D.R. Horton (DHI) Buys Truland Homes, Boosts Gulf Coast Presence

D.R. Horton, Inc. DHI, one of America's leading homebuilders, acquired Truland Homes, the largest private homebuilder along the Gulf Coast. This strategic move will solidify D.R. Horton's position in the region and unlock significant growth opportunities.

Buyout Synergies

Truland Homes brings an impressive portfolio of assets to the table, including approximately 263 lots, 155 homes in inventory and 55 homes in the sales order backlog. In addition, D.R. Horton has gained control of an additional 357 lots through option contracts from Truland affiliates and third parties. With Truland's strong performance, having closed 512 homes and generating $244 million in revenues in 2022, the potential for future success is evident.

The acquisition will be completed for an estimated $100 million in cash, allowing D.R. Horton to integrate Truland's operations into its existing platforms in Baldwin County, AL, and Northwest Florida. This consolidation will enhance operational efficiency and streamline processes, enabling D.R. Horton to deliver homes more effectively to its customers.

Further, the acquisition of Truland Homes aligns with D.R. Horton's growth strategy and reaffirms its commitment to delivering high-quality homes to customers across the United States. With an expanded presence in the Gulf Coast market, D.R. Horton is well-positioned to capitalize on the region's growing demand for housing.

Acquisitions – a Major Tool for Expansion

D.R. Horton has been actively pursuing acquisitions as part of its growth strategy, focusing on acquiring homebuilding companies in lucrative markets. In December 2022, the company took over the homebuilding operations of Riggins Custom Homes in Northwest Arkansas. This acquisition included approximately 170 homes in inventory, 3,000 lots and a sales order backlog of around 100 homes.

In terms of investments, D.R. Horton invested substantial amounts in the first and second quarters of fiscal 2023. DHI spent $900 million and $980 million on finished lots, $690 million and $590 million on land development, and $130 million and $150 million on land acquisitions in the respective periods. Despite a 19% decrease from the previous year, the company's homebuilding investments in lots, land and development for the second quarter of fiscal 2023 totaled $1.7 million, remaining relatively stable compared to the previous quarter.

By selectively investing in attractively-priced land and lots over the past few years, D.R. Horton has been able to develop new appealing communities in desirable markets. With a well-stocked supply of land, plots and homes, the company is well-positioned to meet future demand, resulting in increased sales and home closings.

Stock Performance

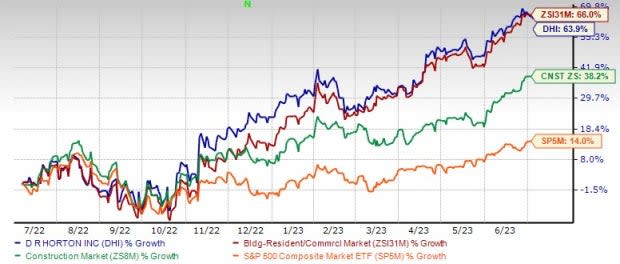

Image Source: Zacks Investment Research

DHI has surged 63.9% in the past year compared with the Zacks Building Products - Home Builders industry’s growth of 66%, the Zacks Construction sector’s increase of 38.2% and the S&P 500 Index’s rise of 14%.

Earnings estimates for fiscal 2023 have moved up to $11.17 per share from $11.14 in the past 30 days. The positive trend signifies bullish analyst sentiments, indicating robust fundamentals and sparking the expectation of outperformance in the near term.

With a strong financial position and a strategic approach to land purchases, D.R. Horton is poised for continued growth and success in meeting the housing demands of prospective buyers in the coming quarters.

Zacks Rank

DHI currently carries a Zacks Rank #3 (Hold).

3 Better-Ranked Homebuilder Stocks Hogging in the Limelight

Beazer Homes USA, Inc. BZH: This Atlanta, GA-based homebuilder designs, constructs and sells single-family and multi-family homes under the Beazer Homes, Gatherings and Choice Plans names. The ample availability of lots and a more efficient and less leveraged balance sheet will drive growth.

BZH — a Zacks Rank #1 (Strong Buy) stock — has surged 115.4% this year. The Zacks Consensus Estimate for its fiscal 2023 and 2024 earnings has been revised upward by 11% and 4.9%, respectively, in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

KB Home KBH: This Los Angeles, CA-based homebuilder builds and sells attached and detached single-family residential homes, townhomes and condominiums primarily for first-time, first move-up, second move-up and active adult homebuyers. Its strong land pipeline and built-to-order approach, along with a solid liquidity level, will drive growth.

KBH sports a Zacks Rank #1 and has jumped 58.7% year to date. The Zacks Consensus Estimate for its 2023 and 2024 earnings has been upwardly revised by 18.9% and 15.6%, respectively, over the past 60 days.

PulteGroup PHM: Based in Atlanta, GA, this homebuilder has been benefiting from a prudent land investment strategy, a focus on entry-level buyers and a return of more free cash flow to shareholders.

PHM — a Zacks Rank #2 (Buy) stock — has surged 69.4% year to date. The Zacks Consensus Estimate for its 2023 and 2024 earnings has been revised upward by 1.9% and 3.9%, respectively, in the past 60 days.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report