Cruise Smooth Sailing to Continue in 2024: 3 Stocks to Watch

As we set sail into 2024, the cruise industry is poised for a promising journey ahead. Despite facing unprecedented challenges in the past, the sector has shown resilience and adaptability. With the promise of smooth sailing on the horizon, investors may be eager to explore opportunities within the cruise industry.

Cruise to Attract More Passengers

As the cruise industry continues its recovery from the impact of Covid-19, prices are frequently more affordable than their land-based counterparts, aimed at attracting a larger customer base. While projections suggest these costs may increase in the upcoming months, the current combination of economical pricing and a heightened post-pandemic travel enthusiasm has resulted in a significant uptick in cruise bookings.

Businesses continue to implement strategic initiatives across their operations to boost operational effectiveness and appropriately size their cost base in order to rebuild and increase profits. While preserving the outstanding guest experience and superior service levels, they are making conscious efforts to increase margins.

Major cruise companies have deployed strategic investment plans to expand and renew their fleet. This includes luxurious accommodations, world-class dining options, captivating entertainment, and a wide range of recreational activities.

The Cruise Lines International Association anticipates a surge in the number of cruise passengers in 2024, with projections reaching 35.7 million, marking a significant increase from the 31.5 million passengers in 2023. This figure reflects a 6% rise compared with the passenger count in 2019.

Exploring three cruise stocks that investors should have on their radar for 2024.

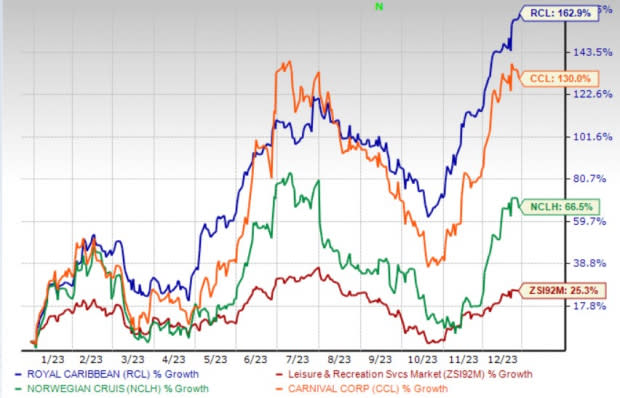

Image Source: Zacks Investment Research

3 Stocks to Watch

Royal Caribbean Cruises Ltd. RCL is benefiting from solid demand for cruising and acceleration in booking volumes. Also, the emphasis on strong pricing (on closer-in-demand) bodes well. The company stated that the momentum has continued into 2024, with booked load factors and rates surpassing those of all previous years.

Shares of the Zacks Rank #2 (Buy) company have surged 162.9% so far this year compared with the industry’s gain of 25.3%. RCL sales and earnings in 2024 are likely to witness growth of 13.7% and 38.1% year over year. In the past 30 days, earnings estimates for 2024 have witnessed upward revisions of 0.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Norwegian Cruise Line Holdings Ltd. NCLH has been benefiting from strong demand and booking volume growth. It reported strength in advance ticket sales. Going forward, the company intends to focus on strategic marketing efforts to drive demand and high-value bookings. Also, focus on fleet-expansion efforts bodes well.

Shares of the Zacks Rank #3 (Hold) company have surged 66.5% so far this year. NCLH sales and earnings in 2024 are likely to witness growth of 9.1% and 57.9% year over year.

Carnival Corporation & plc CCL is benefiting from improved booking trends, courtesy of solid demand, bundled package offerings and increased advertising activities added to the positives. The company stated that its fiscal 2024 cumulative advanced booked position exceeds the upper bound of the historical range and at higher pricing compared with 2019 levels.

Shares of the Zacks Rank #3 company have surged 130% so far this year. CCL sales and earnings in fiscal 2024 are likely to witness growth of 4.4% and 40% year over year. In the past 30 days, earnings estimates for fiscal 2024 have witnessed upward revisions of 5.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carnival Corporation (CCL) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report