Crown Holdings (CCK) Buys Helvetia to Expand in Germany

Crown Holdings CCK announced that it acquired Helvetia Packaging AG, a beverage can and end manufacturing facility in Saarlouis. This move will expand Crown's Europe beverage can platform to Germany, adding around one billion units of yearly can capacity.

On Aug 03, 2023, CCK announced plans to acquire Helvetia.

The Saarlouis facility currently employs 200 people. Crown Holdings acquired Helvetia's current customer base and contracts as part of the deal.

Aluminum has sustainability and recyclability benefits, leading to an increasing demand for beverage cans to serve the alcoholic and non-alcoholic drinks businesses. An estimated 75% of beverage product launches are now in cans. CCK has, thus, been focusing on growing its global beverage can business in order to tap strong demand growth.

Crown Holdings reported second-quarter 2023 adjusted earnings per share of $1.68, beating the Zacks Consensus Estimate of $1.65. The bottom line was within the company’s EPS guidance of $1.60-$1.70. However, the same declined 20% year over year.

Net sales totaled $3,109 million, down 11% from the year-ago quarter. The top line missed the Zacks Consensus Estimate of $3,475 million. The downside was caused by lower volumes across most businesses. Higher beverage can volumes in Americas Beverage and favorable foreign currency translation offset some impacts.

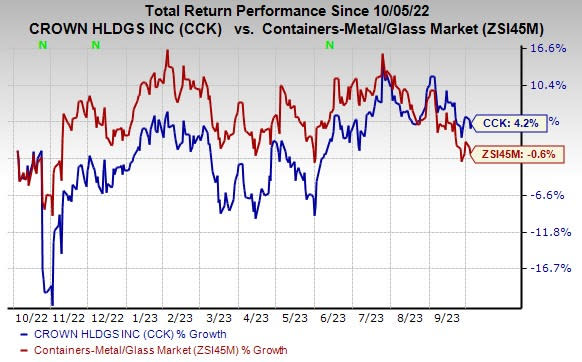

Price Performance

The company’s shares have gained 4.2% over the past year against the industry’s 0.6% fall.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Crown Holdings currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and Eaton Corporation plc. ETN. CAT and ASTE sport a Zacks Rank #1 (Strong Buy), and ETN has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved north by 11.4% in the past 60 days. Its shares gained 51.6% in the last year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares gained 22.8% in the last year.

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share is pegged at $8.80. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 3%. Shares of ETN rallied 68.8% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Crown Holdings, Inc. (CCK) : Free Stock Analysis Report