D.R. Horton Inc (DHI) Reports Stable Earnings Amid Market Headwinds, Declares Dividend

Net Income: $947.4 million, a slight decrease of 1% year-over-year.

Diluted Earnings Per Share: Increased to $2.82 from $2.76 in the prior year quarter.

Consolidated Revenues: Rose by 6% to $7.7 billion compared to the previous year.

Homes Closed: Increased by 12% in number and 8% in value.

Net Sales Orders: Jumped by 35% in number and 38% in value.

Dividend: Quarterly dividend declared at $0.30 per share.

Share Repurchases: 3.3 million shares bought back for $398.3 million.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

D.R. Horton Inc (NYSE:DHI), the largest homebuilder in the United States by volume, released its 8-K filing on January 23, 2024, detailing its financial performance for the first quarter of fiscal 2024. The company, headquartered in Arlington, Texas, operates in 118 markets across 33 states and offers a diversified portfolio of homes catering to various buyer segments. In addition to homebuilding, D.R. Horton provides mortgage financing and title agency services through its financial services segment.

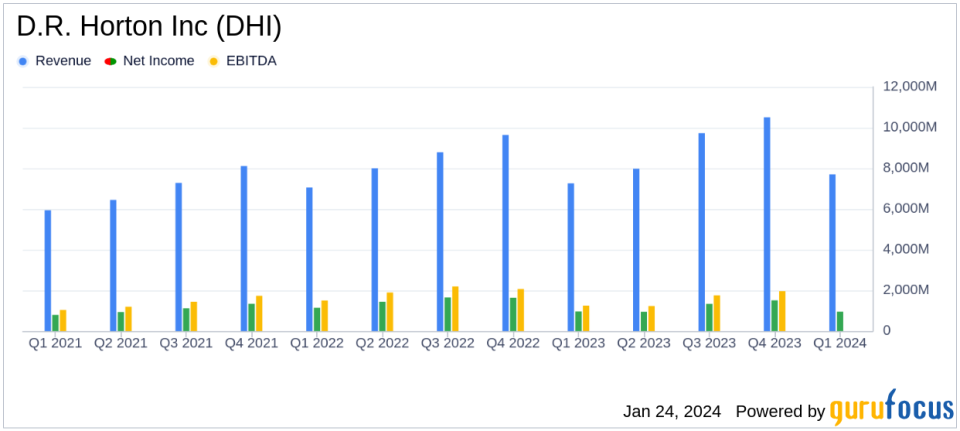

The company's earnings for the quarter stood at $2.82 per diluted share, a 2% increase from the same quarter in the previous fiscal year. Despite a slight 1% dip in net income to $947.4 million, D.R. Horton demonstrated robust revenue growth and increased home closings. The company's consolidated revenues saw a 6% increase to $7.7 billion, with homes closed rising by 12% to 19,340 units and 8% in value to $7.3 billion. Net sales orders also saw a significant uptick, with a 35% increase in homes and a 38% increase in value.

Financial Performance and Market Position

The company's financial achievements are particularly noteworthy given the current economic climate, characterized by elevated inflation and mortgage interest rates. D.R. Horton's ability to increase net sales orders by 35% is a testament to the ongoing demand for affordable housing and the company's strategic positioning in the market. The pre-tax profit margin remained strong at 16.1%, and the company's balance sheet showed $3.3 billion in cash and $3.1 billion in available credit facility capacity, totaling $6.4 billion in liquidity.

Donald R. Horton, Chairman of the Board, commented on the company's performance, stating:

"The D.R. Horton team delivered solid results in the first fiscal quarter of 2024, highlighted by earnings of $2.82 per diluted share. Although inflation and mortgage interest rates remain elevated, our net sales orders increased 35% from the prior year quarter, as the supply of both new and existing homes at affordable price points remains limited, and demographics supporting housing demand remain favorable."

These results underscore D.R. Horton's resilience in a challenging market and its ability to capitalize on the limited supply of affordable homes. The company's strategic focus on affordable product offerings and flexible lot supply has allowed it to adapt to changing market conditions effectively.

Operational Highlights and Future Outlook

Homebuilding revenue for the quarter increased by 8% to $7.3 billion, with pre-tax income for the segment at $1.1 billion. The rental operations contributed $31.3 million in pre-tax income on revenues of $195.3 million. The financial services segment also performed well, with revenues of $192.6 million and a pre-tax income of $66.0 million, reflecting a high pre-tax profit margin of 34.3%.

Looking ahead, D.R. Horton has updated its fiscal 2024 guidance, anticipating consolidated revenues of approximately $36.0 billion to $37.3 billion and home closings between 87,000 to 90,000 homes. The company also expects to generate around $3.0 billion in cash flow from homebuilding operations and plans share repurchases of approximately $1.5 billion.

Value investors may find D.R. Horton's stable performance, consistent dividend payments, and share repurchase program to be attractive attributes, signaling the company's commitment to shareholder returns. The company's strategic initiatives and disciplined capital investment approach aim to enhance long-term value, positioning D.R. Horton favorably for future growth.

For more detailed information on D.R. Horton Inc's financial performance and strategic outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from D.R. Horton Inc for further details.

This article first appeared on GuruFocus.