Cytek Biosciences Inc (CTKB) Reports Robust Revenue Growth and Positive Net Income in Q4 2023

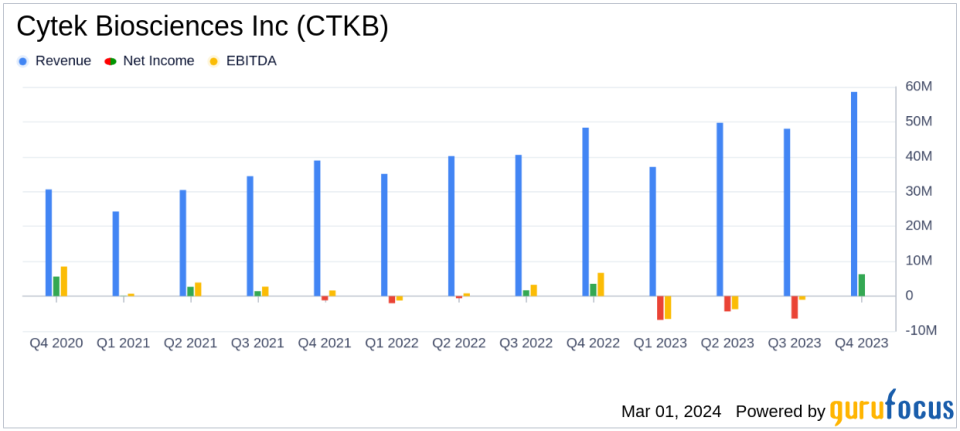

Revenue Growth: Q4 revenue increased by 21% year-over-year, reaching $58.6 million.

Gross Profit Margin: Q4 gross profit margin was 57%, with adjusted gross profit margin at 60%.

Operating Expenses: Q4 operating expenses rose by 12% due to the Luminex acquisition and increased headcount.

Net Income: Q4 net income improved to $6.3 million, up from $3.7 million in the same quarter last year.

Full Year Performance: 2023 full year revenue grew by 18% to $193.4 million, with a net loss of $11.3 million.

2024 Outlook: Cytek anticipates revenue between $203 million and $213 million, with positive net income expected.

On March 1, 2024, Cytek Biosciences Inc (NASDAQ:CTKB) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023 and providing an outlook for 2024. The company, known for its advanced cell analysis solutions, including the Aurora and Northern Lights systems, continues to innovate in the medical devices and instruments industry.

Fourth Quarter Financial Highlights

Cytek Biosciences reported a 21% increase in total revenue for Q4 2023, amounting to $58.6 million. This growth includes revenue from the product lines acquired from Luminex. Excluding these, organic revenue saw a modest 1% increase. The gross profit for the quarter was $33.7 million, a 15% increase year-over-year, although the gross profit margin decreased slightly from 61% to 57% due to higher costs associated with the acquisition.

Operating expenses for Q4 2023 were $32.8 million, reflecting a 12% increase from the same period in the previous year, primarily due to the Luminex transaction and increased personnel-related expenses. Despite these higher expenses, net income for the quarter was $6.3 million, a significant improvement from $3.7 million in Q4 2022.

Annual Financial Performance

For the full year of 2023, Cytek Biosciences achieved an 18% increase in total revenue, reaching $193.4 million. However, the company reported a net loss of $11.3 million, compared to a net income of $2.5 million in the previous year. This loss was attributed to a substantial 33% increase in operating expenses, which totaled $136.8 million for the year.

The company's balance sheet remains strong, with cash, cash equivalents, restricted cash, and short-term investments in marketable securities totaling approximately $262.7 million as of December 31, 2023.

Looking Ahead to 2024

CEO Dr. Wenbin Jiang expressed confidence in the company's strategic growth and long-term profitability, despite the challenging macro-economic environment. Cytek anticipates total revenue for 2024 to be between $203 million and $213 million, representing a growth of 5% to 10% over 2023, and expects to report positive net income.

"We delivered strong fourth quarter performance amidst a challenging macro-economic environment. Our teams navigated well while executing our business strategy, and we took actions to ensure that we remain an agile organization," said Dr. Wenbin Jiang, CEO of Cytek Biosciences. "As we look ahead to 2024, we remain laser focused on effectively driving strategic growth and delivering long-term profitability. Cytek remains on the forefront of innovation and industry leadership, and we are excited for the large opportunities ahead."

The company's performance reflects its ability to adapt and grow in a competitive market, and its outlook suggests a positive trajectory for the coming year. Investors and stakeholders will be watching closely as Cytek Biosciences continues to navigate the evolving landscape of the medical devices and instruments industry.

Explore the complete 8-K earnings release (here) from Cytek Biosciences Inc for further details.

This article first appeared on GuruFocus.