Curtiss-Wright's (CW) Q2 Earnings Beat, '23 Sales View Up

Curtiss-Wright Corporation CW reported second-quarter 2023 adjusted earnings per share (EPS) of $2.15, which surpassed the Zacks Consensus Estimate of $1.97 by 9.1%.

The company reported a GAAP EPS of $2.10, up from $1.83 in the year-ago quarter.

Operational Performance

In the quarter under review, the company’s net sales of $704.4 million went up 15.6% year over year. Also, the top line surpassed the Zacks Consensus Estimate of $649 million by 8.6%.

The company reported operating income of $112.8 million in the second quarter, soaring 15% year over year. The operating margin contracted 10 basis points (bps) to 16%.

Curtiss-Wright’s total backlog at the end of the second quarter was $2.8 billion, up from $2.7 billion at the end of the first quarter.

New orders of $842 million increased 8% year over year in the second quarter, driven by the strong demand for defense electronics, naval defense products and nuclear aftermarket products.

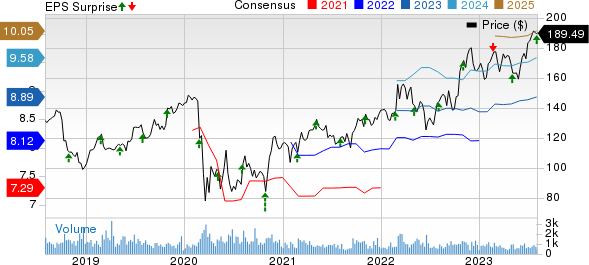

Curtiss-Wright Corporation Price, Consensus and EPS Surprise

Curtiss-Wright Corporation price-consensus-eps-surprise-chart | Curtiss-Wright Corporation Quote

Segmental Performance

Aerospace & Industrial: Sales in this segment improved 8.5% year over year to $226.3 million. The upside was driven by strong demand and higher OEM sales of sensors products and surface treatment services on narrowbody and widebody platforms, increased sales of industrial automation products and surface treatment services and favorable timing of sales for its actuation equipment supporting various programs.

While the operating income increased 9.9% to $35.7 million, the operating margin expanded 20 bps to 15.8%.

Defense Electronics: Sales in this segment increased 32.2% year over year to $197.7 million. This rise was due to increased sales of avionics and flight test equipment on various domestic and international platforms and higher sales of tactical battlefield communications equipment. Also, increased sales of its embedded computing and flight test instrumentation equipment on various fighter jet programs contributed to this segment’s revenue growth.

The operating income increased 76.5% to $43.2 million, while the operating margin increased 540 bps to 21.8%.

Naval & Power: Sales in this segment increased 11.6% year over year to $280.4 million, driven by solid contributions from the arresting systems acquisition and strong demand from international customers. Moreover, higher revenues from Columbia-class and Virginia-class submarines, as well as strong growth in industrial valve sales in the process market and solid growth in commercial nuclear aftermarket revenues, contributed to this unit’s top-line growth.

The unit’s operating income decreased 1% to $46.8 million. The operating margin fell 320 bps to 16.7%. This decrease was due to the unfavorable mix of products.

Financial Update

CW’s cash and cash equivalents as of Jun 30, 2023, were $158.7 million compared with $256.9 million as of Dec 31, 2022.

The long-term debt was $1,176.1 million as of Jun 30, 2023, compared with $1,051.9 million as of Dec 31, 2022.

The operating cash inflow totaled $19.4 million at the end of the second quarter of 2023 against cash outflow of $93.3 million in the prior-year period.

The adjusted free cash flow at the end of the reported quarter was $6.7 million against free cash outflow of $89.5 million recorded a year ago.

2023 Guidance

Curtiss-Wright increased its financial guidance for 2023. The company now expects to generate adjusted earnings in the band of $8.90-$9.15 compared with the earlier guidance of $8.65-$8.90. The Zacks Consensus Estimate for the company’s full-year earnings is pegged at $8.89 per share, which is lower than the CW’s guided range.

Curtiss-Wright now expects sales in the range of $2,730-$2,790 million, up from the prior guidance of $2,655-$2,710 million. The Zacks Consensus Estimate for its full-year sales is pegged at $2.70 billion, lower than the company’s guided range.

Zacks Rank

Curtiss-Wright currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Raytheon Technologies Corporation’s RTX second-quarter 2023 adjusted earnings per share of $1.29 beat the Zacks Consensus Estimate of $1.17 by 10.3%. The bottom line also improved 11% from the year-ago quarter’s level of $1.16.

The second-quarter sales of $18,315 million beat the Zacks Consensus Estimate of $17,543 million by 4.4%. The figure also rose 12.3% from $16,314 million recorded in the year-ago period.

Hexcel Corporation HXL reported second-quarter 2023 adjusted earnings of 50 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 4.2%. The bottom line improved 51.5% from the year-ago earnings of 33 cents per share.

In the second quarter, net sales totaled $454 million, which beat the Zacks Consensus Estimate of $445 million by 2.2%. Also, the top line witnessed an improvement of 15.6% from the year-ago quarter’s $393 million.

Teledyne Technologies Inc. TDY reported second-quarter 2023 adjusted earnings of $4.67 per share, which beat the Zacks Consensus Estimate of $4.63 by 0.9%. The bottom line improved 5.4% from $4.43 recorded in the year-ago quarter.

Total sales amounted to $1,424.7 million, which beat the Zacks Consensus Estimate of $1,416.7 million by 0.6%. The top line improved 5.1% from $1,355.8 million reported in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report