CVR Partners LP (UAN) Reports Decline in Q4 and Full-Year 2023 Earnings; Announces Cash Distribution

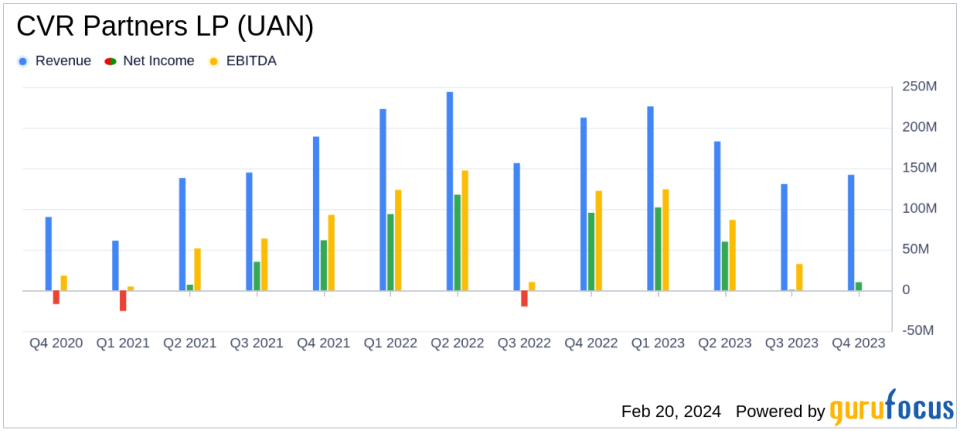

Net Income: Q4 net income of $10 million, full-year net income of $172 million.

Net Sales: Q4 net sales of $142 million, full-year net sales of $681 million.

EBITDA: Q4 EBITDA of $38 million, full-year EBITDA of $281 million.

Distributions: Declared Q4 cash distribution of $1.68 per common unit, total 2023 distributions of $17.80 per common unit.

Ammonia Utilization: Maintained a combined ammonia utilization rate of 100 percent for full-year 2023.

Product Prices: Average realized gate prices for UAN and ammonia declined by 47% and 52% respectively in Q4.

On February 20, 2024, CVR Partners LP (NYSE:UAN), a leading manufacturer of ammonia and urea ammonium nitrate (NYSE:UAN) solution fertilizer products, released its 8-K filing, disclosing its financial results for the fourth quarter and full-year 2023. The company reported a net income of $10 million, or 94 cents per common unit, on net sales of $142 million for the fourth quarter of 2023, a significant decrease from the net income of $95 million, or $9.02 per common unit, on net sales of $212 million for the same period in 2022. For the full year, net income stood at $172 million, or $16.31 per common unit, on net sales of $681 million, compared to $287 million, or $27.07 per common unit, on net sales of $836 million for the previous year.

Company Overview

CVR Partners LP is a manufacturer and supplier of nitrogen fertilizer products, with its principal products being Urea Ammonium Nitrate (NYSE:UAN) and ammonia. The company markets ammonia products to industrial and agricultural customers and UAN products primarily to agricultural customers. CVR Partners LP's key geographic markets include Kansas, Missouri, Nebraska, Iowa, Illinois, Colorado, and Texas, with a significant portion of product sales attributed to UAN.

Performance and Challenges

Despite a challenging market environment characterized by lower fertilizer prices, CVR Partners LP achieved a combined ammonia utilization rate of 100 percent for the full year 2023. This high utilization rate is critical for the company's operational efficiency and profitability, especially in the agriculture industry where demand for nitrogen fertilizers is closely tied to crop cycles and global supply dynamics. The decline in average realized gate prices for UAN and ammonia, by 47 percent and 52 percent respectively in the fourth quarter, reflects the broader market pressures that the company faced during the period.

Financial Achievements and Industry Importance

The company's ability to maintain full ammonia utilization rates despite declining prices is a testament to its operational resilience and strategic positioning within the agriculture sector. The agriculture industry relies on consistent and reliable supplies of nitrogen fertilizers to meet the demands of crop production, making CVR Partners LP's performance crucial for both the company and its customers.

Financial Highlights

The financial results for the fourth quarter and full year 2023 highlight several key aspects of CVR Partners LP's operations:

For the fourth quarter of 2023, the company's EBITDA was $38 million, compared to $122 million for the same period in 2022. Full-year EBITDA was $281 million, a decrease from $403 million for the previous year. The company's total assets as of December 31, 2023, were $975.3 million, with total debt, including the current portion, at $547.3 million.

Operating activities generated net cash flows of $243.5 million for the full year, while net cash flows used in operating activities amounted to $17.9 million for the fourth quarter. Capital expenditures for maintenance and growth for the full year were $29.1 million.

"CVR Partners reported solid operating results for the full-year 2023 driven by safe, reliable operations, with a combined ammonia production rate of 100 percent for the year," said Mark Pytosh, Chief Executive Officer of CVR Partners general partner. "Fall application ammonia demand was one of the strongest we have experienced in recent years."

Analysis and Outlook

Looking ahead, CEO Mark Pytosh expressed optimism for strong nitrogen fertilizer demand during the upcoming spring planting season, bolstered by attractive farmer economics. The company's declaration of cumulative cash distributions of $17.80 per common unit during 2023 reflects a commitment to returning value to shareholders, even as it navigates market volatility.

The full financial tables and additional details can be found in the company's 8-K filing. Investors are encouraged to review the complete report to gain a deeper understanding of CVR Partners LP's financial position and outlook.

For further information and detailed financial analysis, stay tuned to GuruFocus.com, where we provide valuable insights for value investors and potential members.

Explore the complete 8-K earnings release (here) from CVR Partners LP for further details.

This article first appeared on GuruFocus.