CSX Q3 Earnings In Line With Estimates, Revenues Surpass

CSX Corporation’s (CSX) third-quarter 2023 earnings per share (EPS) of 42 cents matched the Zacks Consensus Estimate. However, the bottom line declined 19.2% year over year.

Total revenues of $3,572 million beat the Zacks Consensus Estimate of $3,563 million. The top line decreased 8.3% year over year due to lower fuel prices, reduced intermodal storage revenues, a decline in export coal benchmark prices, and a decrease in intermodal volumes. These factors offset the effects of higher merchandise yields and coal volume growth.

Third-quarter operating income fell 18% to $1,295 million. The operating ratio (operating expenses as a percentage of revenues) rose to 63.8% from 59.5% in the prior-year quarter, with total expenses increasing 2% year over year.

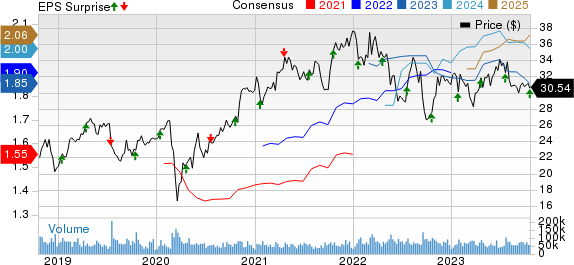

CSX Corporation Price, Consensus and EPS Surprise

CSX Corporation price-consensus-eps-surprise-chart | CSX Corporation Quote

Segmental Performances

Merchandise revenues fell 1% year over year to $2,112 million in the reported quarter. Merchandise volumes grew $1 million to $649 million. Segmental revenue per unit decreased 2%.

Intermodal revenues fell 14% year over year to $517 million. Volumes fell 7% year over year. Segmental revenue per unit decreased 8%.

Coal revenues fell 5% year over year to $594 million in the reported quarter. Coal volumes increased 9%. Segmental revenue per unit fell 13%.

Effective from third-quarter 2021,CSX introduced a segment called Trucking comprising the operations of Quality Carriers, acquired by CSX last year. Revenues from the segment totaled $218 million, down 13% year over year due to lower fuel and capacity surcharges.

Other revenues fell 52% to $131 million in the reported quarter. The downside was owing to lower intermodal storage and equipment usage.

Liquidity, Dividends and Buyback

CSX exited the third quarter with cash and cash equivalents of $1,360 million compared with $956 million at the prior-quarter end. Long-term debt totaled $17,903 million compared with $17,898 million at the second-quarter end.

CSX generated $1,566 million of cash from operating activities in the third quarter.

As of Sep 30, 2023, CSX rewarded its shareholders through buybacks and dividends worth $971 million and $218 million, respectively.

Outlook

CSX continues to expect capex for 2023 to be around $2.3 billion. To combat inflationary pressures, management aims to focus on increasing efficiencies. Volumes are expected to be aided by strength in the merchandise and coal units.

Currently, CSX carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT third-quarter 2023 EPS of $1.80 missed the Zacks Consensus Estimate of $1.85 and declined 30% year over year.

JBHT’s total operating revenues of $3,163.8 million also lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year.

Delta Air Lines, Inc. (DAL) reported third-quarter 2023 EPS (excluding 31 cents from non-recurring items) of $2.03, which comfortably beat the Zacks Consensus Estimate of $1.92 and improved 35% on a year-over-year basis.

DAL’s revenues of $15,488 million beat the Zacks Consensus Estimate of $15,290.4 million and increased 11% on a year-over-year basis, driven by higher air-travel demand.

Alaska Air Group, Inc. ALK reported third-quarter 2023 EPS of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year.

Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line jumped 0.4% year over year, with passenger revenues accounting for 92.2% of the top line and increasing 0.1% owing to continued recovery in air-travel demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report