CrowdStrike (NASDAQ:CRWD) Posts Q4 Sales In Line With Estimates, Stock Jumps 16.8%

Cybersecurity company CrowdStrike (NASDAQ:CRWD) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 32.6% year on year to $845.3 million. The company expects next quarter's revenue to be around $904 million, in line with analysts' estimates. It made a non-GAAP profit of $0.95 per share, improving from its profit of $0.47 per share in the same quarter last year.

Is now the time to buy CrowdStrike? Find out by accessing our full research report, it's free.

CrowdStrike (CRWD) Q4 FY2024 Highlights:

Revenue: $845.3 million vs analyst estimates of $840 million (small beat)

ARR: $3.44 billion vs analyst estimates of $3.40 billion (1.2% beat)

Operating Profit (non-GAAP): $213.1 million vs analyst estimates of $187.8 million (13.5% beat)

EPS (non-GAAP): $0.95 vs analyst estimates of $0.82 (15.3% beat)

Revenue Guidance for Q1 2025 is $904 million at the midpoint, slightly above what analysts were expecting (non-GAAP EPS guidance for the period more convincingly ahead)

Management's revenue guidance for the upcoming financial year 2025 is $3.96 billion at the midpoint, slightly above analyst expectations and implying 29.5% growth (vs 36.7% in FY2024) (non-GAAP EPS guidance for the period more convincingly ahead)

Free Cash Flow of $283 million, up 18.4% from the previous quarter

Gross Margin (GAAP): 75.3%, up from 72.4% in the same quarter last year

Market Capitalization: $75.36 billion

"CrowdStrike delivered an exceptionally strong and record fourth quarter with net new ARR growth accelerating to 27% year-over-year, reaching a new high of $282 million and ending ARR growing 34% year-over-year to reach $3.44 billion,” said George Kurtz, CrowdStrike's president, chief executive officer and co-founder.

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

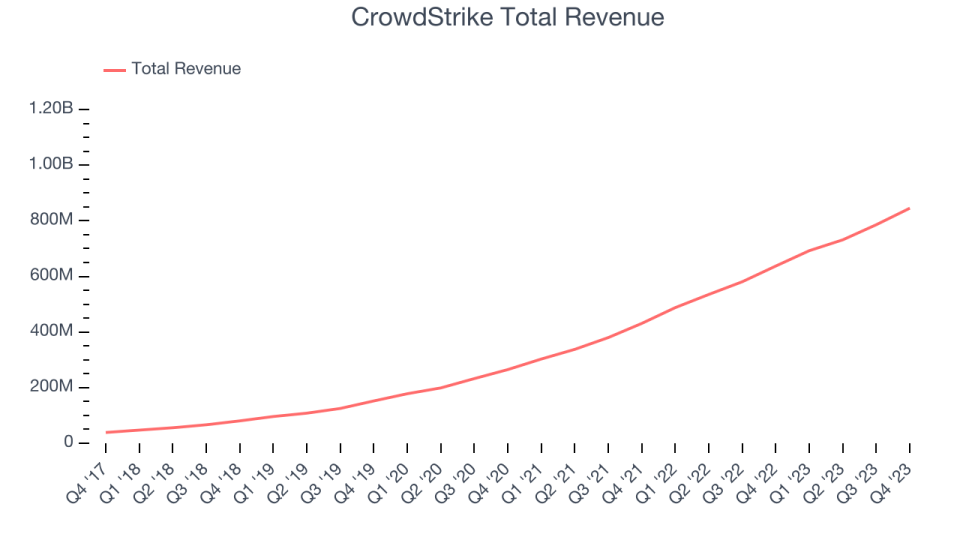

Sales Growth

As you can see below, CrowdStrike's revenue growth has been impressive over the last two years, growing from $431 million in Q4 FY2022 to $845.3 million this quarter.

Unsurprisingly, this was another great quarter for CrowdStrike with revenue up 32.6% year on year. On top of that, its revenue increased $59.32 million quarter on quarter, a solid improvement from the $54.39 million increase in Q3 2024. This is a sign of slight re-acceleration of growth.

Next quarter's guidance suggests that CrowdStrike is expecting revenue to grow 30.5% year on year to $904 million, slowing down from the 42% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $3.96 billion at the midpoint, growing 29.5% year on year compared to the 36.3% increase in FY2024.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

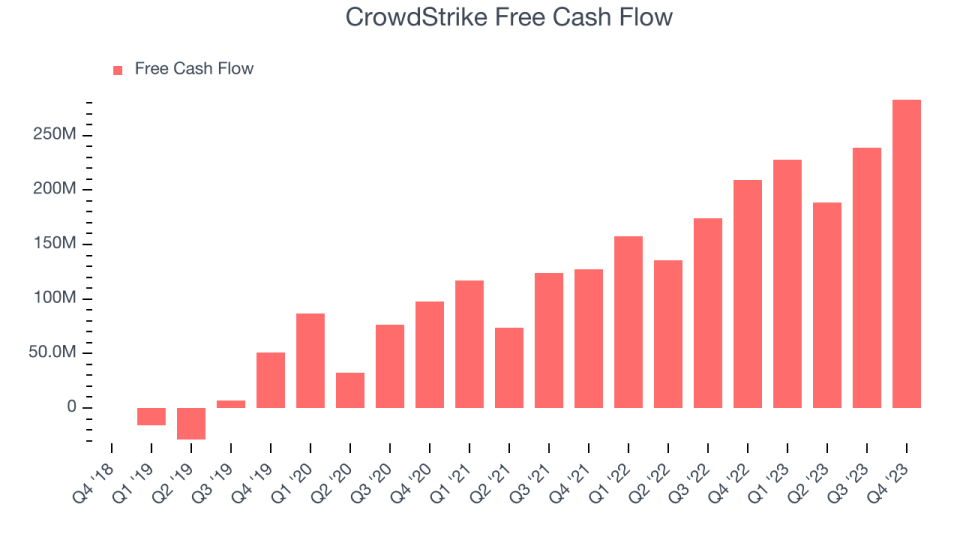

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. CrowdStrike's free cash flow came in at $283 million in Q4, up 35.1% year on year.

CrowdStrike has generated $938.2 million in free cash flow over the last 12 months, an eye-popping 30.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from CrowdStrike's Q4 Results

This was a strong quarter for CrowdStrike, with the company beating slightly on revenue and ARR but very convincingly on operating profit. Keeping with that theme, while forward guidance for next quarter and the full year were only slightly above expectations, non-GAAP EPS guidance was more convincingly ahead, showing better-than-expected profitability. Lastly, Palo Alto Networks (NASDAQ:PANW) warned of weakness in security spending a few weeks ago when it reported earnings, sending waves of caution across the sector. Cybersecurity peers that reported after Palo Alto put up mixed results, which kept investors on edge for CrowdStrike's results. The stock is up 16.5% after reporting and currently trades at $347 per share.

So should you invest in CrowdStrike right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.