Daily ETF Roundup: Stocks Higher After Fed Decision

Equities rallied for a second-straight day as commentary from the Federal Reserve helped offset the latest developments in euro zone’s Cyprus drama. In his press conference, Fed Chairman Ben Bernanke indicated that the central bank will continue buying $85 billion in bonds each month to support the economic recovery and that the interest rate will remain unchanged near zero. The chairman also stated that he does not believe the recent stock market rally to be inconsistent with historical patterns, and that the Fed will be keeping a close eye on the developments in Cyprus [see Free Member Report: How To Pick The Right ETF Every Time].

Global Market Overview: Stocks Higher After Fed

Decision

Following the Fed’s press conference, all three major U.S. equity indexes rallied to close in positive territory. The Dow Jones Industrial Average ETF (DIA, B) rose 0.35%, as its underlying index hit an intraday high at 14,546.82. The S&P 500 ETF (SPY, A) rallied 0.70%, while the tech-heavy Nasdaq ETF (QQQ, A-) also jumped 0.70% higher.

In Europe, markets were slightly higher as investors awaited the next developments in the Cyprus bailout drama; Cyprus Finance Minister Michalis Sarris is currently in Russia to discuss potential financial support. Meanwhile, Asian markets were higher. China’s Shanghai Composite Index jumped 2.7%, led by banks and developers. Japan’s equity markets were closed for holiday.

Bond ETF Roundup

U.S. Treasury yields were pushed to intraday highs today following the Fed’s policy statement and press conference. Yields on 10-year notes rose 4 basis points, while yields on 30-year bonds and 5-year note rose 6 and 3 basis points, respectively [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Crude oil futures closed higher today on tight supply data released last week; Cyprus and euro zone concerns, however, kept prices in check. Meanwhile, gold futures traded lower after the Fed issued its latest policy statement. Prices for silver were also lower, though platinum and palladium futures were slightly higher.

ETF Chart Of The Day #1: (TTT)

The UltraPro Short 20+ Year Treasury ETF (TTT, n/a) was one of the best performers today, gaining 3.30% during the session. Following the Fed’s announcement that it will continue purchasing treasuries each month, yields on 30-year bonds jumped, forcing this leveraged ETF to gap significantly higher at the open. TTT inched higher throughout the day, eventually settling at $19.08 a share [see Better-Than-AGG Total Bond Market ETFdb Portfolio].

Click To Enlarge

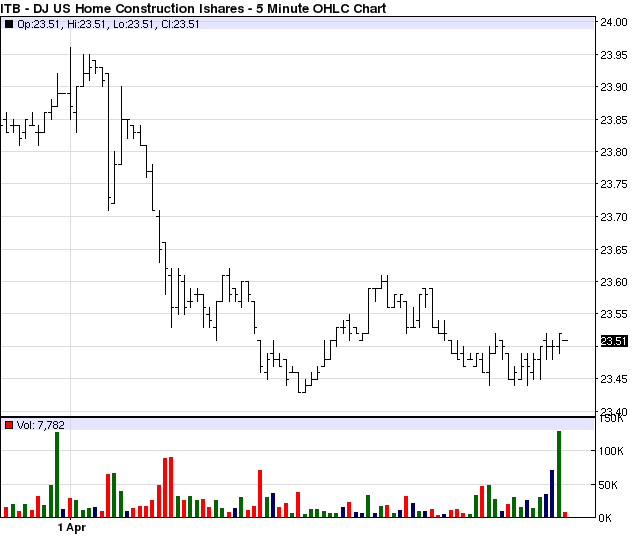

ETF Chart Of The Day #2: (ITB)

The Dow Jones U.S. Home Construction Index Fund (ITB, A-) was also one of the best performers today, gaining 2.92% during the session. Shares of Lennar (LEN) rallied today after the home builder reported better-than-expected earnings. As a result, this ETF gapped slightly higher at the open. ITB rallied for the remainder of the day, eventually settling at $24.71 a share [see Consumer Centric ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing retirement strategy over the trailing 4-week period has been the Low Volatility Portfolio, which has gained 1.24%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts: