Danaos: A Track Record of Resilience and Strategic Maritime Growth

On Oct. 6, 2006, Danaos Corp. (NYSE:DAC), headquartered in Piraeus, Greece, publicly listed on the New York Stock Exchange. During that time, its fleet consisted of 27 containerships with a combined capacity of 116,115 twenty-foot equivalent units (teu). Since then, the company has proven its commitment to consistent and sustainable growth, now being among the most prominent players in the maritime container shipping industry as it currently owns and charters out one of the world's largest independent container ship fleets, consisting of 68 vessels.

There is more strategic growth to come as Danaos has committed to not only the expansion of its fleet, but also the future-proofing of its fleet with the recent addition of 10 newly acquired, eco-friendly, methanol fuel-ready container ships aligning with the latest emission standards. This will add an additional 74,914 teu to the company's container shipping capacity and showcases Danaos' active role in environmental sustainability and growth, while also tapping into and exploring modern maritime solutions.

Additionally, the company has begun to diversify its operations with its recent debut into the dry bulk market, marked by the acquisition of seven capesize dry bulk carriers. These acquisitions add a very significant dry bulk carrying capacity of 1,231,071 deadweight tons, thus further serving to widen the company's operations while also adding new lanes of profitability.

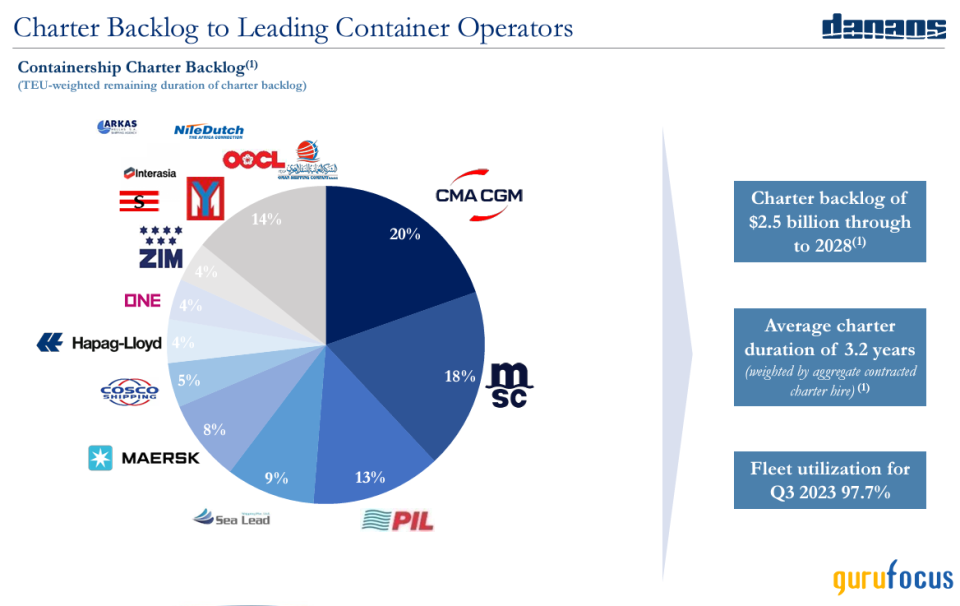

Beyond the sheer scale of its fleet, Danaos strategically leverages its maritime assets to generate profits through chartering arrangements with leading liner companies. This involves the chartering of its ships under multiyear, fixed-rate time charters to a geographically diverse group of liner companies.

Danaos' customer base includes maritime industry giants such as Maersk (AMKBY), COSCO (CICOY), Hapag-Lloyd (HPGLY), CMA-CGM and Hyundai. These charters range from two and a half to 12 years and provide the company with stable cash flows and high utilization rates. These factors ensure Danaos' adaptability when navigating the maritime industry and has provided it a strong foothold in the containership market, further allowing the company to consistently expand its revenue streams while opening itself up to more diversified operations even in the face of the challenging times and global uncertainties that were brought forth to the industry during the peak of the pandemic struggles.

This discussion will serve as a timeline analysis to delve into the challenging events Danaos faced during the rough heights of the pandemic and the strategies it employed that showcase its abilities to overcome pandemic hurdles, adapt to global disruptions and secure its strong position in the maritime industry.

Pandemic disruptions and strategic response

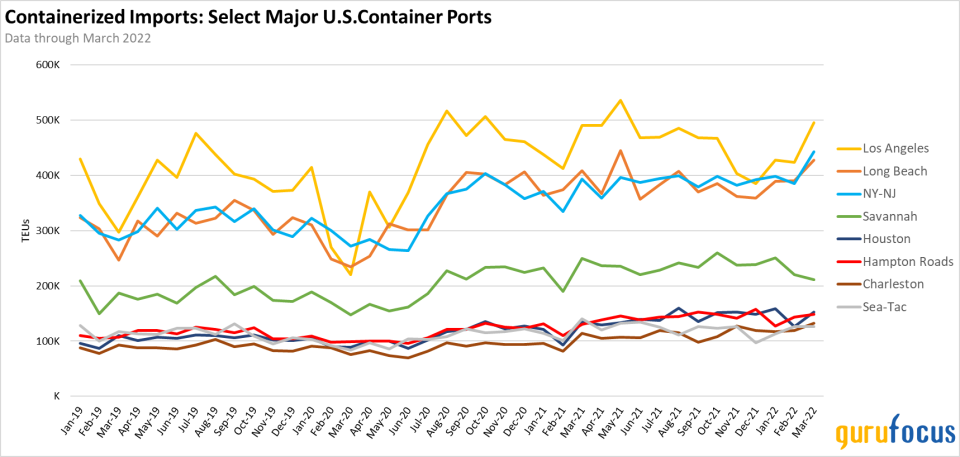

The Covid-19 pandemic wreaked havoc on global trade, disrupting maritime and air freight services. In the first half of 2020, Danaos, like many others, faced challenges stemming from the cancellation of sailings, flight cancellations, port delays and container shortages. U.S. maritime container imports experienced a 7% decline in the first half of the year, with a subsequent surge of 9.5% in the second half.

Source: Transportation.gov

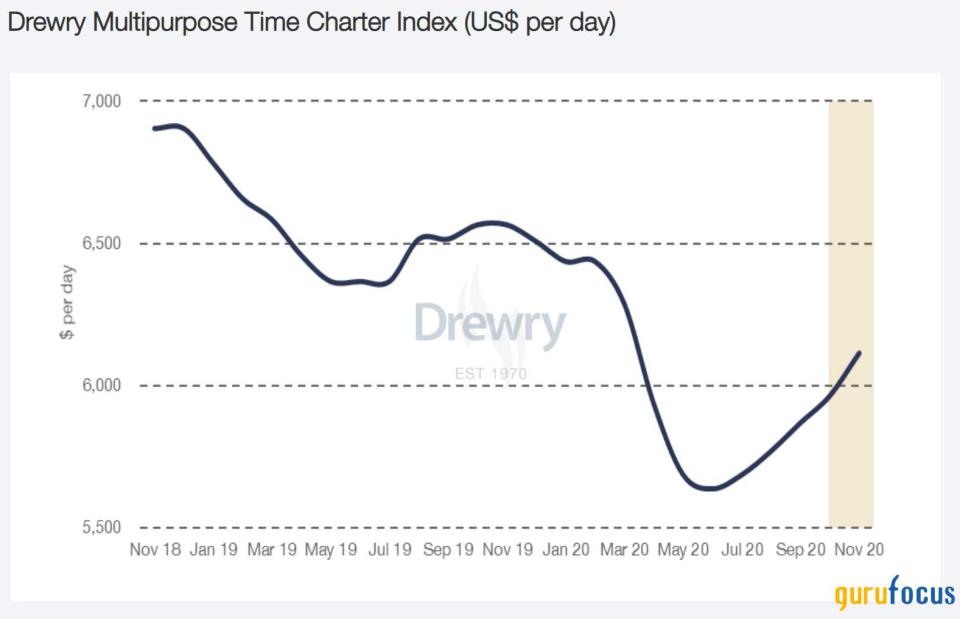

This fluctuation created a volatile environment marked by gyrating freight rates and significant delays in delivery. The severity of the declines can be seen in the 2020 snapshot of the Drewry Multipurpose Time Charter Index chart below:

This index monitors one-year period charter rates for various vessel types and sizes, with a focus on breakbulk, project cargo and containerships. This rapid decline came at a time and as a result of challenges the maritime industry faced due to the substantial decrease in volumes triggered by the pandemic. This prompted liner companies to take decisive measures.

In response to the drop in demand, these liner companies, many of them being customers of Danaos, canceled their sailings and suspended their capacity. As a consequence of these actions, short-term charter rates experienced a notable decline, ranging between 25% and 40% depending on the vessel size.

The economic unrest caused by the pandemic prompted the Federal Reserve to accelerate its reduction of the federal funds rate in an effort to stabilize and ease financial conditions. In addition, the central bank also began purchasing Treasury securities, mortgage-backed securities and corporate bonds in an effort to support the economy and keep bond yields low, thus supporting an easing in credit conditions broadly through the suppression of interest rates.

During this time, Danaos noted in its first-quarter 2020 earnings report that prudent capacity management, reduced bunker prices and falling interest rates significantly alleviated pressure on the cash flows of its liner company customers. Despite the challenges in the charter markets, the company remained resilient as it strategically adopted a conservative approach where it would aim to solidify its customer base, further reduce debt and utilize its financial relationships to maintain higher charter renewals than its peers, while maintaining a high charter contract coverage that was 86% in terms of operating revenues and 66% in terms of operating days over the next 12 months.

The high charter coverage provided a positive impact into cash flows during the period of market turbulence.

Through the first quarter of 2020, Danaos weathered the challenges posed by the pandemic with notable resilience as its earnings results remained largely unaffected by the pandemic with the only discernible impact being the increase in off-hire days. This was attributed to delays in scrubber installations in Chinese shipyards as a result of the logistical disruptions experienced during that period.

In terms of financial performance, Danaos reported an adjusted net income of $33.3 million for the first quarter of 2020, reflecting a decrease of $5.3 million when compared to the same quarter in 2019.

Danaos also highlighted ample liquidity and a hefty $1.2 billion charter backlog, which offered it a great amount of flexibility to navigate the maritime landscape and further reinforced its financial stability and ability to weather market uncertainties. In the second quarter of 2020, the world experienced a boom in consumer demand. ^his can potentially be tied the influx in government stimulus paired with the effects of the Federal Reserve's aggressive policy loosening during the same period.

This consumer boom would come at a time when much of the world's shipping capacity remained stagnant as well as there being a labor shortage within both the onshore and offshore transportation sectors due to the health concerns arisen by the rise in Covid-19 cases. This resulted in logistical bottlenecks, container shortages and shipping delays that would fail to meet the rising consumer demand.

These shortages and logistical slowdowns only further fueled demand, which rose well above the active shipping capacity, thus causing more shortages and leading to rising prices in consumer goods, basic materials, natural gas, oil and other commodities.

This caused demand for global shipping to skyrocket, leading to many of the world's biggest liner companies strained.

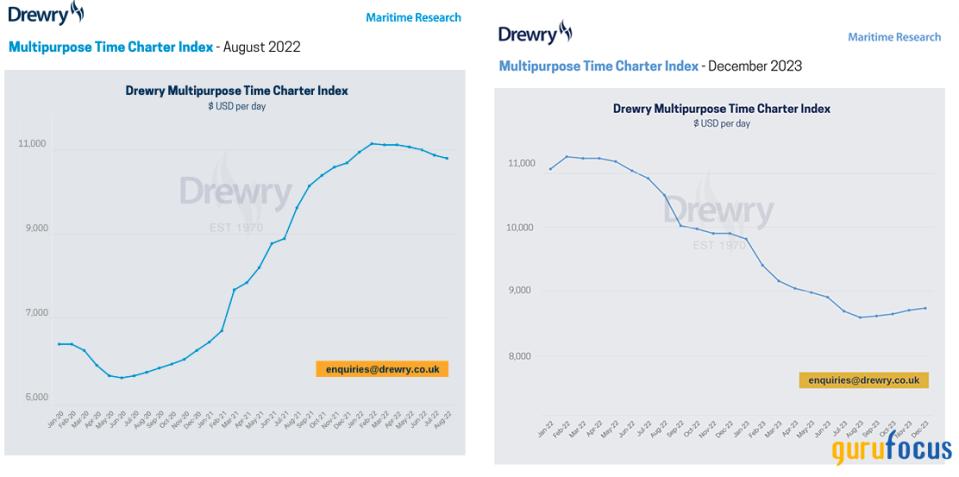

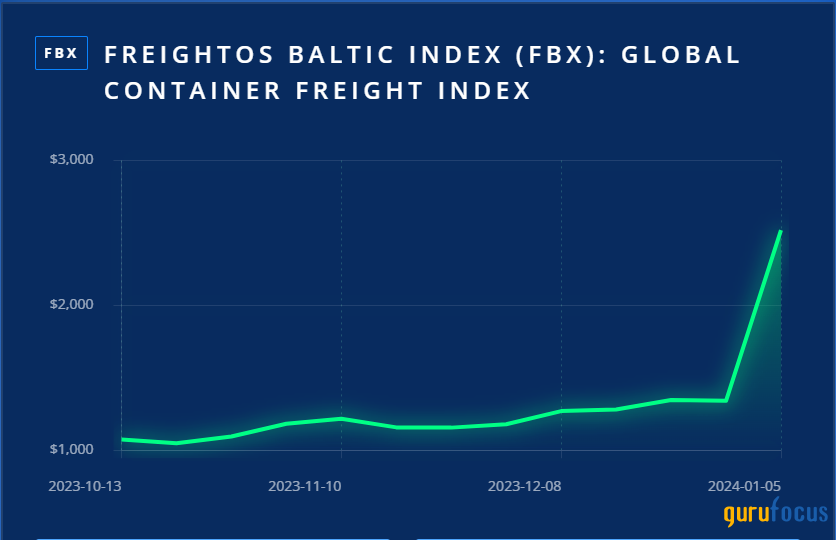

These supply and demand dynamics would continue to be felt leading into 2021 and into the third quarter of 2022, where only then did freight rates begin to normalize and come back down to earth as Covid-19 became much less of a problem and supply chains recovered from bottlenecks. The effects this had on freight rates can be observed in the chart of the Freightos Baltic Index (FBX):

Source: https://app.terminal.freightos.com/fbx

The Freightos Baltic Index, like the Drewry Multipurpose Time Charter Index, is a charter index that tracks rates across a basket of routes. The only difference being that it tracks rates of containers in forty-foot equivalent units, instead of twenty-foot equivalent units. Despite this difference it provides great insight into charter rates as a whole as similar rises and declines can be seen in the Drewry Multipurpose Time Charter Index over the same period:

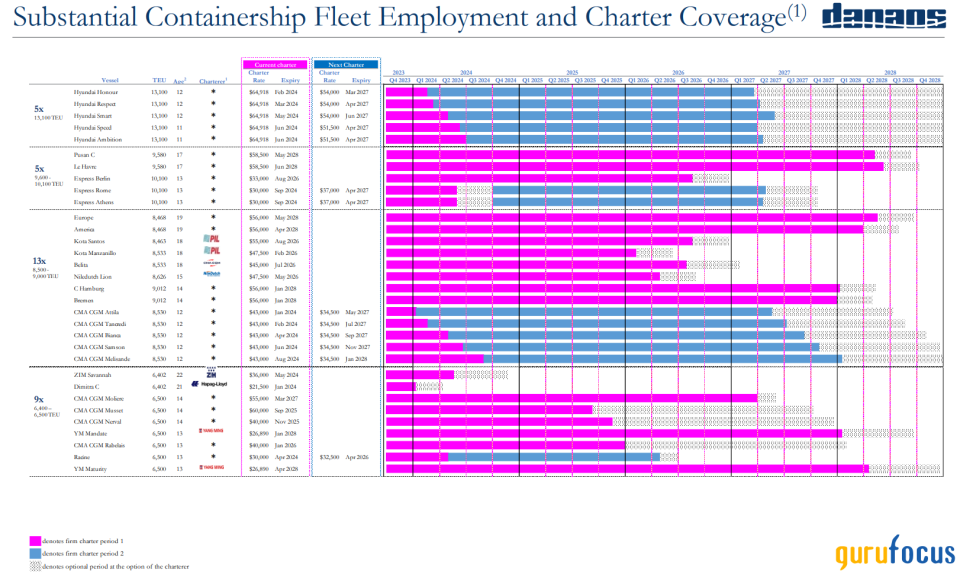

During the height of the chartering market, Danaos charted its ships out to many of the biggest maritime shippers in the world, thus securing a robust charter backlog of $2.5 billion with an average charter duration of 3.2 years at the much higher 2020 to 2022 rates.

Source: Third-Quarter 2023 Earnings Presentation

In September of 2022, Danaos announced it had sold its remaining stake in ZIM for $161.3 million. This would prove to be great timing as the value of ZIM shares would proceed to decline over 70% in the months following the announcement due to rapidly declining freight rates.

Source: tradingview.com

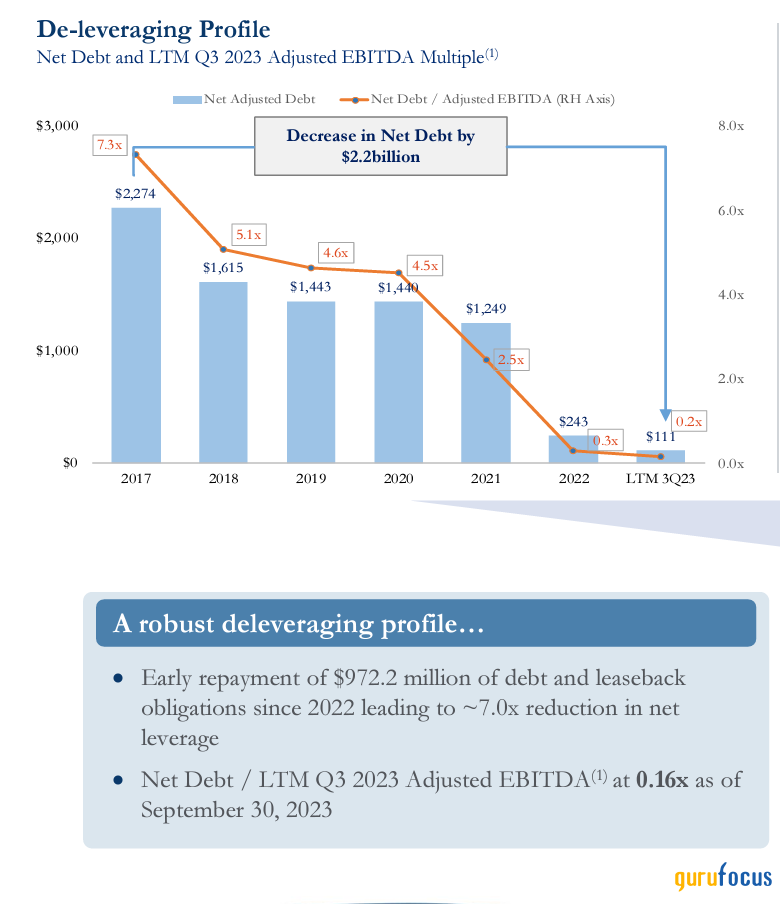

In addition, the company confirmed in its third-quarter 2023 earnings presentation that it had achieved its goal of substantial net debt reduction while also lowering its net debt-to-Ebitda ratio significantly. This ratio is a measure of a company's leverage, indicating how much debt it has relative to its earnings. The lower the number, the less likely the company is to come under any strain when paying off its short- and long-term obligations. In this regard, Danaos has done a great job of lowering its debt load while also increasing its earnings.

Source: Third-Quarter 2023 Earnings Presentation

The company reaffirmed that shifting tides of market dynamics, propelled by geopolitical uncertainties and economic risks, had prompted it to steer with caution, adopting a careful strategy focused on strategic growth, reducing debt loads and maintaining a low leverage ratio. This has proven to be a major success.

As of Sept. 30, 2023, Danaos reported its net debt stood at $111.1 million, down from $243 million the previous year and down over $2.2 billion over the last seven years. The net debt to ajusted Ebitda ratio was 0.16, representing a massive and continued reduction in net leverage over the last several years, as can be seen in the chart above.

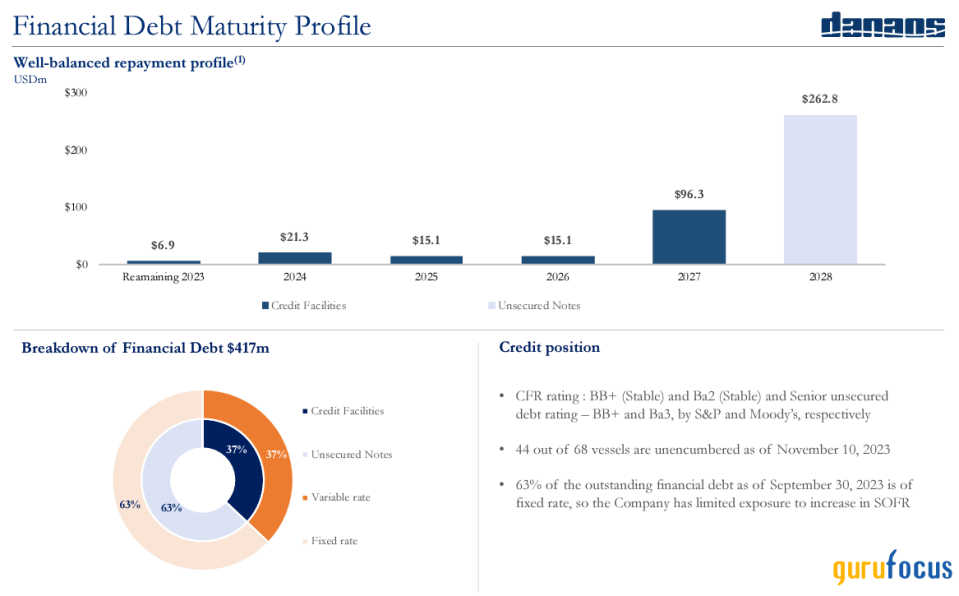

As seen below, currently 44 out of the company's 68 container vessels and four recently acquired dry bulk vessels are debt-free. Further, 63% of their debts are fixed rate, therefore shielding them from a rising rate environment. They also demonstrate a well balanced repayment profile for the debt and maintain a healthy credit condition.

Source: Third-Quarter 2023 Earnings Presentation

In consideration of the locked in high charter rates, the 97.7% fleet utilization and charter contract coverage, Danaos appears well established for high operating cash flows for years to come:

Source: Third-Quarter 2023 earnings presentation

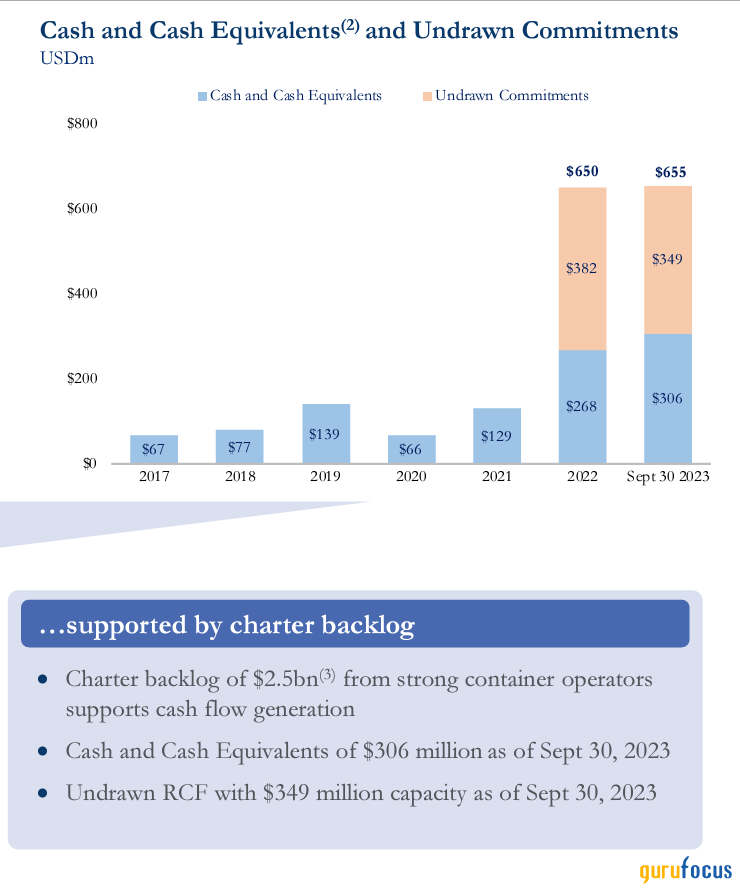

As a result of the company's strategic debt management, paired with the impressive fleet growth over time and increased operating revenues, Danaos' on-hand cash position has dramatically increased.

Source: Third-Quarter 2023 Earnings Presentation

Financial metric overview

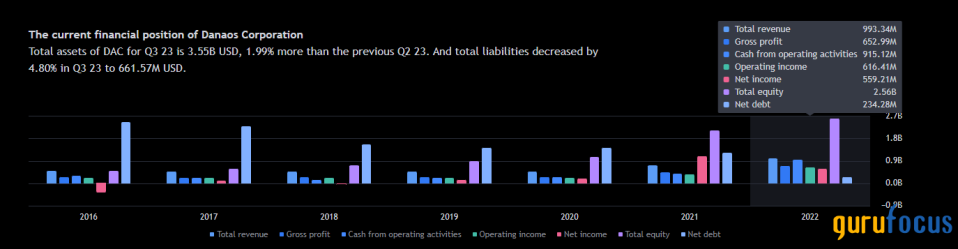

Source: Tradingview.com

The last several years for Danaos, as seen in the financial overview above, can be viewed as a period of consistent major year-over-year growth in revenue, net income and total equity, along with the significant and continuous declines of its debt.

It can also be seen that the company has also steadily increased its total assets while keeping liabilities to a minimum. Danaos has had a long history of having more assets than liabilities, but particularly over the last three years the value of its total assets has risen and very noticeably towered above the total liabilities, thus putting the company in a very strong financial position where it may thrive in both a positive and negative macro environment.

Source: Tradingview.com

The company also offers a competitive dividend yield to its shareholders. The yields have historically been comparable to that of the risk-free rate:

Source: Tradingview.com

Impressive EPS growth

Source: Macrotrends.net

The above chart shows the company's net earnings per share growth over the last 14 years as well as the pricing of the stock and price-earnings ratio during the same period. It is made apparent that Danaos has seen exponential EPS growth since the second quarter of 2020 and that despite the 2022 cooldown in freight rates, the company has maintained a majority of its EPS gains. Currently valued at $28.85 EPS, Danaos effectively positions its stock as a greater value than even the majority of its peers. Even its biggest competitor, Maersk, is being valued at a significantly lower EPS of $6.81.

Out of all of the financial metrics covered in this section, I consider Danaos's high EPS of $28.85 paired with the low price-earnings ratio of 2.27 to be the boldest and most impressive.

In taking in all of the data, it would appear that the current valuation screams value and that it wouldn't be unreasonable to see the stock trade well above $100 per share, especially as freight rates have already begun to pick up again as new potential maritime disruptions develop.

Operational challenges and the course ahead

Facing crewing challenges head-on, Danaos seamlessly adapted to the dynamic landscape of the Covid-19 pandemic and further secured its equity during the following period of high charter rates, demonstrating foresight and experience to the vast maritime markets it navigates. While Danaos keeps a watchful eye amid global containment, the ongoing conflict in Ukraine and the recent developments in the Red Sea, it will remain steadfast in its commitment to supporting affected seafarers and their families as a gesture of maritime spirit and solidarity.

Despite the rising challenges on the horizon, Danaos President and CEO Dr. John Coustas, in his closing statement, stood resolute in expressing confidence in successfully navigating future landscapes, seizing opportunities and safely weathering potential economic storms. He also expressed appreciation to the company's shareholders for their unwavering support and ensuring that Danaos will sail into the future with strength and resilience.

Technical outlook

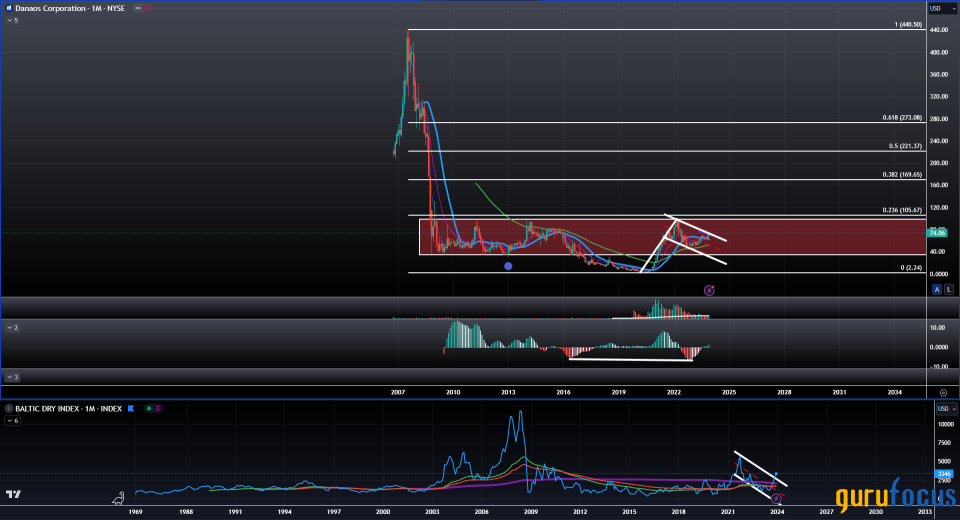

Source: Tradingview.com

Since its EPS expansion began, the stock has come off of all-time lows and is now trading back within an old support/resistance zone it formed between 2008 and 2016. As such, it has developed what appears to be a bull flag with hidden MACD Bullish Divergence and is on course to breaking out of it bullishly.

Below the chart of Danaos is a chart of the Baltic Dry Index (a charter rate index that specifically tracks the charter rates of dry bulk ships) and it can be seen that it too is breaking out of a similar bullish channel and range. If this breakout is successful, I think Danaos could reach a minimum 38.2% Fibonacci retrace, which would take it to a conservative target of $169.65. But with the lack of any notable resistance zones past $120, I could very easily picture shares of Danaos trading toward the more ambitious 61.8% Fibonacci retrace, which would take it all the way up to $273.08.

This article first appeared on GuruFocus.