CVR Energy Inc (CVI) Announces Full-Year 2023 Financial Results and Dividend Payout

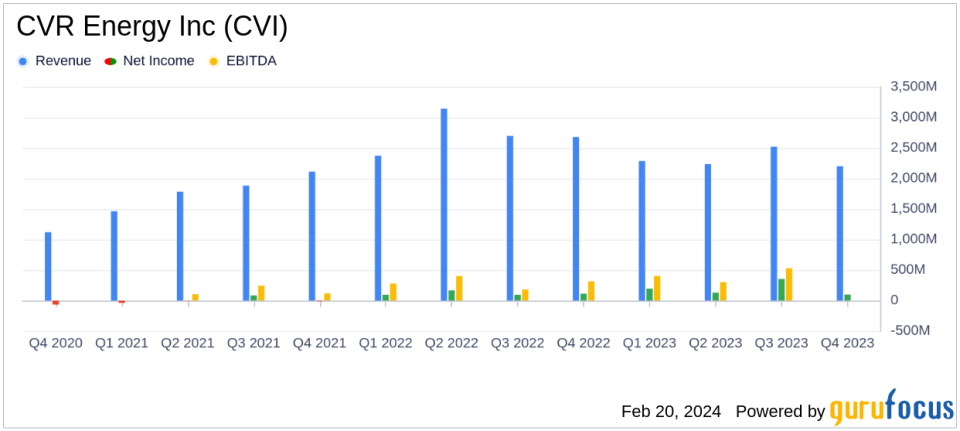

Net Income: CVR Energy Inc (NYSE:CVI) reported a full-year 2023 net income of $769 million, a significant increase from $463 million in 2022.

EBITDA: The company achieved a record EBITDA of $1.4 billion for the year, up from $1.2 billion in the previous year.

Dividends: CVR Energy declared a quarterly cash dividend of 50 cents for Q4 2023, with a total of $4.50 per share for the year.

Net Sales: Full-year net sales were $9.2 billion, a decrease from $10.9 billion in 2022, reflecting market dynamics.

Adjusted Earnings Per Share: Adjusted earnings for the full year were $5.64 per diluted share, compared to $6.04 in 2022.

Refining Margin: The refining margin for the full year was $1.7 billion, or $21.82 per total throughput barrel, an improvement from 2022.

Nitrogen Fertilizer Segment: Operating income for the segment was $201 million on net sales of $681 million for the full year, down from 2022 results.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 20, 2024, CVR Energy Inc (NYSE:CVI) released its 8-K filing, detailing the financial performance for the fourth quarter and full year of 2023. The company, a diversified holding entity engaged in petroleum refining and nitrogen fertilizer manufacturing, navigated a challenging market environment to post significant financial achievements.

Company Overview

CVR Energy Inc operates through its holdings in CVR Refining LP and CVR Partners, LP. The company's refineries, capable of processing a variety of crude oil types, are supported by a gathering system, pipelines, and storage tanks. CVR's marketing and supply chain deliver products directly to customers in proximity to the refineries and through throughput terminals. The company's customer base includes retailers, railroads, and farm cooperatives.

Financial Performance and Challenges

The company's performance in 2023, particularly the record EBITDA, underscores the efficient utilization of assets and improved capture rates. Despite a decrease in net sales from the previous year, CVR Energy managed to increase its net income attributable to stockholders, reflecting strong operational management. However, the company faced headwinds such as a decrease in the Group 3 2-1-1 crack spread and lower realized gate prices for nitrogen fertilizer products, which may pose challenges moving forward.

Financial Achievements

The increase in net income and EBITDA is a testament to CVR Energy's resilience in a volatile oil and gas industry. The company's ability to declare cumulative cash dividends of $4.50 per share for 2023 is indicative of its commitment to shareholder returns and confidence in its cash flow generation capabilities.

Key Financial Metrics

The income statement reveals a robust net income growth year-over-year, while the balance sheet shows a healthy cash position of $581 million as of December 31, 2023. The cash flow statement highlights a strong free cash flow, enabling the company to support its dividend payouts. Important metrics such as refining margin and throughput volumes are crucial indicators of the company's operational efficiency and market positioning.

Commentary from Management

"CVR Energy reported record EBITDA for 2023 driven by high utilization of our assets, improved capture rates, record premium gasoline production, record crude oil gathering volumes and our continued peer-leading distillate yield," said Dave Lamp, CVR Energys Chief Executive Officer. "We are pleased that our results for the year enabled our Board of Directors to authorize regular and special dividends for 2023 totaling $4.50 per share, representing a payout ratio of 64 percent of free cash flow generation for the year."

Analysis of Company's Performance

The company's performance in 2023, particularly in the context of a challenging market environment, demonstrates strong operational discipline and strategic management of resources. The record EBITDA and increased net income, despite reduced net sales, reflect a focus on profitability and cost management. The ability to maintain a high dividend payout ratio also signals a strong financial position and commitment to shareholder value.

For further details on CVR Energy Inc's financial performance, including full financial tables and additional commentary, investors and analysts are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from CVR Energy Inc for further details.

This article first appeared on GuruFocus.