Crocs Is a Rising Star in Footwear

Crocs Inc. (NASDAQ:CROX) experienced a significant surge of nearly 21% in a single trading day, with its share price rising from $86.70 to approximately $104.50. This increase followed positive updates in the company's financial guidance. However, the stock's performance over the past 12 months shows a different picture when considering a broader time frame. During this period, Crocs' share price declined by nearly 26%, while the S&P 500 (SPY) gained around 24.7%.

Let's delve deeper to determine whether Crocs remains a viable investment option for investors in light of the recent jump in its share price.

Business overview

Crocs designs and sells casual lifestyle footwear and accessories, including brands such as Crocs, LifeRide and HEYDUDE. The company markets its products in over 85 countries through two primary channels: wholesale and direct-to-consumer. The wholesale channel, comprised of brick-and-mortar retailers, e-retailers and distributors in various countries, accounted for 54.90% of the company's total sales. Meanwhile, the direct-to-consumer channel, which includes e-commerce marketplaces and full-priced retail stores, represented 45.10% of total revenue.

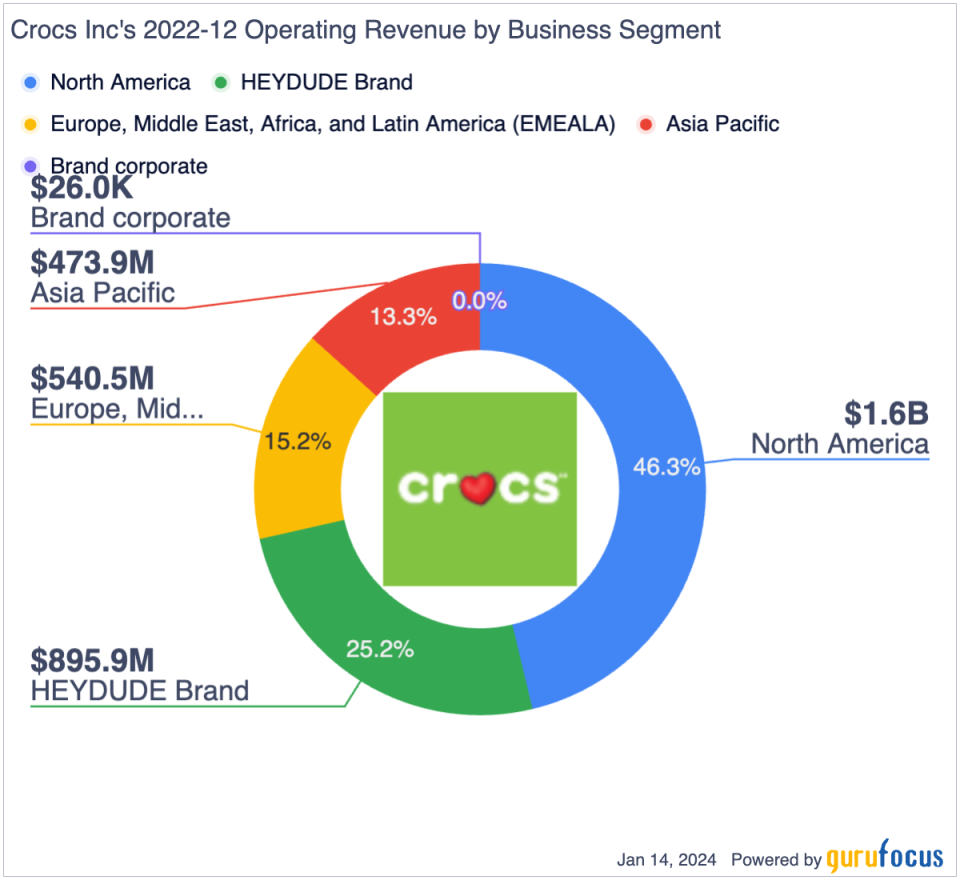

The company recorded North America as its largest business segment, generating $1.60 billion in 2022 and accounting for 46.3% of the total revenue. The HEYDUDE brand ranked second with nearly $896 million in sales, representing 25.20% of sales. Europe and Asia Pacific contributed $540.5 million and $474 million in revenue, respectively.

Revenue boom and margin recovery post-pandemic

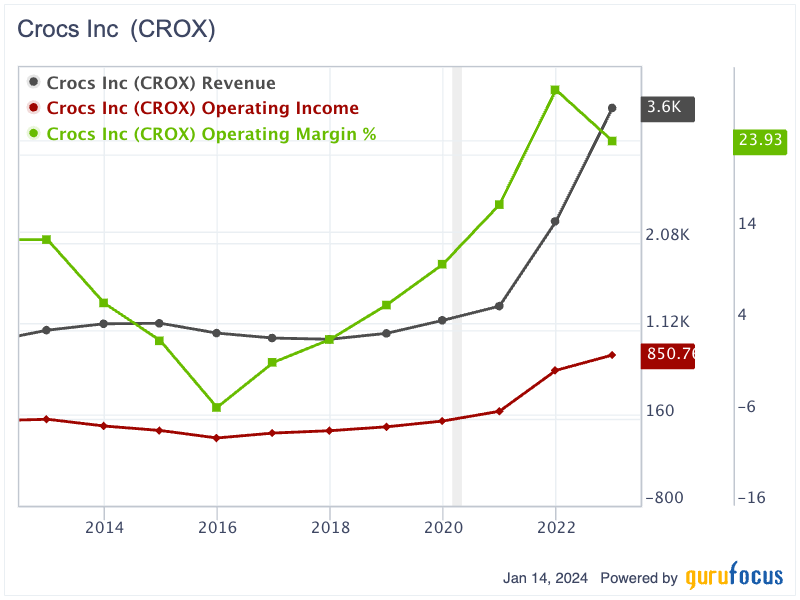

Before the pandemic, Crocs experienced relatively modest revenue growth, increasing from $1.12 billion in 2012 to $1.23 billion in 2019. However, there was a significant surge in revenue post-pandemic, reaching over $3.55 billion in 2022. The sales were 54% higher than in 2021, primarily driven by the acquisition of HEYDUDE and the increased sales volume of the Crocs brand. Additionally, $155 million of the sales growth, amounting to a 6.7% increase, was attributed to higher average selling prices for the Crocs brand. This suggests that Crocs can raise prices while maintaining or increasing sales volume, indicating a strong pricing power over consumers.

Operating income decreased slightly, from $147.6 million in 2012 to $128.7 million in 2019, then shot up to $850.76 million in 2022. The growth of operating income in 2022 compared to 2021 was also driven by HEYDUDE's acquisition.

Crocs' operating margin has improved over the years. From 2012 to 2015, there was a substantial decline in the operating margin, dropping from 13.14% to a low of -5.23% due to the impairment charges and restructuring charges to replace the executive management. However, since 2015, there has been a consistent improvement, with the operating margin reaching 29.53% in 2021 and stabilizing at 23.95% in 2022.

Best-in-class operating margin

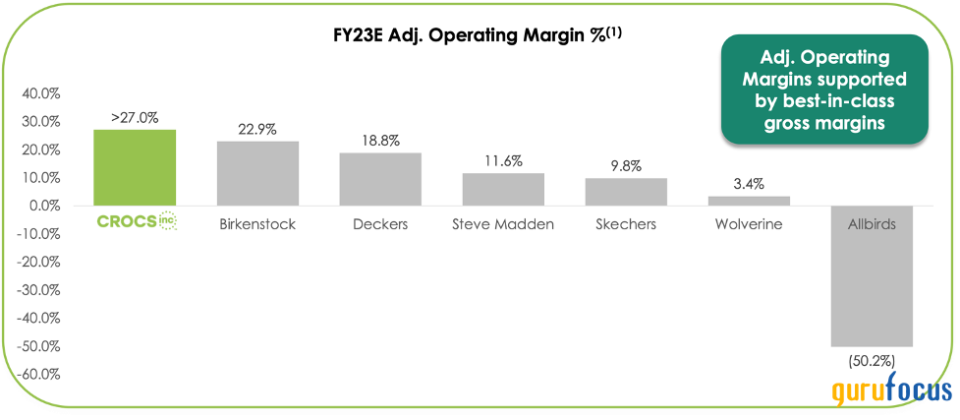

For 2023, Crocs is projected to generate approximately $3.95 billion in revenue, marking an 11% increase over 2022's figures. Its revenue includes $3 billion in sales from the Crocs brand and $949 million from the HEYDUDE brand. Further, the company has raised its adjusted operating margin forecast to over 27%.

This positions Crocs at the top of its peer group, surpassing Birkenstock (NYSE:BIRK), Deckers (NYSE:DECK), Steven Madden (NASDAQ:SHOO) and Skechers (NYSE:SKX). Birkenstock follows closely with an operating margin of around 22.9% and Deckers' at 18.8%, while Steven Madden and Skechers have considerably lower margins at 11.6% and 9.8%.

Source: Crocs' presentation

Impressive growth in cash flow

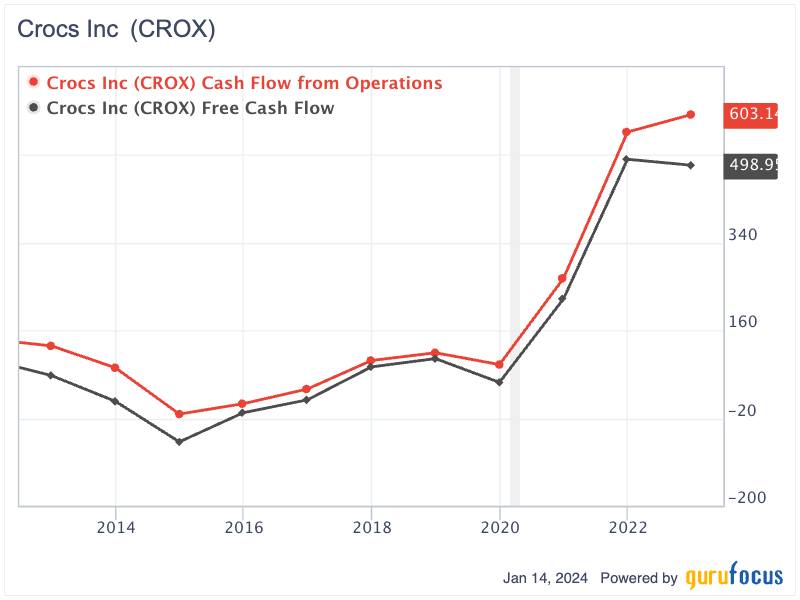

Crocs' operating and free cash flow have followed a similar trend with operating profitability, experiencing a decline from 2012 to 2015 and gradually improving. In 2012, Crocs' operating cash flow stood at $128.36 million, with the free cash flow at a mere $67.52 million. By 2022, these figures had risen significantly, with the operating cash flow reaching $603.14 million and the free cash flow climbing to $499 million. Consequently, despite some fluctuations, the compounded annual growth rate of free cash flow over the past decade has been an impressive 24.48%.

Manageable debt level

Investors are currently concerned about Crocs' high leverage. As of September, the company's shareholders' equity was approximately $1.2 billion, compared to its nearly $1.94 billion in borrowings. Additionally, it held roughly $287 million in long-term operating lease liabilities, while its cash and cash equivalents totaled only $127.3 million. This results in a debt-to-equity ratio of about 1.85. A significant factor contributing to the low shareholders' equity is the Treasury stock value of $1.86 billion, which reflects the company's share repurchases over time.

However, upon closer examination, Crocs' long-term debt situation appears manageable. The long-term borrowings are set to mature in 2029 and 2031 and carry reasonable interest rates of approximately 4.12% to 4.25%. In 2022, the company demonstrated a high interest coverage ratio of 6.25, indicating it can manage its long-term debt without concern.

Source: Crocs' 10-K filing

Potential upside

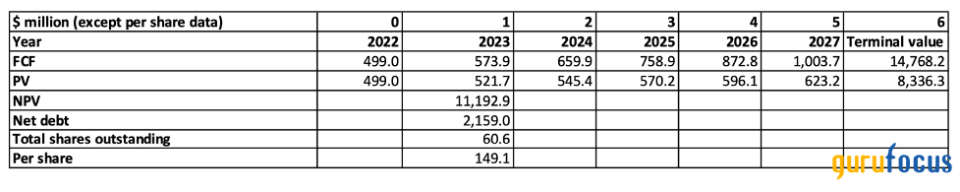

Let's conduct a discounted free cash flow analysis for Crocs. My growth assumption is the company's free cash flow will grow at a reduced rate of 15% over the next five yearslower growth compared to its compounded annual growth rate of approximately 24.5% observed in the past decadesfollowed by a 3% terminal growth rate. Applying a discount rate of 10%, Crocs' enterprise value is estimated to be around $11.19 billion. After adjusting for a net debt of $2.16 billion and considering a total of 60.6 million shares outstanding, the calculated value per share for Crocs should be approximately $149, a potential 43% upside from the current trading price.

Source: Author's table

Key takeaway

The recent surge in share price following the updated financial guidance has attracted considerable attention. While its stock has underperformed in the broader market over the past year, Crocs' robust business model, evident in its leading operating margins and strong sales growth across multiple segments, paints a promising picture. The company's ability to manage its debt effectively and forecast a significant revenue increase in 2023 further bolsters investor confidence.

Crocs appears to be an attractive investment opportunity with an estimated value per share of approximately $149, representing potential 43% upside from its current trading price. Investors should weigh these factors alongside the risks associated with the company's high leverage and recent fluctuations in stock performance, keeping in mind the potential for substantial long-term gains.

This article first appeared on GuruFocus.