Cummins (CMI) Q4 Earnings Miss Estimates, Revenues Rise Y/Y

Cummins Inc. CMI reported fourth-quarter 2023 earnings of $4.14 per share, which declined from $4.52 per share recorded in the corresponding quarter of 2022. The bottom line also missed the Zacks Consensus Estimate of $4.41 per share. Cummins’ revenues totaled $8.54 billion, up from $7.77 billion recorded in the year-ago quarter. The top line also beat the Zacks Consensus Estimate of $8.08 billion.

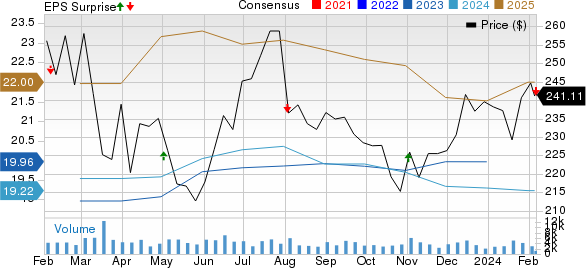

Cummins Inc. Price, Consensus and EPS Surprise

Cummins Inc. price-consensus-eps-surprise-chart | Cummins Inc. Quote

Key Takeaways

In the reported quarter, sales in the Engine segment were up 5% year over year to $2.8 billion. The metric topped our estimate of $2.76 billion. The outperformance was attributable to the increase in on-highway revenues, which increased 10% due to strong demand in the North American truck market and pricing actions. The segment’s EBITDA fell to $353 million (accounting for 12.7% of sales) from $362 million (13.7% of sales) and missed our estimate of $357.4 million.

Sales in the Distribution segment totaled $2.7 billion, up 17% year over year, beating our estimate of $2.52 billion. Higher sales in North America resulted in outperformance. Revenues in North America jumped 18%, while international sales rose 15%. The segment’s EBITDA came in at $269 million (9.9% of sales), up from the year-ago quarter’s $256 million (11% of sales). The metric, however, missed our estimate of $311.6 million.

Sales in the Components segment totaled $3.2 billion, up 3% from the prior-year quarter, but missed our estimate of $3.24 billion. Lower sales in North America resulted in the underperformance. Revenues in North America fell 2%. The segment’s EBITDA was $406 million (12.7% of sales), higher than the year-ago figure of $377 million (12.2% of sales). The metric missed our estimate of $499.1 million.

Sales in the Power Systems segment rose 8% from the year-ago quarter to $1.4 billion but lagged our estimate of $1.42 billion. A fall in industrial revenues resulted in the underperformance. The segment’s EBITDA fell to $182 million (12.7% of sales) from $185 million (14% of sales) and missed our estimate of $209.9 million.

Sales in the Accelera segment came in at $81 million, up 8% from the year-ago level but lagging our estimate of $120.2 million. The segment incurred a pretax loss of $121 million, which was wider than our estimate of $100.4 million. Costs associated with the development of electric powertrains, fuel cells and electrolyzers, as well as products to support battery electric vehicles, contributed to EBITDA losses.

Financials

Cummins’ cash and cash equivalents were $2.18 billion as of Dec 31, 2023, up from $2.1 billion on Dec 31, 2022. Long-term debt totaled $4.8 billion, up from $4.50 billion on Dec 31, 2022.

In the fourth quarter of 2023, Cummins increased its dividend to $1.68 per share, payable on Dec 7, 2023, to shareholders of record on Nov 24, 2023.

2024 Outlook

For full-year 2024, Cummins expects revenues to decline 2-5% year over year. EBITDA is forecasted to be in the range of 14.4-15.4% of sales. Cummins continues to stick to its plan of returning nearly 50% of its operating cash flow to shareholders in the form of dividends.

Zacks Rank & Key Picks

CMI currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Honda Motor Co., Ltd. HMC, Oshkosh Corporation OSK and Modine Manufacturing Company MOD, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HMC’s 2024 sales and earnings implies year-over-year growth of 14.8% and 37.3%, respectively. The EPS estimates for 2024 and 2025 have moved up 16 cents and 22 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 6.7% and 4%, respectively. The EPS estimates for 2024 and 2025 have improved 8 cents and 22 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings suggests year-over-year growth of 4% and 67.2%, respectively. The EPS estimates for 2024 and 2025 have improved 22 cents each in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report