CSW Industrials Inc (CSWI) Reports Record Fiscal 2024 Q3 Results with Strong Revenue and ...

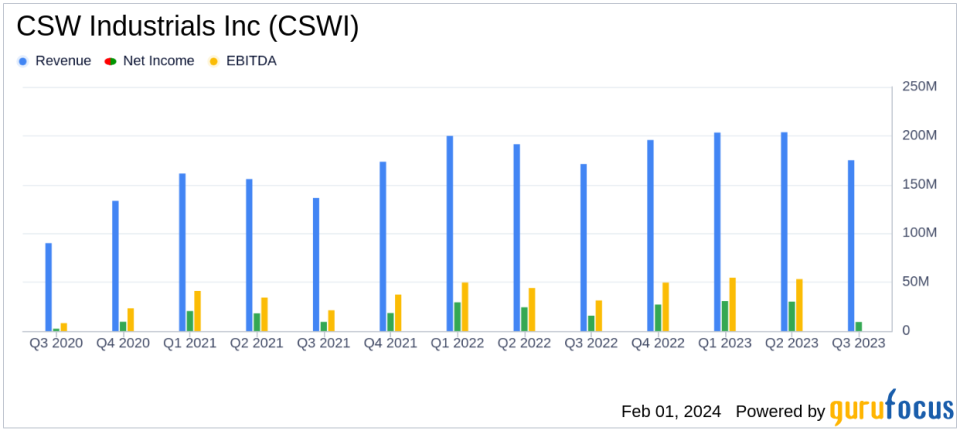

Revenue: Increased 2% to $175.0 million in Q3 and 4% to $582.0 million YTD due to organic growth.

Net Income: Q3 net income attributable to CSWI was $9.2 million, with adjusted net income of $16.7 million, a 7.2% increase over the prior year period.

Earnings Per Share (EPS): Q3 EPS of $0.59, or $1.07 adjusted, a 6% increase in adjusted EPS compared to the prior year.

Adjusted EBITDA: Grew 18% to $36.8 million in Q3, with margin expansion of 270 bps to 21%.

Cash Flow: Record cash flow from operations of $141.9 million YTD, a 69% increase over the prior year period.

Debt Reduction: Paid down $100.0 million of debt, strengthening the balance sheet and reducing leverage ratio to 0.69x.

Dividends and Share Repurchases: Returned cash to shareholders of $8.9 million in dividends and $5.8 million in share repurchases.

On February 1, 2024, CSW Industrials Inc (NASDAQ:CSWI) released its 8-K filing, announcing record results for the fiscal 2024 third quarter and nine-month fiscal year-to-date periods ended December 31, 2023. The company, a diversified industrial growth company with platforms in Contractor Solutions, Engineered Building Solutions, and Specialized Reliability Solutions, has demonstrated resilience and growth despite challenging market conditions.

CSW Industrials Inc's Contractor Solutions segment, which manufactures products for HVAC/R and plumbing applications and is the primary revenue driver, particularly in the US market, has continued to perform strongly. This segment's success is crucial as it reflects the company's ability to maintain and expand its market share in the competitive industrial products industry.

Fiscal Performance and Strategic Highlights

CSW Industrials Inc reported a 2% increase in total revenue to $175.0 million for the third quarter, driven by organic growth. The company's net income attributable to CSWI was $9.2 million, or $16.7 million adjusted, compared to $15.6 million in the prior year's quarter. The adjusted earnings per share (EPS) increased by 6% to $1.07, reflecting the company's operational efficiency and successful growth strategies.

Adjusted EBITDA for the quarter grew by an impressive 18% to $36.8 million, with a significant margin expansion of 270 basis points to 21%. This growth in profitability is a testament to the company's ability to manage costs effectively while scaling its operations. The company also demonstrated strong cash generation, with cash flow from operations increasing by 28% to $47.0 million for the quarter.

Joseph B. Armes, CSW Industrials Chairman, President, and CEO, highlighted the company's impressive operating leverage and strong cash flow, which enabled significant debt repayment, liquidity increase, and balance sheet strengthening. Armes expressed confidence in the company's ability to deliver record performance for the full fiscal year in revenue, adjusted EBITDA, and adjusted EPS, while maintaining robust free cash flow generation.

Financial Statements and Metrics

Key financial statements reflect the company's solid performance. Gross profit for the third quarter was $74.0 million, a 12.4% increase over the prior year, with gross margin improving to 42.3%. Operating income also saw a notable rise to $27.6 million, representing a 230 basis points improvement in operating income margin. The company's effective tax rate was 43.2%, or 32.5% adjusted, which was influenced by the finalization of international tax deductions and credits.

For the nine-month period, total revenue increased by 4% to $582.0 million, with adjusted net income growing by 12% to $77.4 million. The year-to-date adjusted EBITDA increased by 16% to $144.2 million, with a margin expansion of 260 basis points to 25%. These metrics underscore the company's financial health and the importance of its strategic initiatives.

CSW Industrials Inc's balance sheet remains strong, with a total asset value of $993.1 million. The company's debt management efforts are evident, with long-term debt reduced to $153.0 million from $253.0 million at the end of the previous fiscal year.

Outlook and Analysis

The company's performance indicates a robust operational framework capable of delivering growth even in challenging market conditions. The increase in revenue, net income, and cash flow from operations, coupled with debt reduction and shareholder returns, positions CSW Industrials Inc favorably for sustainable growth.

The strategic appointment of Jeff Underwood as Senior Vice President of CSWI and General Manager, Contractor Solutions, effective April 1, 2024, is expected to further strengthen the company's leadership and drive its growth initiatives forward.

Value investors may find CSW Industrials Inc's consistent performance, strong financial position, and commitment to shareholder returns an attractive proposition. The company's ability to navigate market challenges while delivering record results is a testament to its resilient business model and strategic execution.

For more detailed information on CSW Industrials Inc's financial performance, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from CSW Industrials Inc for further details.

This article first appeared on GuruFocus.