CSX Shares Rise on Q3 Earnings Beat, Revenues Miss Mark

CSX Corporation CSX reported third-quarter 2019 earnings of $1.08 per share, beating the Zacks Consensus Estimate of $1.01. The bottom line also inched up 2.9% year over year on lower costs. Following this earnings outperformance, shares of the company rose more than 4% in after-hours trading on Oct 16.

Meanwhile, total revenues of $2,978 million lagged the Zacks Consensus Estimate of $2,980.6 million and also decreased 4.8% year over year. The top line was affected by disappointing performance at the coal and intermodal segments.

Third-quarter operating income was flat year over year at $1,287 million. Operating ratio (operating expenses as a percentage of revenues) improved to 56.8% from 58.7% in the prior-year quarter with total expenses decreasing 8% from the year-ago period. Costs reduced primarily due to increased efficiency and low fuel prices.

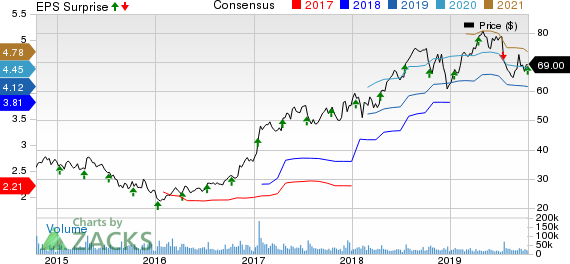

CSX Corporation Price, Consensus and EPS Surprise

CSX Corporation price-consensus-eps-surprise-chart | CSX Corporation Quote

Segmental Performance

Merchandise revenues climbed 1% year over year to $1,906 million in the quarter under review. Merchandise volumes were flat year over year.

Coal revenues declined 12% year over year to $516 million in the reported quarter. Coal volumes also contracted 9% year over year due to lower domestic and export coal volumes.

Moreover, Intermodal revenues dropped 11% year over year to $447 million. Volumes also shrank 9% on a year-over-year basis with both domestic and international volumes slipping.

Other revenues too fell 28% to $109 million in the reported quarter.

Liquidity & Share Buyback

This Zacks Rank #3 (Hold) company exited the third quarter with cash and cash equivalents of $1,521 million compared with $858 million at the end of last December. Long-term debt totaled $15,992 million compared with $14,739 million at 2018 end. As of Sep 30, 2019, net cash provided by operating activities was $3,737 million compared with $3,406 million in the year-earlier period. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

During the first nine months of 2019, the company repurchased 39 million shares at an average price of $71.11.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter 2019 earnings reports from key players like Norfolk Southern Corporation NSC, United Parcel Service UPS and Southwest Airlines Co. LUV. While UPS and Norfolk Southern will report earnings numbers on Oct 22 and Oct 23, respectively, Southwest will announce financial results on Oct 24.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research