Daily ETF Roundup: Stocks Reverse Losses To Close Higher

U.S. equities reversed earlier losses to end near session highs during a relatively quiet trading session. Investors, however, hesitated jumping in ahead of what many expect to be a lackluster first quarter earnings season. To kick things off, bellwether Alcoa (AA) released its Q1 earnings today after the closing bell, posting a 59% rise in profits on one-time benefits and cost-reduction efforts. The aluminum giant did however note that revenue suffered from lower aluminum prices due to a massive supply glut. Meanwhile, investors also remained cautious ahead of tonight’s Atlanta Federal Reserve Conference, where Fed Chairman Ben Bernanke will speak [see Free Member Report: How To Pick The Right ETF Every Time].

Global Market Overview: Stocks Reverse Losses To Close Higher

After reversing earlier losses, all three major U.S. equity indexes managed to close in positive territory. The Dow Jones Industrial Average ETF (DIA, B) gained 0.44%, as its underlying index ticked 48.23 points, or 0.3%, higher. The S&P 500 ETF (SPY, A) rose 0.68%, while the tech-heavy Nasdaq ETF (QQQ, A-) inched 0.53% higher.

In Europe, markets were slightly higher after a report showed that total German industrial output in February rose more than expected; the Stoxx Europe 600 inched 0.2% higher. Meanwhile, Asian markets were mixed; Japan’s Nikkei Stock Average jumped 2.8% as the yen declined to a new four-year low against the dollar, while China’s Shanghai Composite Index slipped 0.6%.

Bond ETF Roundup

U.S. Treasury prices fell today, snapping a three-session win streak. Yields on 10-year notes rose 3 basis points, while yields on 5-year notes and 30-year bonds rose 2 and 4 basis points, respectively [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Crude oil futures rose today, marking its first gain in four sessions, as conflicts in Iran and Nigeria stirred up concerns over oil supplies. Natural gas futures, however, ended slightly lower. Meanwhile, gold futures slid as a stronger dollar prompted profit taking pressures.

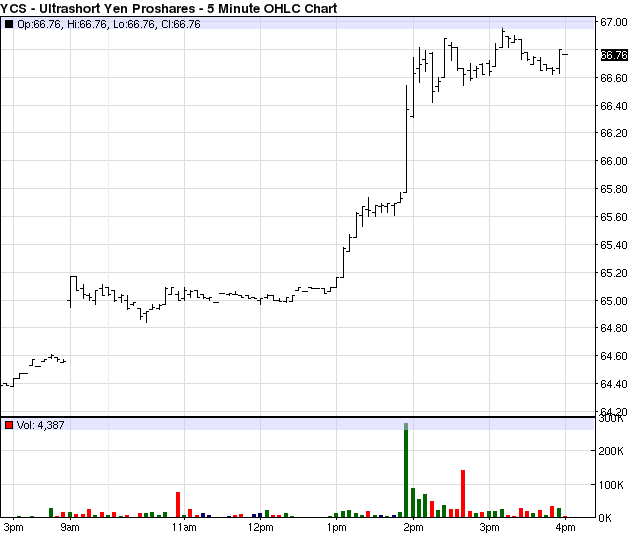

ETF Chart Of The Day #1: (YCS)

The UltraShort Yen Fund (YCS, A-) was one of the best performers today, gaining 3.09% during the session. As the yen fell to a new four-year low against the dollar, this leveraged short ETF gapped significantly higher at the open. YCS inched higher throughout the day, eventually settling at $65.35 a share [see Asia-Centric ETFdb Portfolio].

Click To Enlarge

ETF Chart Of The Day #2: (XLY)

The Consumer Discretionary Select Sector SPDR ETF (XLY, A) also posted a strong performance today, gaining 1.14% during the session. Consumer discretionary shares were among today’s top performers, forcing this ETF to jump slightly higher at the open. XLY charged higher throughout the day, eventually settling at $53.19 a share [see Consumer Centric ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing retirement strategy over the trailing 1-year period has been the Cheapskate Portfolio, which has gained 13.02%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: Historic Week Finishes On Upbeat Labor Data

Daily ETF Roundup: Stocks Close Higher As Earnings Season Kicks Off