Cronos Group Inc (CRON) Posts Mixed 2023 Financial Results Amidst Global Expansion

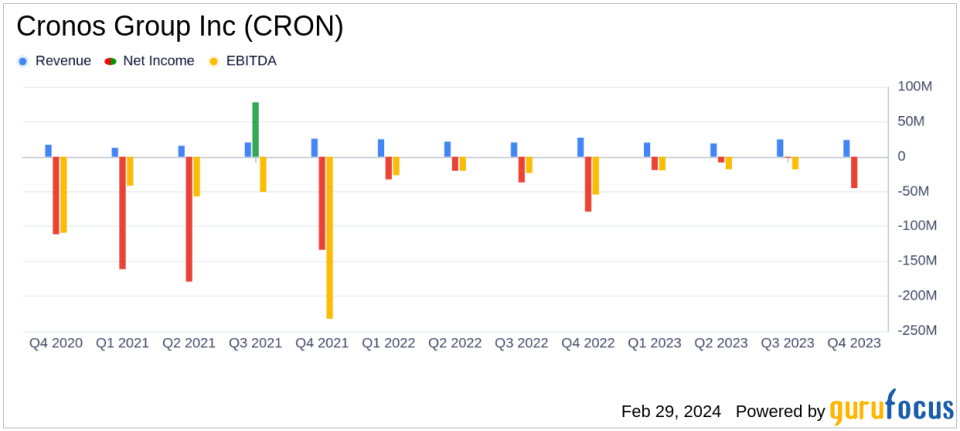

Consolidated Net Revenue: Increased by 9% in Q4 2023 compared to Q4 2022; full-year increase was marginal at 1%.

Net Income (Loss): Improved by 41% in Q4 2023 compared to Q4 2022; full-year improvement was 55%.

Adjusted EBITDA: Improved by 22% in Q4 2023 compared to Q4 2022; full-year improvement was 12%.

Cash Position: Ended 2023 with approximately $862 million in cash and short-term investments.

International Expansion: Commenced sales to Australian partner and launched the Lord Jones brand in Canada.

Operational Savings: Achieved $30 million in savings in 2023, overachieving the target of $20 to $25 million.

On February 29, 2024, Cronos Group Inc (NASDAQ:CRON) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year of 2023. Headquartered in Toronto, Canada, Cronos Group cultivates and sells medicinal and recreational cannabis through its brands, including Peace Naturals, Cove, and Spinach. The company has a growing international presence, with operations in Canada, Israel, and recent expansions into Germany and Australia.

Financial Performance and Challenges

Cronos Group's consolidated net revenue saw a 9% increase in Q4 2023 compared to the same quarter in the previous year, with an 11% increase on a constant currency basis. The growth was primarily driven by higher cannabis flower sales in Canada and new sales to Germany and Australia. However, the company faced challenges in Israel due to the war and competitive pressures leading to pricing challenges and increased excise tax payments as a percentage of revenue.

The company's net revenue in Canada increased by 20% in Q4 2023 compared to Q4 2022, with a 21% increase on a constant currency basis. Despite these increases, the full-year net revenue growth was modest at 1%. Gross profit for the full year decreased by 23%, and gross margin declined by 4 percentage points, reflecting the competitive and operational challenges faced by the company.

Net income (loss) improved significantly, with a 41% improvement in Q4 and a 55% improvement for the full year. Adjusted EBITDA also showed improvement, with a 22% increase in Q4 and a 12% increase for the full year. These improvements were primarily driven by operating expense savings and robust interest income.

Financial Achievements and Importance

The company's financial achievements, particularly the increase in cash balance by $22 million from the third quarter to approximately $862 million in cash and short-term investments, underscore its strong liquidity position. This is crucial for Cronos Group as it continues to invest in international expansion and product development in a volatile and competitive industry.

Key Financial Metrics

Important metrics from the financial statements include:

"In 2023, the Spinach brand became the number two overall brand in Canada, propelled by number one market share rankings in the flower and edibles categories, according to Hifyre."

This commentary highlights the company's brand strength in the Canadian market, which is a key driver of revenue growth.

The company's strategic and organizational updates indicate a focus on cost savings and efficiency, with $30 million saved in 2023 and an additional $5 to $10 million expected in 2024. These savings are expected to drive profitable and sustainable growth over time.

Analysis of Company Performance

Cronos Group's performance in 2023 reflects a company in transition, focusing on operational efficiency and international market penetration. While revenue growth has been modest, the company's ability to improve its net income and Adjusted EBITDA is a positive sign. The challenges in Israel and competitive pressures in Canada highlight the need for continued innovation and strategic market positioning.

The company's strategic shift away from U.S. hemp-derived CBD operations and its focus on cost savings initiatives are expected to streamline operations and position Cronos for future growth. With a strong cash position and a growing international footprint, Cronos Group is poised to capitalize on new market opportunities as they arise.

For more detailed information and analysis on Cronos Group Inc (NASDAQ:CRON)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Cronos Group Inc for further details.

This article first appeared on GuruFocus.