Crude Oil Pops, Energy Sector Rebounds: Stocks to Watch

It’s been a wild couple of years for oil prices.

The days of negative prices for crude oil futures seem lightyears away. The pandemic-induced oversupply of oil led to an unprecedented collapse, forcing the contract futures price for West Texas Intermediate (WTI) to plunge near -$37/barrel.

As economies around the world reopened from lockdowns, oil prices rebounded as travel slowly picked back up. WTI finished that year just under $50/barrel.

Fast forward to 2022, a 40-year high in inflation saw WTI crude hit over $130/barrel. The journey from negative to a nearly 14-year high (in a span of less than two years) was unparalleled, and speaks to the remarkable stage of events that took place. It also highlights the unpredictable and dynamic nature of the financial (in this case, commodity) markets.

Recent Uptick in Crude Oil Prices

Oil prices peaked for the cycle in March of last year, and since then have been in a steady downtrend, shedding more than 50% of their value from peak to trough. But a recent surge above $80/barrel has WTI crude on the verge of a breakout:

Image Source: StockCharts

WTI crude prices leapt 16% in July. Why are prices rising? For one, Saudi Arabia instituted a 1 million barrel-per-day cut, and voluntary production cuts by OPEC+ members were made back in April. But perhaps more importantly, U.S. stocks of crude oil fell by 17.05 million barrels for the week ended July 28th. It marked the largest single-week decrease dating back to 1982, when the Energy Information Administration (EIA) first began reporting the data.

Stocks to Watch

Coinciding with the recent pop in oil prices is a resurgence in the energy sector, which lagged throughout the majority of this year. The Zacks Oils and Energy sector posted a gain of more than 6% during the month of July. Still, major oil companies have been reporting large declines in second-quarter profits. Lower fossil fuel prices relative to the same period in the prior year are putting a dent into bottom lines. Energy stocks have largely shrugged off the results, as companies have been accentuating larger dividends and stock repurchases.

On the other hand, a select number of companies have been able to buck the downward earnings trend. In late July, Schlumberger SLB, the world’s largest oilfield services company, delivered second-quarter earnings results of $0.72/share, a 44% increase versus the same quarter last year. Revenues of $8.01 billion improved 19.6% during the quarter.

SLB pays a $1.00 (1.74%) dividend. A Zacks Rank #3 (Hold) stock, Schlumberger has exceeded earnings estimates in each of the past four quarters, with an average surprise of 5.54% over that timeframe. SLB shares have bounced more than 30% off the June low and are approaching 52-week highs.

Image Source: Zacks Investment Research

Another company that has navigated the current landscape is Oceaneering International OII, a Zacks Rank #1 (Strong Buy). Oceaneering International is a leading supplier of offshore equipment and technology solutions to the energy industry. The company provides engineered services and products, as well as robotic solutions to offshore energy, defense, manufacturing, and entertainment industries.

Just last week, the energy company reported Q2 earnings of $0.18/share, a 157.1% increase versus the same quarter last year. Revenues jumped 14.1% to $597.9 million.

OII stock has more than doubled in price over the past year. Shares broke out last month to a new 52-week high before recently experiencing a minor pullback.

Image Source: Zacks Investment Research

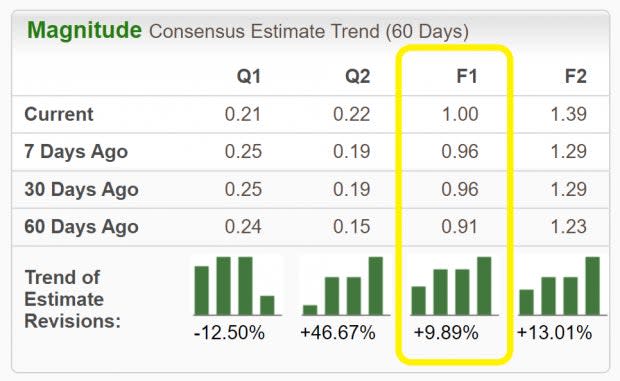

Oceaneering International has been on the receiving end of positive earnings estimate revisions lately, which our research has shown to be the most powerful force impacting stock prices. For fiscal 2023, estimates have been raised by 9.89% in the past 60 days. The Zacks Consensus Estimate now stands at $1.00/share, reflecting potential growth of 222.58% relative to last year.

Image Source: Zacks Investment Research

Make sure to keep an eye on crude oil as prices near a potential breakout, as well as a renewed energy sector.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report