CVS Health (CVS) to Report Q1 Earnings: What's in the Cards?

CVS Health Corporation CVS is scheduled to report first-quarter 2022 results on May 4, before the opening bell.

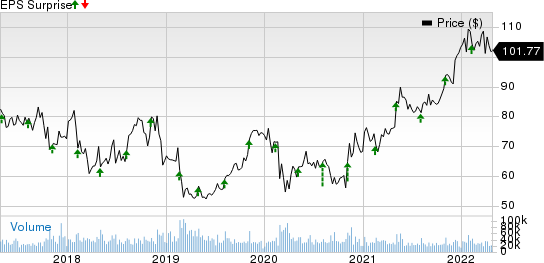

In the last reported quarter, the company’s adjusted earnings of $1.98 exceeded the Zacks Consensus Estimate by 2.1%. The company beat estimates in the trailing four quarters, the average surprise being 11.91%.

Let’s take a look at how things have shaped up prior to this announcement.

Factors at Play

CVS Health has been making noteworthy progress in terms of expanding access to care through digital and virtual channels. Per the February 2022 update, the CVS.com website has gathered more than 2 billion visits over the past year. Similar to the last-reported quarter, the company’s digital capabilities for health interactions, including COVID-19 testing and vaccines, prescription services and sales of health and wellness products sales are anticipated to have enhanced consumer engagement across all CVS Health businesses. Further, contributions from the company’s first national Virtual Primary Care program and several digital health services powered by advanced analytics are likely to have driven the first-quarter top line.

The company has also been making continued efforts to simplify digital health adoption among customers. In the last-reported fourth quarter’s earnings update, the company noted that it has simplified the CarePass enrollment for consumers, driving enhanced growth in subscribers. The company has also simplified and digitized the check-in process for its HealthHUB and MinuteClinic patients. Meanwhile, nearly 80% of patients presently utilize its self-service digital tool, allowing them to complete traditional paperwork ahead of their appointment. These developments should have positively contributed to the company’s first-quarter performance.

CVS Health Corporation Price and EPS Surprise

CVS Health Corporation price-eps-surprise | CVS Health Corporation Quote

In the past year, the pharmacy services segment delivered above-market growth, ahead of expectations. We expect this trend to have continued in the first quarter, banking on increased pharmacy sales and prescriptions filled, especially with growing demand for over-the-counter COVID-19 tests, vaccine booster shots as well as cough and cold, beauty and personal care products. However, as the effects of the pandemic fade, with COVID-19 cases registering a steady decline in recent months, we anticipate the volatility surrounding COVID-19 testing to have impeded growth in the to-be-reported quarter.

In addition, ongoing growth in specialty pharmacy and continued brand inflation are likely to have fueled growth in the pharmacy services arm. The company pairs specialty pharmacy programs with digital capabilities to provide customers with a convenient and connected experience while driving value in the marketplace.

The healthcare benefits arm is likely to have gained from sustained growth across all Medicare product lines in the first quarter. The company’s performance in government services is expected to have maintained momentum, driving growth in the to-be-reported quarter. CVS Health’s competitive cost structure, integrated benefit designs and innovative product portfolio position the healthcare benefits business for further growth.

Key Q1 Estimates

The Zacks Consensus Estimate for first-quarter adjusted earnings of $2.14 per share implies a 4.9% rise from the year-ago reported figure. The consensus estimate for revenues is pegged at $75.54 billion, suggesting 9.3% growth from the prior-year reported number.

What Our Model Suggests

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) along with a positive Earnings ESP has higher chances of beating estimates. However, this is not the case here, as you can see:

Earnings ESP: The company has an Earnings ESP of -0.10%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks Worth a Look

Here are a few stocks worth considering, as these have the right combination of elements to beat on earnings this reporting cycle.

Computer Programs and Systems CPSI has an Earnings ESP of +1.52% and a Zacks Rank of #1. Computer Programs and Systems will release first-quarter 2022 results on May 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Computer Programs and Systems’ long-term earnings growth rate is estimated at 14%. CPSI’s earnings yield of 8.47% compares favorably with the industry’s (7.51%).

Alcon Inc. ALC has an Earnings ESP of +10.04% and a Zacks Rank of #2. Alcon is expected to release first-quarter 2022 results on May 3.

Alcon’s long-term earnings growth rate is estimated at 14.7%. ALC’s earnings yield of 3.08% compares with the industry’s (7.01%).

Meridian Bioscience, Inc. VIVO has an Earnings ESP of +26.32% and a Zacks Rank of #2. Meridian Bioscience is scheduled to release second-quarter fiscal 2022 results on May 6.

Meridian Bioscience’s long-term historical earnings growth rate is 16.3%. VIVO’s earnings yield of 5.23% compares favorably with the industry’s 0.89%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meridian Bioscience Inc. (VIVO) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Computer Programs and Systems, Inc. (CPSI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research