Crown Holdings (CCK) Q2 Earnings Beat, Dip Y/Y on Low Volumes

Crown Holdings, Inc. CCK reported second-quarter 2023 adjusted earnings per share (EPS) of $1.68, beating the Zacks Consensus Estimate of $1.65. The bottom line came within the company’s EPS guidance of $1.60-$1.70. However, the same declined 20% year over year.

Including one-time items, the company reported earnings of $1.31 per share in the quarter under review compared with $2.43 in second-quarter 2022.

Net sales totaled $3,109 million, down 11% from the year-ago quarter. The top line missed the Zacks Consensus Estimate of $3,475 million. The downside was caused by lower volumes across most businesses. Higher beverage can volumes in Americas Beverage and favorable foreign currency translation offset some impacts.

Crown Holdings, Inc. Price, Consensus and EPS Surprise

Crown Holdings, Inc. price-consensus-eps-surprise-chart | Crown Holdings, Inc. Quote

Costs and Margins

The cost of products sold fell 14% year over year to $2,463 million. On a year-over-year basis, gross profit moved down 0.5% to $646 million. The gross margin improved to 20.8% from the year-ago quarter’s 18.5%.

Selling and administrative expenses rose 5.7% year over year to $148 million. Segmental operating income was $414 million compared with the prior-year quarter’s $432 million.

Benefits from contractual recovery of prior year’s inflationary cost increases in European Beverage and cost reduction initiatives in Transit Packaging were offset by lower volumes.

Segment Performances

Net sales in the Americas Beverage segment totaled $1,292 million, down 6% year over year. It lagged our estimate of $1,431 million for the quarter. Segmental operating profit dipped 2% year over year to $211 million. Our estimate for the metric was $238 million.

The European Beverage segment’s sales fell 11% year over year to $532 million. The figure fell short of our estimate of $576 million. Operating income was $74 million compared with the year-ago quarter’s $56 million. The metric outpaced our estimate of $49 million.

The Asia-Pacific segment’s revenues totaled $332 million, down 23% year over year. It missed our estimate of $365 million for the quarter. Operating profit was $38 million compared with the prior-year quarter’s $55 million. Our estimate was $42.6 million.

Revenues in the Transit Packaging segment totaled $597 million compared with the year-ago quarter’s $691 million. The figure was lower than our estimation of $680 million. Operating profit improved 20.3% year over year to $89 million. However it was lower than our projection of $93 million.

Financial Update

Crown Holdings had cash and cash equivalents of $547 million at second-quarter 2023 end, up from $438 million at the end of the prior-year quarter. The company generated $293 million of cash in operating activities in the first half of 2023 compared with $196 million in the year-ago comparable period.

Crown Holdings’ long-term debt increased to $6,986 million as of Jun 30, 2023, from $5,466 million as of Jun 30, 2022.

Outlook

Crown Holdings projects third-quarter 2023 adjusted EPS to be between $1.70 and $1.80.

The company maintains 2023 adjusted annual EBITDA growth of 8-12%. CCK has lowered 2023 adjusted EPS guidance to $6.10-$6.30 from the prior expectation of $6.20-$6.40. This reflects the impact of higher transactional foreign exchange expense and lower equity earnings. CCK expects improved operating results in global beverage and Transit Packaging in 2023.

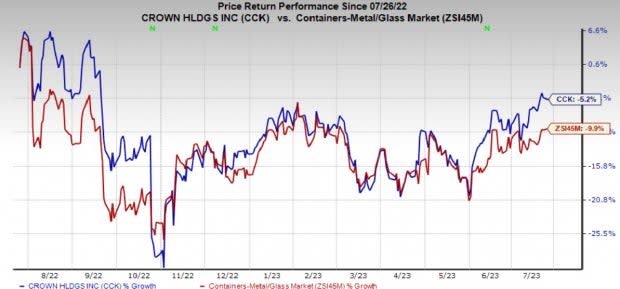

Price Performance

Crown Holdings’ shares have lost 5.2% in the past year compared with the industry’s fall of 9.9%.

Image Source: Zacks Investment Research

Zacks Rank

Crown Holdings currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and W.W. Grainger, Inc. GWW. WOR and MTW sports a Zacks Rank #1 (Strong Buy) at present, and GWW has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Worthington Industries has an average trailing four-quarter earnings surprise of 14.9%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $5.65 per share, up 22.6% in the past 60 days. Its shares gained 55% in the last year.

Manitowoc has an average trailing four-quarter earnings surprise of 256.3%. The Zacks Consensus Estimate for MTW’s 2023 earnings has moved 7.8% north to $1.12 per share in the past 60 days. MTW’s shares surged 68.8% in the last year.

The Zacks Consensus Estimate for Grainger’s 2023 earnings per share is pegged at $35.86, up 1% in the past 60 days. It has a trailing four-quarter average earnings surprise of 9.1%. GWW increased 59.5% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Crown Holdings, Inc. (CCK) : Free Stock Analysis Report