Crown Castle Inc (CCI) Maintains Steady Outlook Amidst 2023 Financial Challenges

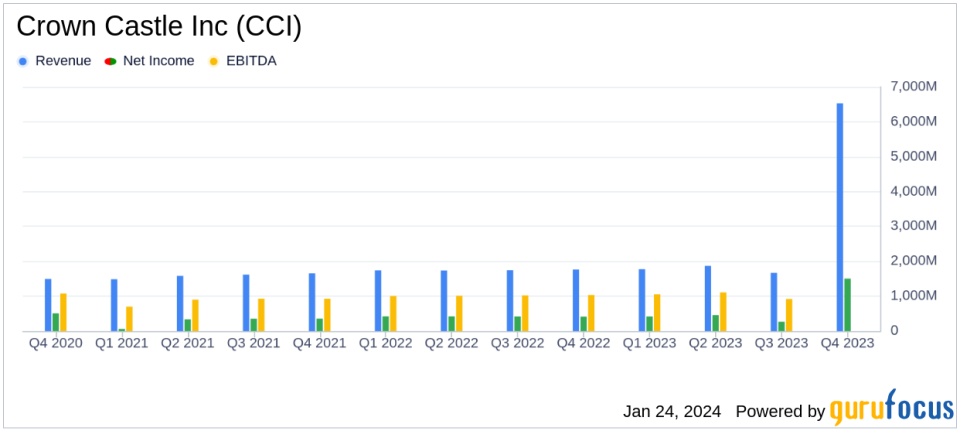

Site Rental Revenues: Crown Castle Inc (NYSE:CCI) reported a 4% increase in site rental revenues for the full year 2023, reaching $6,532 million.

Net Income: Net income for 2023 experienced a 10% decrease year-over-year, totaling $1,502 million.

Adjusted EBITDA: Adjusted EBITDA saw a 2% growth from the previous year, amounting to $4,415 million.

AFFO: Adjusted Funds from Operations (AFFO) also grew by 2%, resulting in $3,277 million, or $7.55 per share.

Capital Expenditures: Discretionary capital expenditures were significant, with $1.4 billion spent, primarily in the Fiber segment.

Dividends: Common stock dividends increased by 4.7% per share compared to the previous year, totaling approximately $2.7 billion.

Debt Management: Crown Castle issued $1.5 billion in senior unsecured notes, ending the year with over 90% fixed rate debt.

On January 24, 2024, Crown Castle Inc (NYSE:CCI) released its 8-K filing, detailing the fourth quarter and full year 2023 results. The company, a leading REIT specializing in cell towers and fiber networks, maintained its outlook for the full year 2024, demonstrating confidence in its business model despite facing certain financial headwinds.

Company Overview

Crown Castle International Corp. is a powerhouse in the U.S. wireless communication industry, boasting a portfolio of approximately 40,000 cell towers and over 85,000 route miles of fiber. The company primarily leases space on its towers to major wireless service providers, who in turn use the infrastructure to support their networks. With a focus on the largest U.S. cities, Crown Castle's customer base is highly concentrated, with the big three U.S. mobile carriers accounting for over 70% of its revenue. Operating as a real estate investment trust (REIT), the company's financial health is closely tied to the leasing activity and demand for its extensive network of towers and fiber.

Performance and Challenges

Crown Castle's 2023 performance was marked by resilience in site rental revenues, which grew by 4% year-over-year, driven by a $361 million organic contribution to site rental billings. However, net income and net income per share both saw a 10% decline from the previous year. The company also faced a $136 million decrease in straight-lined revenues and incurred $85 million in restructuring charges. Despite these challenges, Crown Castle achieved a 5% full-year tower organic revenue growth and returned to year-over-year fiber solutions revenue growth of approximately 3% in the fourth quarter.

The company's financial achievements, including a 2% growth in both Adjusted EBITDA and AFFO, underscore the importance of Crown Castle's strategic investments and operational efficiency. These metrics are critical for REITs, as they reflect the company's ability to generate cash flow and maintain dividend payments to shareholders.

Financial Highlights and Analysis

Capital expenditures for the year were substantial, with $1.4 billion directed towards discretionary and sustaining investments, particularly in the Fiber segment. The company's strategic financial management was evident in its issuance of $1.5 billion in senior unsecured notes, which helped to secure a strong debt profile with more than 90% fixed rate debt and a weighted average maturity of 8 years.

Looking ahead, Crown Castle's unchanged 2024 outlook suggests a steady course, despite anticipating a (2)% midpoint growth rate in site rental revenues and a (17)% decrease in net income and AFFO. The company's focus on delivering on its 2024 expectations, serving customers with excellence, and navigating through its CEO transition period are key factors that will influence its future performance.

In conclusion, Crown Castle's 2023 financial results reflect a company that is navigating through market challenges with a clear strategy and a focus on maintaining a strong financial foundation. The company's ability to sustain growth in site rental revenues and Adjusted EBITDA, despite headwinds, positions it well for the future as it continues to capitalize on the demand for wireless infrastructure.

For a more detailed analysis and updates on Crown Castle Inc (NYSE:CCI), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Crown Castle Inc for further details.

This article first appeared on GuruFocus.