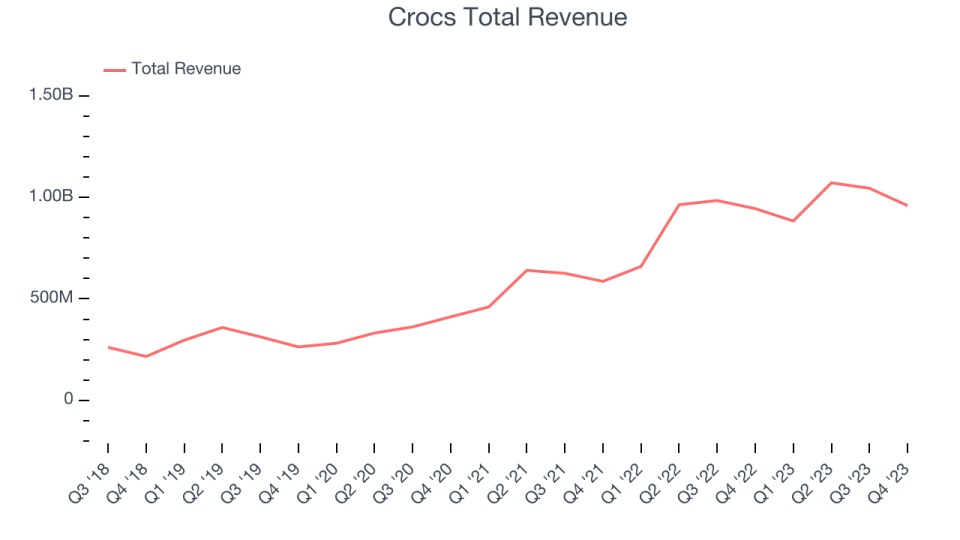

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Crocs's annualized revenue growth rate of 29.5% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Crocs's healthy annualized revenue growth of 30.9% over the last two years is above its five-year trend, suggesting its brand resonates with consumers.

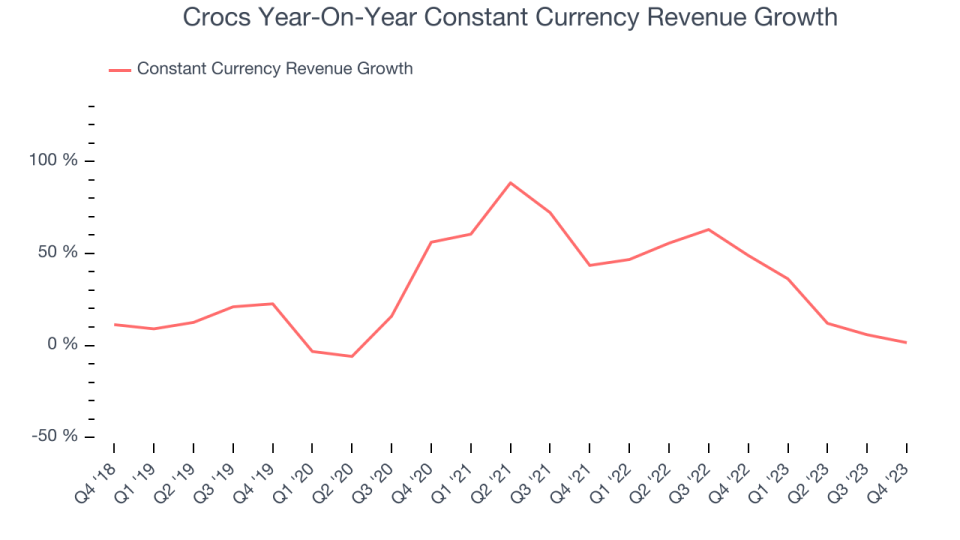

Crocs also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 33.7% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that foreign exchange rates have been a headwind for Crocs.

This quarter, Crocs grew its revenue by 1.6% year on year, and its $960.1 million of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

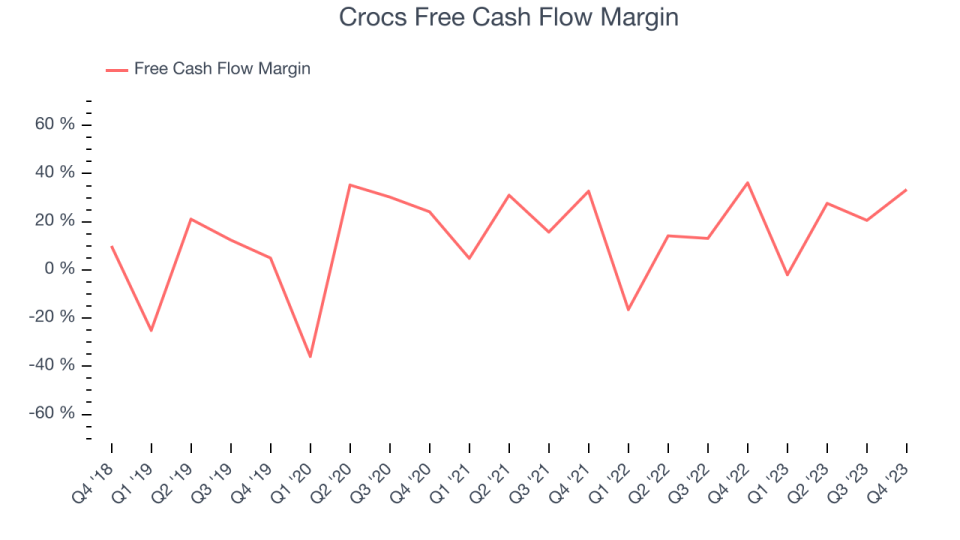

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Crocs has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 17.5%, above the broader consumer discretionary sector.

Crocs's free cash flow came in at $320.5 million in Q4, equivalent to a 33.4% margin and down 6.3% year on year. Over the next year, analysts predict Crocs's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 20.6% will increase to 23.7%.

Key Takeaways from Crocs's Q4 Results

It was good to see Crocs beat analysts' revenue and EPS expectations this quarter, driven by better-than-expected performance at both its Crocs and HEYDUDE brands. We were also glad its full-year 2024 revenue and earnings guidance exceeded Wall Street's estimates despite next quarter's earnings guidance coming in soft. For 2024, the company expects its Crocs brand to grow revenue by 5% year on year and for its HEYDUDE brand to be flat to slightly up - an improvement from the 18.5% decrease HEYDUDE posted this quarter. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 5.2% after reporting and currently trades at $114.01 per share.

So should you invest in Crocs right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.