Cullen/Frost (CFR) Q4 Earnings & Revenues Beat, Costs Up Y/Y

Cullen/Frost Bankers, Inc. CFR reported fourth-quarter 2023 adjusted earnings per share (excluding the impact of FDIC surcharge) of $2.18, down from $2.91 in the prior-year quarter. Nonetheless, the bottom line surpassed the Zacks Consensus Estimate of $2.01.

Results were primarily aided by a rise in non-interest income and higher loan balances during the quarter. However, a rise in non-interest expenses and credit loss expenses were significant drags.

The company reported net income available to common shareholders of $100.9 million, down from $189.5 million in the prior-year quarter.

For 2023, earnings per share were $9.10, up from $8.81 in the prior-year quarter. The bottom line missed the Zacks Consensus Estimate of $9.59. Net income available to common shareholders was $591.3 million, up from $572.5 million in 2022.

Revenues Decline, Expenses Rise

The company’s total revenues were $523.7 million in the fourth quarter, down 1.1% year over year. Nonetheless, the top line surpassed the Zacks Consensus Estimate of $498.1 million.

In 2023, revenues were up 16.1% to $2.08 billion, surpassing the Zacks Consensus Estimate of $2.04 billion.

NII on a taxable-equivalent basis declined 3.3% to $409.9 million year over year. Nonetheless, net interest margin (NIM) expanded 10 basis points (bps) year over year to 3.41%. Our estimates for NII and NIM were $389.5 million and 3.36%, respectively.

Non-interest income improved 7.6% to $113.8 million year over year. The rise was due to an increase in all components of non-interest income. Our estimate for non-interest income was $101.6 million.

Non-interest expenses of $365.2 million jumped 29.8% year over year. The rise was majorly due to FDIC insurance expense incurred during the fourth quarter. Our estimate for non-interest expenses was $308.2 million.

As of Dec 31, 2023, total loans were $18.82 billion, up 2.3% sequentially. Total deposits amounted to $41.92 billion, up 2.3% from the previous quarter.

Credit Quality Deteriorates

As of Dec 31, 2023, the company recorded credit loss expenses of $16 million compared with $3 million in the prior-year quarter. Further, net charge-offs, annualized as a percentage of average loans, expanded 14 bps year over year to 0.23%.

Nonetheless, the allowance for credit losses on loans, as a percentage of total loans, was 1.31%, down 2 bps.

Capital Ratios Improve & Profitability Ratios Decline

As of Dec 31, 2023, the Tier 1 risk-based capital ratio was 13.73%, up from 13.35% at the end of the year-earlier quarter. The total risk-based capital ratio was 15.18%, up from 14.84% as of the prior-year quarter. The common equity Tier 1 risk-based capital ratio was 13.25%, up from the year-ago quarter’s 12.85%.

The leverage ratio increased to 8.35% from 7.29%.

Return on average assets and return on average common equity were 0.82% and 13.51% compared with 1.44% and 27.16% in the prior-year quarter, respectively.

Capital Distribution Update

The company declared first-quarter cash dividend of 92 cents per share, which will be paid on Mar 15, 2024, to shareholders of record as of Feb 29.

Its board of directors also approved an additional share buyback program with authorization to purchase up to $150 million of its common stock. The plan will expire on Jan 24, 2025.

Our Viewpoint

Cullen/Frost has put up a decent performance in the fourth quarter of 2023. It is well-positioned for revenue growth, given the steady improvement in loan balances, higher interest rates and its efforts to boost fee income. However, rising expenses may affect the bottom line to some extent in the near term.

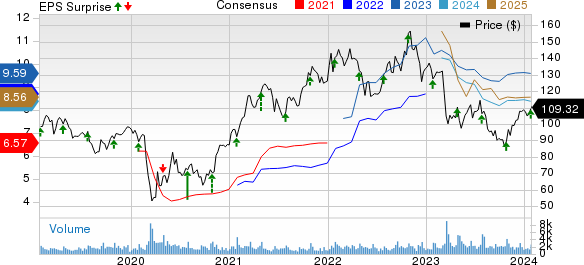

Cullen/Frost Bankers, Inc. Price, Consensus and EPS Surprise

Cullen/Frost Bankers, Inc. price-consensus-eps-surprise-chart | Cullen/Frost Bankers, Inc. Quote

Currently, Cullen/Frost carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

The Bank of New York Mellon Corporation’s BK fourth-quarter 2023 adjusted earnings of $1.28 per share surpassed the Zacks Consensus Estimate of $1.12. However, the bottom line reflects a fall of 1.5% from the prior-year quarter.

Results were primarily aided by a rise in net interest revenues and fee revenues. The assets under management balance witnessed a rise, which was another major positive for BK. However, higher expenses hurt the results to some extent. Also, the credit quality was weak in the reported quarter.

East West Bancorp’s EWBC fourth-quarter 2023 adjusted earnings per share of $2.02 surpassed the Zacks Consensus Estimate of $1.89. However, the bottom line declined 14.8% from the prior-year quarter.

Results were primarily aided by an increase in non-interest income. Also, loan balances increased sequentially in the quarter, which was a positive for EWBC. However, lower NII, and higher expenses and provisions were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Cullen/Frost Bankers, Inc. (CFR) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report