Daily ETF Wrap: Homebuilders Rise on Housing Data

Housing and construction ETFs such as iShares DJ US Home Construction (ITB) and SPDR S&P Homebuilders ETF (XHB) continue to do well and rise to multiyear highs on the back of recent improvement in housing starts and growth in builder confidence.

VIX based ETFs such as iPath S&P 500 VIX Short Term Futures ETN (VXX) are among the poorest performers as volatility continues to go lower. Complacency is probably the word of the day. [VIX ETFs Still Flopping]

On the desk we saw inflows into iShares MSCI Switzerland (EWL), which was among the best performing country ETFs of the day.

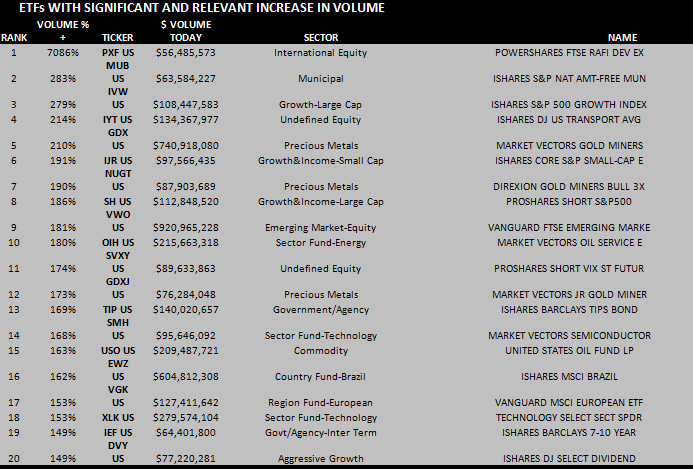

In international names we also saw flows into PowerShares FTSE RAFI Developed Markets ex US (PXF) and iShares MSCI Pacific Ex-Japan (EPP).

Domestic ETFs saw buyers of First Trust ISE-Revere Natural Gas (FCG) and outflows from PowerShares S&P Small Cap Healthcare (PSCH).

Fixed income saw two way flow on the short end of the curve, with buyers of Vanguard Short-Term Bond (BSV) and sellers of Vanguard Short-Term Corporate Bond (VCSH).

We also saw further outflows from iShares Core Total US Bond Market (AGG), as well as outflows from international bond names SPDR Barclays Capital Emerging Market Local Bond (EBND) and iShares Emerging Markets Local Currency Bond (LEMB). [Emerging Market Bond ETFs]

Chris Hempstead is Director of ETF Execution Services at WallachBeth Capital.