CSX Corp (CSX) Reports Decline in Annual Operating Income and Net Earnings for 2023

Operating Income: Full-year operating income fell by 8% to $5.56 billion.

Net Earnings: Annual net earnings decreased to $3.72 billion, or $1.85 per share.

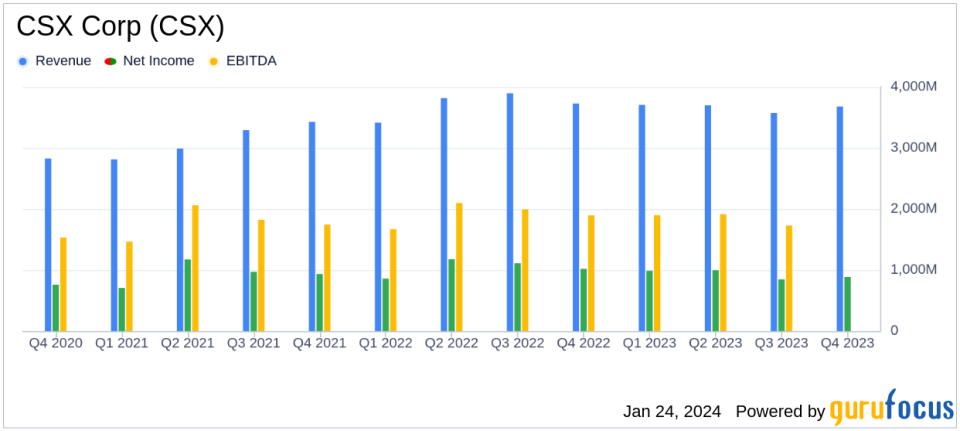

Revenue: Revenue for 2023 was down 1% year-over-year, totaling $14.66 billion.

Operating Ratio: Operating ratio for the year worsened to 62.1%.

Volume Growth: Total volume increased by 1% in Q4, with merchandise and coal volumes up.

Challenges: Lower intermodal storage revenue, reduced fuel surcharge, and lower global benchmark coal prices impacted earnings.

On January 24, 2024, CSX Corp (NASDAQ:CSX) disclosed its financial results for the fourth quarter and full year of 2023, revealing a downturn in operating income and net earnings compared to the previous year. The company's 8-K filing indicates that despite a slight increase in total volume, CSX faced significant economic headwinds.

Operating as a leading Class I railroad in the Eastern United States, CSX generated approximately $14.8 billion in revenue in 2023, navigating through a dynamic economic landscape over its expansive network of over 21,000 miles of track. The company specializes in transporting a diverse range of commodities, including coal, chemicals, intermodal containers, automotive cargo, and other bulk and industrial merchandise.

Financial Performance and Challenges

CSX's operating income for the year stood at $5.56 billion, an 8% decrease from the previous year, while net earnings dropped to $3.72 billion, or $1.85 per share, from $4.17 billion, or $1.95 per share, in 2022. The company's President and CEO, Joe Hinrichs, highlighted the reliable network performance and consistent results delivered by the ONE CSX team amidst the challenging economic environment.

However, the company's financial achievements were overshadowed by several challenges, including a decline in intermodal storage revenue, reduced fuel surcharge, lower global benchmark coal prices, and a decrease in trucking revenue. These factors contributed to a 1% year-over-year decline in revenue for 2023, totaling $14.66 billion.

Key Financial Metrics

CSX's operating ratio, a key metric in the transportation industry indicating efficiency, worsened to 62.1% for the full year 2023. The diluted earnings per share (EPS) also saw a decrease of 5% from the previous year. Despite these setbacks, the company experienced a 1% increase in total volume during the fourth quarter, with merchandise and coal volumes showing growth, while intermodal volume remained flat.

"Our railroad is running well, we have the right team and resources in place, and we look forward to building on our positive momentum with profitable growth over this next year," said Joe Hinrichs, President and CEO of CSX.

CSX's financial tables reflect the impact of the economic challenges on its performance. The company's balance sheet remains solid, but the income statement and cash flow statement highlight the areas where CSX has faced headwinds over the past year.

Analysis of Company's Performance

While CSX has demonstrated resilience in maintaining a high level of service and network performance, the decline in key financial metrics suggests that the company must navigate through economic uncertainties and industry-specific challenges. The transportation sector is highly sensitive to economic cycles, and CSX's performance is a testament to the broader challenges faced by the industry.

Investors and stakeholders will be closely monitoring CSX's strategies for growth and efficiency improvements in the coming year, as indicated by the company's forward-looking optimism. The full financial details of CSX's performance are available in the company's quarterly financial report and the Form 8-K filed with the Securities and Exchange Commission.

For more in-depth analysis and up-to-date information on CSX Corp (NASDAQ:CSX) and other significant market players, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from CSX Corp for further details.

This article first appeared on GuruFocus.