Is CSX Corp (CSX) Modestly Undervalued?

CSX Corp (NASDAQ:CSX) experienced a daily gain of 1.98% and a 3-month loss of -4.35%. The company's Earnings Per Share (EPS) stands at 1.98. But is the stock modestly undervalued? This article provides a comprehensive valuation analysis to answer this question. Let's delve in.

Company Overview

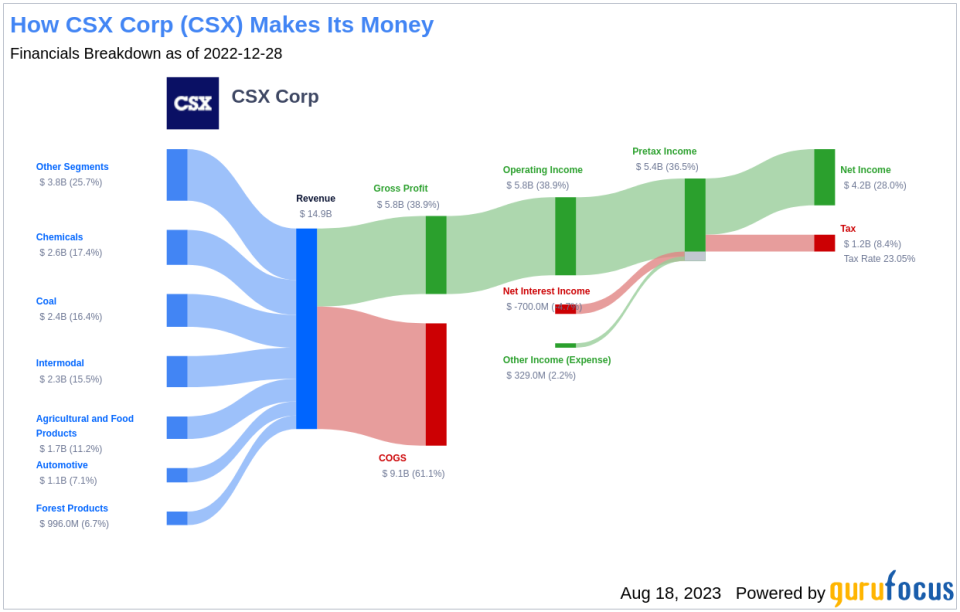

Operating in the Eastern United States, Class I railroad CSX Corp (NASDAQ:CSX) generated revenue near $14.8 billion in 2022. On its more than 21,000 miles of track, CSX hauls shipments of coal, chemicals, intermodal containers, automotive cargo, and a diverse mix of other bulk and industrial merchandise. With a current stock price of $30.87 and a GF Value of $43, the stock appears to be modestly undervalued. Let's explore further.

Understanding GF Value

The GF Value represents an estimation of the intrinsic value of a stock, calculated based on historical multiples, an internal adjustment factor based on the company's past performance and growth, and future business performance estimates. The GF Value Line provides an ideal fair trading value for the stock.

CSX Corp (NASDAQ:CSX) appears to be modestly undervalued based on the GF Value. The stock's current price of $30.87 per share and market cap of $61.90 billion suggest a potential for higher future returns due to its undervaluation. However, it's crucial to examine the financial strength, profitability, and growth prospects of the company for a holistic understanding.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

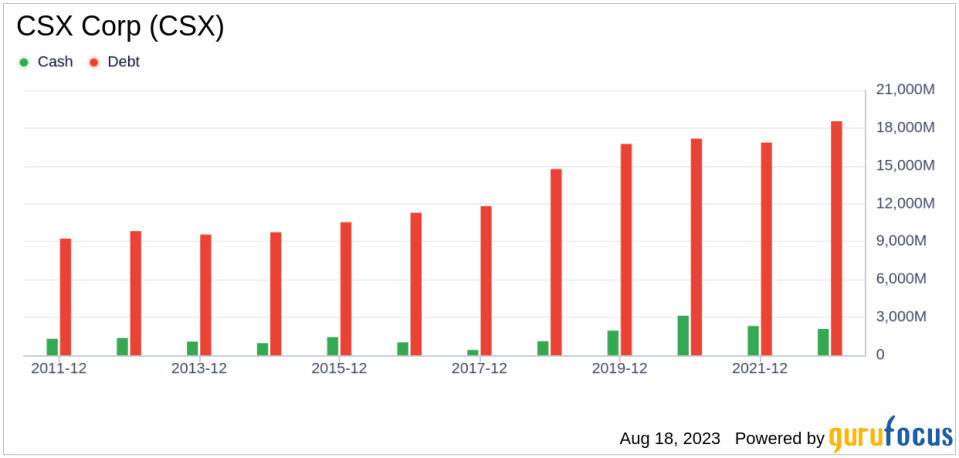

A company's financial strength is a critical factor to consider to avoid the risk of permanent capital loss. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. CSX has a cash-to-debt ratio of 0.06, ranking lower than 90.96% of companies in the Transportation industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. CSX has shown strong profitability with an operating margin of 39.14%, ranking better than 93.92% of companies in the Transportation industry. Moreover, CSX's growth prospects are promising, with a 3-year average revenue growth rate better than 66.59% of companies in the Transportation industry.

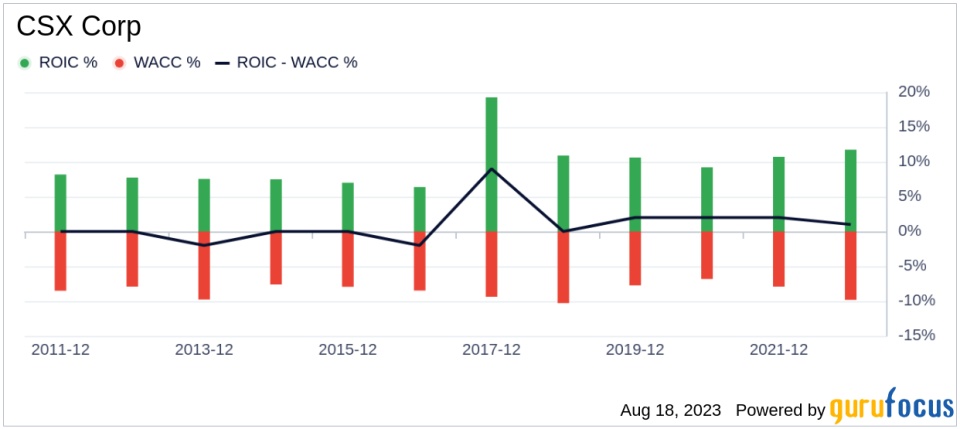

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) provides insights into its profitability. CSX's ROIC of 11.77, higher than its WACC of 9.77, implies the company is creating value for shareholders.

Conclusion

In conclusion, CSX Corp (NASDAQ:CSX) appears to be modestly undervalued. The company's fair financial condition, strong profitability, and promising growth prospects suggest potential for higher future returns. For a detailed understanding of CSX's financials, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.