Crown Holdings Inc (CCK) Reports Mixed Results Amid Operational Adjustments

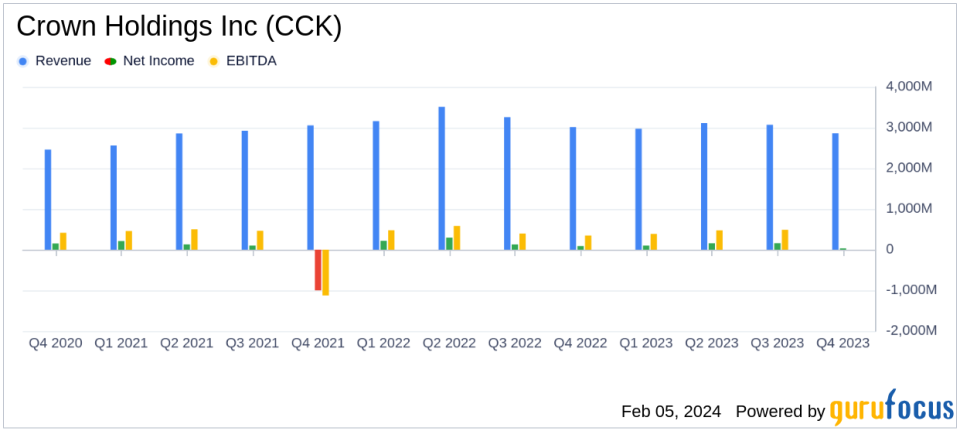

Net Sales: Q4 net sales decreased to $2,858 million from $3,012 million in Q4 2022.

Income from Operations: Q4 income from operations rose to $259 million from $229 million in the prior year.

Net Income: Q4 net income attributable to CCK was $32 million, down from $89 million in Q4 2022.

Diluted EPS: Reported Q4 diluted EPS was $0.27, compared to $0.74 in 2022.

Adjusted Diluted EPS: Q4 adjusted diluted EPS was $1.24, slightly up from $1.17 in 2022.

Full Year Net Income: 2023 net income was $450 million, a decrease from $727 million in 2022.

2024 Outlook: Adjusted diluted EPS for 2024 is estimated to be between $5.80 and $6.20.

On February 5, 2024, Crown Holdings Inc (NYSE:CCK), a global leader in metal packaging solutions, released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, known for its production of beverage cans, metal food cans, closures, and aerosol cans, as well as protective transport packaging, faced a challenging macroeconomic environment, which reflected in its mixed financial results.

Performance Highlights and Challenges

Crown Holdings Inc (NYSE:CCK) reported a decrease in net sales for the fourth quarter, primarily due to lower material costs and reduced volumes in most businesses, despite higher beverage can volumes in the Americas and favorable foreign currency translation. The company's income from operations saw an increase, benefiting from higher beverage can volumes in the Americas and the recovery of inflationary cost increases in Europe. However, net income and reported diluted earnings per share for the quarter saw significant declines, attributed to under-absorption of fixed costs and lower equity earnings.

For the full year, net sales also decreased compared to 2022, with the company facing lower overall net volumes and a significant inventory impact from steel repricing. Despite these challenges, Crown Holdings achieved record adjusted EBITDA, an 8% improvement over the prior year, driven by strong operating performance in its largest businesses. Interest expenses increased substantially due to higher interest rates, impacting net income and earnings per share for the year.

Financial Achievements and Industry Significance

The company's segment income for the full year improved, reflecting benefits from higher beverage can volumes in the Americas and cost reduction initiatives in Transit Packaging. These achievements are particularly important in the Packaging & Containers industry, where operational efficiency and volume growth are key drivers of profitability. Crown Holdings' ability to adjust production schedules and achieve significant working capital reduction contributed to free cash flow that exceeded prior expectations, despite a reduction in off-balance sheet financing arrangements.

Operational Adjustments and Outlook

During the fourth quarter, Crown Holdings made strategic decisions to cease operations at several facilities to improve operational efficiencies, utilization rates, and fixed cost absorption. Looking ahead to 2024, the company is focusing on cash generation and continuous operational improvement, expecting to service market demand with reduced capital investment levels. The anticipated capital expenditures of no more than $500 million in each of 2024 and 2025 are set to increase cash flow, reduce net leverage, and return capital to shareholders.

Analysis of Company Performance

While Crown Holdings Inc (NYSE:CCK) faced headwinds in 2023, including soft consumer demand and inflationary pressures, the company's strategic adjustments and focus on operational efficiency have positioned it for improved performance. The reduction in capital expenditures and emphasis on cash flow management are likely to strengthen the company's financial position in the coming years. However, the outlook for 2024 suggests continued challenges with demand softness and a consumer base under pressure in most markets.

For a more detailed analysis and to stay updated on Crown Holdings Inc's (NYSE:CCK) financial journey, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Crown Holdings Inc for further details.

This article first appeared on GuruFocus.