Danaher Corp (DHR) Reports Decline in 2023 Revenues Amid Transformational Year

Net Earnings: $4.2 billion for the full year, with diluted EPS of $5.65 and non-GAAP adjusted diluted EPS of $7.58.

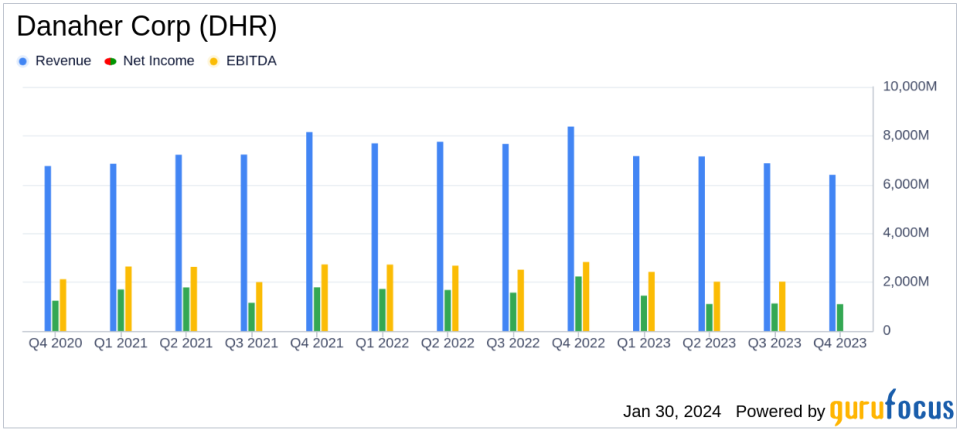

Revenue: Decreased by 10.5% year-over-year to $23.9 billion for the full year.

Operating Cash Flow: Reported at $6.5 billion for the full year, with non-GAAP free cash flow of $5.1 billion.

Core Revenue Decline: Non-GAAP core revenue decreased by 10.0% for the full year, including a 0.5% non-GAAP base business core revenue decline.

2024 Outlook: Anticipates non-GAAP core revenue to be down low-single digits year-over-year.

On January 30, 2024, Danaher Corp (NYSE:DHR) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which has evolved into a focused life sciences and diagnostics innovator following the spin-off of its environmental and applied solutions group, Veralto, faced a year of transformation and challenges.

Financial Performance and Challenges

Danaher's net earnings for the fourth quarter stood at $1.1 billion, with diluted EPS of $1.50 and non-GAAP adjusted diluted EPS of $2.09. However, the company saw a 10.0% decrease in revenues compared to the previous year, totaling $6.4 billion for the quarter. The non-GAAP core revenue also experienced an 11.5% decline, which included a 4.5% non-GAAP base business core revenue drop. This performance reflects the dynamic market environment and the impact of the COVID-19 pandemic transitioning to an endemic state.

Despite these challenges, Danaher's President and CEO, Rainer M. Blair, highlighted the company's better-than-expected revenue in each segment for the fourth quarter, led by respiratory revenue at Cepheid. Blair emphasized the strong execution by Danaher's team, which enabled the company to exceed margin and cash flow expectations.

Financial Achievements and Industry Importance

The company's financial achievements, particularly in operating cash flow and free cash flow, underscore its ability to generate substantial liquidity. These metrics are crucial for Danaher, as they provide the financial flexibility to invest in growth opportunities, innovation, and shareholder returns, which are particularly important in the competitive medical diagnostics and research industry.

Income Statement and Balance Sheet Highlights

For the full year, Danaher reported net earnings of $4.2 billion, with diluted EPS of $5.65 and non-GAAP adjusted diluted EPS of $7.58. The total revenue for the year was $23.9 billion, marking a 10.5% decrease from the previous year. The operating cash flow was strong at $6.5 billion, with non-GAAP free cash flow at $5.1 billion, demonstrating the company's robust cash-generating capabilities.

"2023 was a transformational year for Danaher. Following the spin-off of Veralto, we are a more focused Life Sciences and Diagnostics Innovator with an enhanced long-term growth and earnings trajectory," said Rainer M. Blair, President and CEO of Danaher.

Analysis of Company's Performance

Danaher's performance in 2023 reflects a period of significant change and adaptation. The divestiture of Veralto allowed the company to concentrate on its core areas of life sciences and diagnostics. While the revenue decline indicates the challenges faced, particularly due to the pandemic's evolution, the company's ability to exceed margin and cash flow expectations suggests operational efficiency and resilience. The acquisition of Abcam also points to strategic moves to bolster Danaher's position in the proteomics market.

For the first quarter of 2024, Danaher anticipates a high-single-digit year-over-year decline in non-GAAP core revenue, while for the full year 2024, a low-single-digit decline is expected. This outlook reflects the company's cautious stance in a still uncertain market environment.

As Danaher navigates through these transformative times, investors and stakeholders will be closely monitoring how the company leverages its focused strategy in life sciences and diagnostics to drive long-term growth and shareholder value.

Explore the complete 8-K earnings release (here) from Danaher Corp for further details.

This article first appeared on GuruFocus.