CSG Systems International Inc: An In-Depth Look at its Dividend Performance

Assessing the Sustainability and Growth of CSG Systems International Inc's Dividend

CSG Systems International Inc (NASDAQ:CSGS) recently announced a dividend of $0.28 per share, payable on 2023-09-28, with the ex-dividend date set for 2023-09-13. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into CSG Systems International Inc's dividend performance and assess its sustainability.

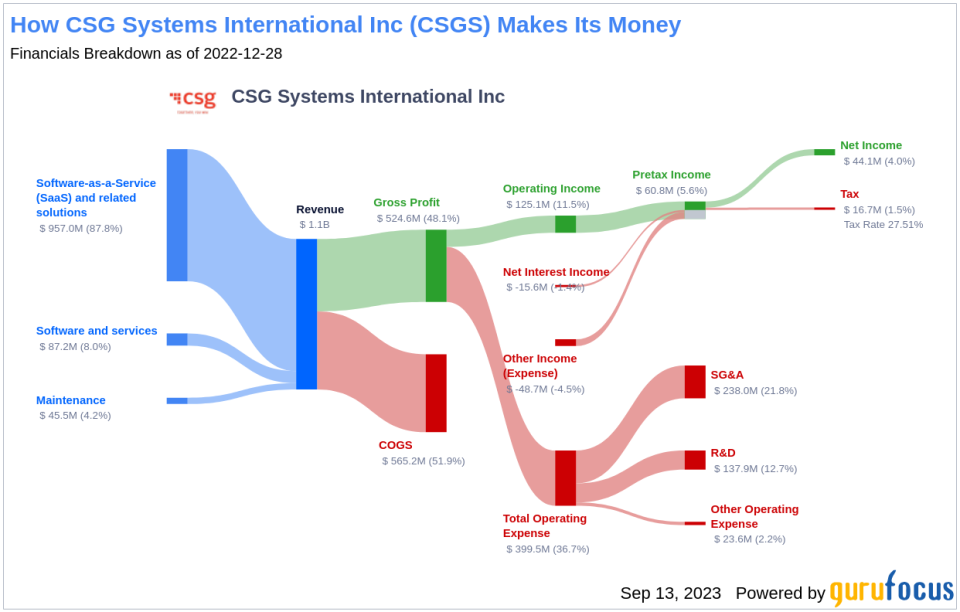

What Does CSG Systems International Inc Do?

Warning! GuruFocus has detected 2 Warning Signs with CSGS. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

CSG Systems International Inc is a purpose-driven, SaaS platform company that enables companies in a wide variety of industry verticals to tackle the growing complexity of business in the digital age. The company's cloud-first architecture and customer-centric approach empower companies to deliver unforgettable experiences for B2B (business-to-business), B2C (business-to-consumer), and B2B2X (business-to-business-to-consumer) customers, making it easier for people and businesses to connect to, use and pay for the services the company offers. The company operates in one segment i.e. Solutions and Services. Geographically, the company generates revenue from the Americas (principally the U.S.).

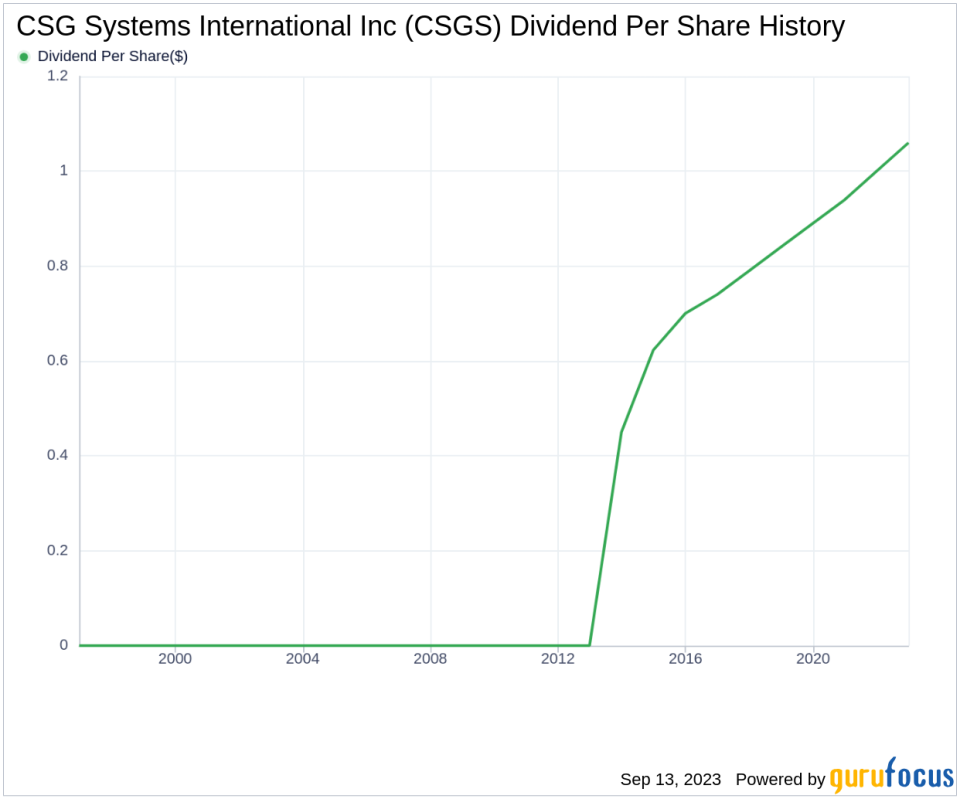

A Glimpse at CSG Systems International Inc's Dividend History

CSG Systems International Inc has maintained a consistent dividend payment record since 2013. Dividends are currently distributed on a quarterly basis. CSG Systems International Inc has increased its dividend each year since 2013. The stock is thus listed as a dividend achiever, an honor that is given to companies that have increased their dividend each year for at least the past 10 years. Below is a chart showing annual Dividends Per Share for tracking historical trends.

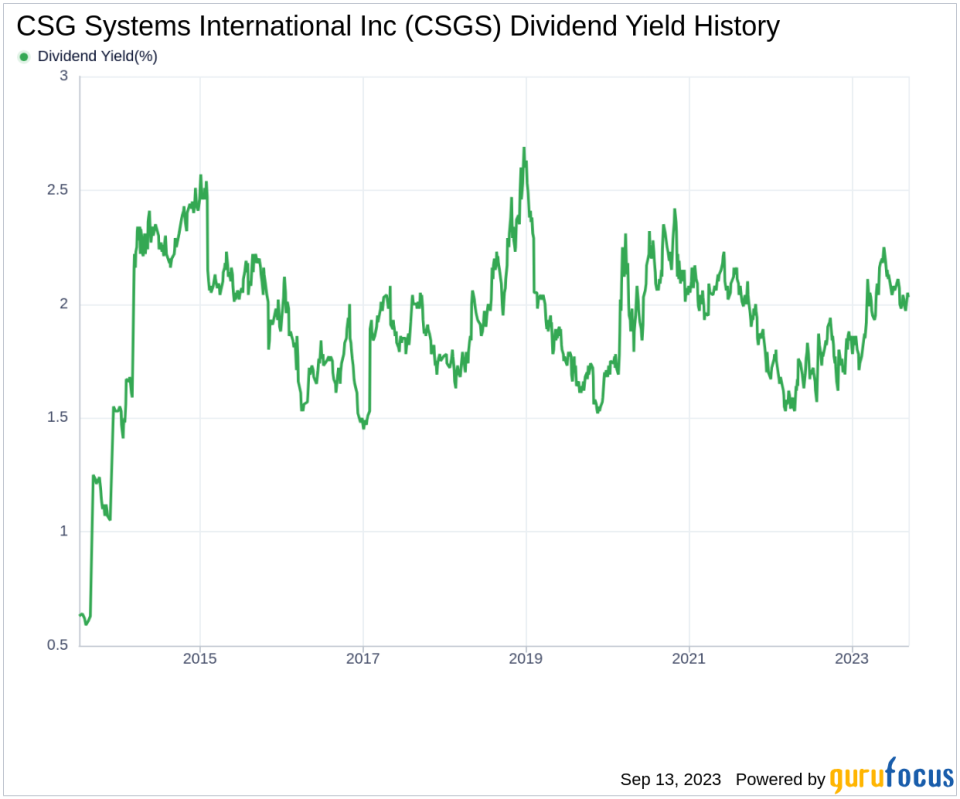

Breaking Down CSG Systems International Inc's Dividend Yield and Growth

As of today, CSG Systems International Inc currently has a 12-month trailing dividend yield of 2.00% and a 12-month forward dividend yield of 2.05%. This suggests an expectation of increased dividend payments over the next 12 months.

Over the past three years, CSG Systems International Inc's annual dividend growth rate was 6.00%. Extended to a five-year horizon, this rate stayed the same. Based on CSG Systems International Inc's dividend yield and five-year growth rate, the 5-year yield on cost of CSG Systems International Inc stock as of today is approximately 2.68%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, CSG Systems International Inc's dividend payout ratio is 0.50.

CSG Systems International Inc's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks CSG Systems International Inc's profitability 8 out of 10 as of 2023-06-30, suggesting good profitability prospects. The company has reported positive net income for each of year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. CSG Systems International Inc's growth rank of 8 out of 10 suggests that the company's growth trajectory is good relative to its competitors.

Revenue is the lifeblood of any company, and CSG Systems International Inc's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. CSG Systems International Inc's revenue has increased by approximately 4.30% per year on average, a rate that underperforms than approximately 59.91% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, CSG Systems International Inc's earnings increased by approximately -17.90% per year on average, a rate that underperforms than approximately 76.52% of global competitors.

Lastly, the company's 5-year EBITDA growth rate of -3.90%, which underperforms than approximately 77.72% of global competitors.

Conclusion

CSG Systems International Inc has demonstrated a steady history of dividend payments, with consistent growth and a sustainable payout ratio. Despite some underperformance in growth metrics compared to global competitors, the company's robust profitability and anticipated dividend yield increase provide positive signals for dividend-focused investors. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.