Danaher: A Long-Term Prospect With a Potential Bonus

Danaher Corp. (NYSE:DHR) is planning to spin off another piece of its conglomerate. Could this be an opportunity for investors, especially considering its share price has been in decline?

In the fourth quarter of this year, it plans to spin off its environmental and applied sciences division. The new company, which will be based in Waltham, Massachusetts, will be called Veralto.

It will be made up of several leading brands, including Hach, ChemTreat, Trojan, OTT HydroMet and McCrometer from Danaher's Water Quality Platform and Videojet, Esko, X-Rite Pantone and Linx from the Product Identification Platform.

As a division within Danaher, the brands generated 2022 revenue of $4.8 billion and had a global workforce of 16,000. So the new Veralto will become publicly traded when it has already bulked up.

After the spinoff is finalized, shareholders should end up with shares of both companies. To make the new company more attractive, the parent reported in a news release that Veralto will have the Danaher Business System built in.

That is the continuous improvement system that has been admired by many other corporations. Most recently, when the General Electric Co. (NYSE:GE) board of directors brought in a new CEO, they recruited a Danaher alumnus.

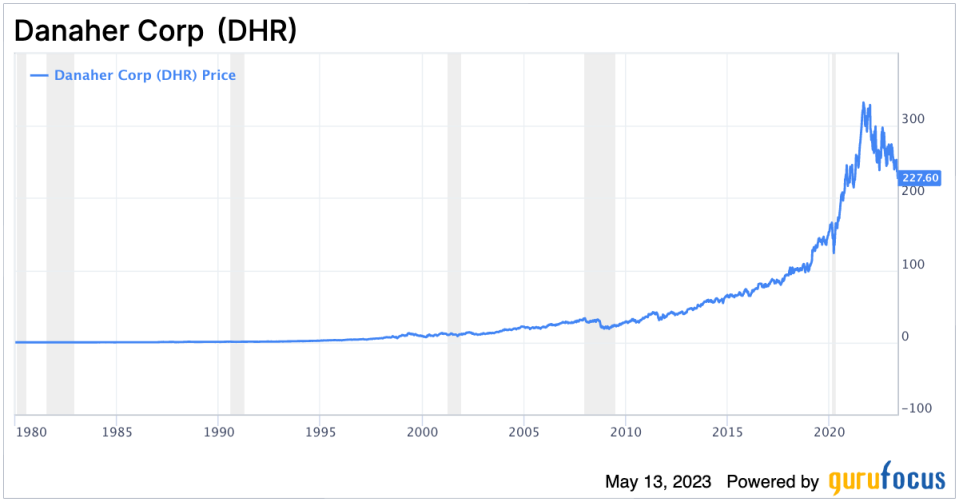

The system also provided investors with significant capital gains in the 2010s:

As the chart shows, the share price averaged gains of 19.24% per year over the past 23 years. And that includes the pullback that began at the beginning of 2022.

From another perspective, Danaher has gone from basically a zero market capitalization to nearly $168 billion capitalization in just over 40 years.

The share price has not recovered since declining with the 2022 slump. That is likely due to short-term considerations; traders were unhappy with its most recent quarterly update and disappointing guidance.

However, president and CEO Rainer Blair was optimistic. He said, Looking ahead, we believe the combination of our leading businesses, the power of the Danaher Business System and the strength of our balance sheet differentiates Danaher and positions us to continue delivering sustainable, long-term shareholder value.

Should we be as optimistic? Should we zig when the traders and short-term investors zag? That depends on the fundamentals.

Overall, they look promising, with a GF Score of 91 out of 100. Financial strength is a bit iffy at 7 out of 10; still, it has an interest coverage ratio of 36.93 and an Altman Z-Score of 4.5. It has a solid balance sheet.

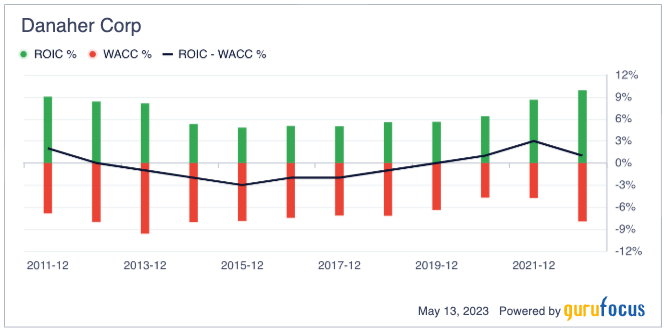

Further, Danaher has returned to being a value creator after several poor years in the mid-2010s. That is displayed in this 12-year chart of return on invested capital versus the weighted average cost of capital.

As for profitability, it has industry-leading (medical diagnostics and research) operating and net margins at 26.85% and 22.40%, respectively. It also has been profitable every year for the past 10 years.

Give it high marks, too, for growth of revenue, Ebitda and earnings per share without non-recurring items.

Over the past three years, it has generated average annual revenue growth of 20%, average Ebitda growth of 31.90% and average earnings per share without non-recurring items growth of 43.60%. All are laudable.

At the same time, free cash flow, the source of funds for capital expenditures, acquisitions and dividends, has been strong as well. Over the past three years, it has averaged 29.80% per year.

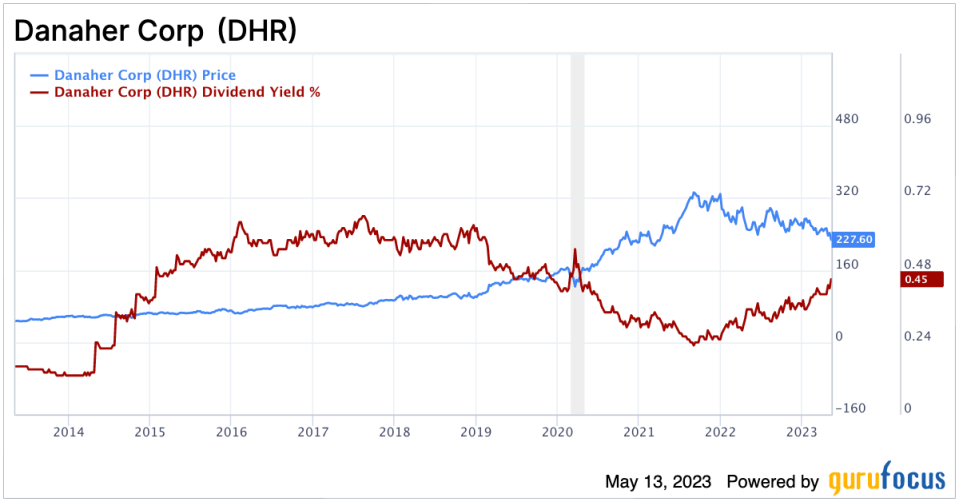

Speaking of dividends, Danaher currently pays 27 cents per quarter or $1.08 annually. This 10-year chart shows how the yield grew when the share price was relatively flat, then fell and rose again.

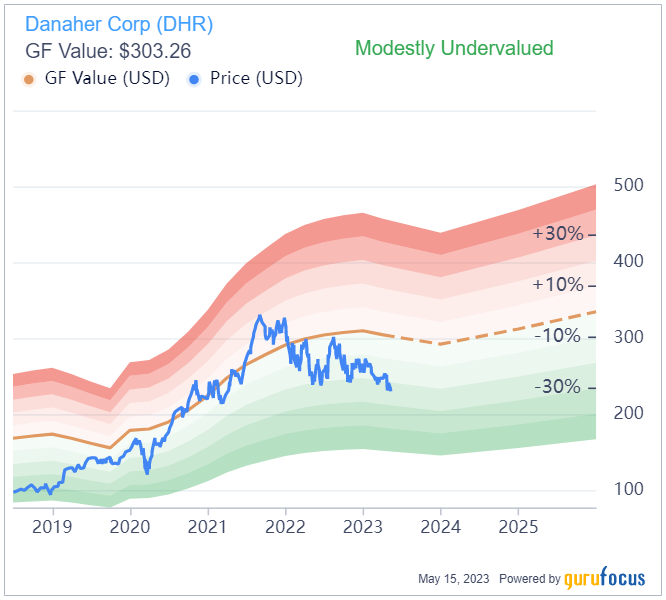

As noted, the share price has fallen significantly. According to the GF Value Line, it is currently undervalued by $75.80, based on the GF Value of $303.40 and the May 12 closing price of $227.60.

The price-earnings ratio of 24.53 indicates it is slightly overvalued when compared to the industry median of 21.23.

The PEG ratio, calculated by dividing the price-earnings ratio by the average five-year growth rate of Ebitda (24.90%), is 0.99. Thats at the top end of the undervaluation range.

On the price chart, we see it has fallen below its 10-year trendline, which is at $310.98. In my opinion, the shares are more likely to be undervalued than overvalued.

Gurus like it a lot. Danaher has 24 of them among its shareholders, and that is more than almost any other stock. The big three holders, according to 13F filings for the end of 2022, were Vanguard Health Care Fund (Trades, Portfolio) (4,617,864 shares), Ken Fisher (Trades, Portfolio) of Fisher Asset Management (3,991,639) and Daniel Loeb (Trades, Portfolio) of Third Point with 2,700,000 shares.

Institutional investors have a relatively modest stake, with 59.10% of shares outstanding. Insiders owned 1.13%.

Investors should be aware that 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

In conclusion, I would argue Danaher may be a weak stock from a short-term perspective, but a strong stock for the long term. It knows how to generate revenue, Ebitda and earnings, and how to make its shareholders happy with capital gains. Thanks to short-term issues, it is bargain-priced and may even give investors stock in a new company later this year.

This article first appeared on GuruFocus.