Custom Truck One Source Inc Reports Record Full-Year Revenue for 2023

Annual Revenue: Increased to $1,865.1 million, up 18.6% from 2022.

Annual Gross Profit: Grew by 18.4% to $454.3 million compared to the previous year.

Annual Net Income: Rose to $50.7 million, an increase of $11.8 million from 2022.

Quarterly Net Income: Decreased to $16.1 million in Q4, down from $30.9 million in Q4 2022.

Adjusted EBITDA: Annual Adjusted EBITDA increased by 8.6% to $426.9 million.

2024 Outlook: Revenue projected between $2,000 million and $2,180 million, with Adjusted EBITDA between $440 million and $470 million.

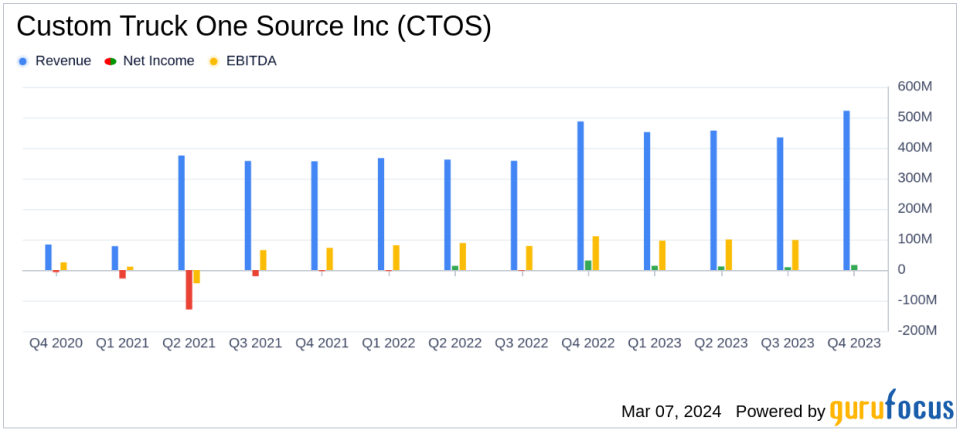

On March 7, 2024, Custom Truck One Source Inc (NYSE:CTOS) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of specialty equipment to various infrastructure-related end markets, reported a record annual revenue of $1,865.1 million, marking an 18.6% increase from the previous year. This growth was driven by strong demand across CTOS's end markets, particularly in the Truck and Equipment Sales (TES) segment, which saw a 29% revenue growth compared to 2022.

Despite a strong year overall, CTOS faced challenges in the fourth quarter, with a quarterly net income decrease of $14.8 million to $16.1 million, compared to $30.9 million in the same period of the previous year. This decline was attributed primarily to higher interest expenses on variable-rate debt. However, the company's annual net income saw an increase of $11.8 million to $50.7 million, compared to $38.9 million in 2022.

Financial Performance and Segment Highlights

CTOS's Equipment Rental Solutions (ERS) segment experienced a 5.5% decrease in rental revenue in Q4 2023, with fleet utilization declining to 77.6% from 86.3% in Q4 2022. The Truck and Equipment Sales (TES) segment, however, showcased a 20.9% increase in revenue in Q4 2023, benefiting from supply chain improvements and strong customer demand. The Aftermarket Parts and Services (APS) segment saw a modest increase in revenue and a significant improvement in gross profit, reflecting the company's focus on managing costs.

Adjusted EBITDA for Q4 2023 was $118.4 million, a decrease from $124.5 million in Q4 2022. Despite this, the annual Adjusted EBITDA increased by 8.6% to $426.9 million, demonstrating the company's ability to grow its core metrics amidst market pressures.

Our fourth quarter results concluded a strong year despite some end-market pressures in the second half of the year. As we head into 2024, we continue to see strong demand from customers across all our primary end-markets and in all three of our business segments," said Ryan McMonagle, Chief Executive Officer of CTOS.

Looking Ahead: 2024 Outlook

CTOS provided guidance for 2024, anticipating another year of growth with revenue projected between $2,000 million and $2,180 million, and Adjusted EBITDA between $440 million and $470 million. The company expects to generate more than $100 million of levered free cash flow and aims to achieve a net leverage ratio of less than 3.0 times by the end of the fiscal year.

The company's focus on capital allocation is expected to drive free cash flow generation and continued deleveraging, creating long-term value for shareholders. With a strong backlog entering the year and healthy inventory levels, CTOS is well-positioned to meet the sustained demand in its end markets.

For more detailed information on CTOS's financial results, including segment performance and financial statements, investors are encouraged to review the full 8-K filing.

CTOS will hold a conference call at 5:00 P.M. Eastern Time on March 7, 2024, to discuss its fourth quarter and full year 2023 financial results. Interested parties can access the webcast at investors.customtruck.com or dial in by phone.

Value investors and potential GuruFocus.com members seeking to explore investment opportunities in the Business Services sector may find Custom Truck One Source Inc's growth trajectory and strategic focus on capital allocation to be of particular interest.

Explore the complete 8-K earnings release (here) from Custom Truck One Source Inc for further details.

This article first appeared on GuruFocus.