CSI Compressco LP Reports Improved Year-Over-Year Earnings and Provides 2024 Outlook

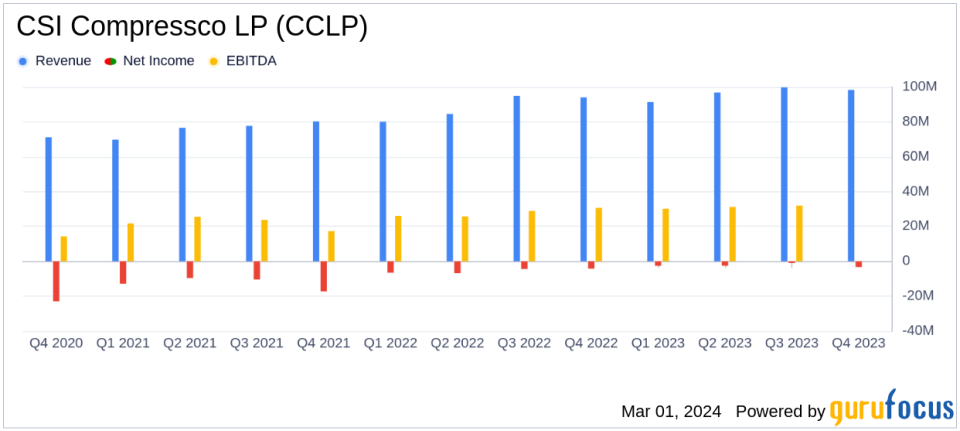

Total Revenues: Increased to $386.1 million in 2023 from $353.4 million in 2022.

Net Loss: Reduced to $9.5 million in 2023 from $22.1 million in 2022.

Adjusted EBITDA: Rose to $131.8 million in 2023, up from $114.5 million in 2022.

Distributable Cash Flow: Improved to $51.5 million in 2023 from $42.4 million in 2022.

Net Leverage Ratio: Decreased to 4.8x at the end of 2023 from 5.5x at the end of 2022.

Utilization Rate: Slightly increased to 87.1% in Q4 2023 from 86.8% in Q4 2022.

2024 Guidance: Adjusted EBITDA is expected to be between $135 million and $145 million.

On March 1, 2024, CSI Compressco LP (NASDAQ:CCLP) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a key player in the oil and gas sector providing compression services and equipment, has shown a year-over-year improvement in its financial performance, despite the challenges faced in the industry.

Financial Performance and Challenges

CSI Compressco reported a 5% increase in total revenues for the fourth quarter of 2023, amounting to $98.3 million, compared to $94.0 million for the same period in 2022. The net loss for the quarter was reduced to $3.3 million from $4.2 million year-over-year. The company's Adjusted EBITDA for the fourth quarter grew by 11% to $34.7 million, compared to $31.4 million in the previous year. These improvements reflect the company's ability to navigate the volatile oil and gas market and maintain a strong service utilization rate.

Despite the positive trends, CSI Compressco faced a net cash usage in operating activities of $2.4 million in the fourth quarter of 2023, a stark contrast to the $35.2 million net cash provided by operating activities in the third quarter of 2023. This indicates potential challenges in cash flow management that could impact the company's operations and investment capabilities.

Financial Achievements and Industry Significance

The reduction in net loss and the increase in distributable cash flow, which rose to $51.5 million from $42.4 million in 2022, are significant achievements for CSI Compressco. These improvements demonstrate the company's enhanced profitability and its ability to generate cash that can be potentially distributed to unitholders or reinvested in the business. In the oil and gas industry, where capital expenditures and debt management are critical, the decrease in the net leverage ratio from 5.5x to 4.8x is a positive sign of the company's improving financial health and its ability to manage debt effectively.

Key Financial Metrics and Commentary

CSI Compressco's balance sheet shows long-term debt, net as of December 31, 2023, totaling $628.6 million, a slight decrease from $634.0 million as of December 31, 2022. The company's capital expenditure guidance for 2024 is estimated to be between $52.0 million and $69.0 million, which includes maintenance and expansion of its contract services fleet, as well as investments in technology and facilities.

The fourth quarter distribution of $0.01 per common unit was paid on February 14, 2024, reflecting a distribution coverage ratio of 9.7x for the fourth quarter of 2023, compared to 9.2x in the same quarter of the previous year.

CSI Compressco's 2024 guidance anticipates an Adjusted EBITDA between $135 million and $145 million, signaling confidence in the company's continued performance and growth prospects.

Analysis of Company's Performance

The company's performance in 2023, with increased revenue and reduced net loss, suggests a resilient operational strategy and an ability to adapt to market conditions. The slight uptick in utilization rate indicates stable demand for CSI Compressco's services. However, the fluctuation in net cash from operating activities between quarters highlights the importance of monitoring cash flow closely to ensure sustainable operations and growth.

CSI Compressco's focus on maintaining a strong balance sheet, as evidenced by the reduction in net leverage ratio, positions the company well for future capital investments and potential market opportunities. The provided guidance for 2024 suggests a cautious yet optimistic outlook, with planned capital expenditures aimed at reinforcing the company's service offerings and technological capabilities.

For investors and stakeholders, the company's performance in 2023 and its strategic outlook for 2024 provide a comprehensive view of its financial health and future direction. CSI Compressco's ability to navigate the complexities of the oil and gas industry while delivering improved financial results is a testament to its operational efficiency and market adaptability.

For further details and investor inquiries, Jon Byers of CSI Compressco LP can be contacted at (281) 364-2279 or via email at jon.byers@csicompressco.com. More information is available on the company's website at www.csicompressco.com.

Explore the complete 8-K earnings release (here) from CSI Compressco LP for further details.

This article first appeared on GuruFocus.