Daqo (DQ) Provides Updates on $700M Share Repurchase Program

Daqo New Energy Corp. DQ, a prominent manufacturer of high-purity polysilicon for the global solar PV industry, has provided an update on its previously announced a $700-million share repurchase program, which was initially announced on Nov 7, 2022.

Around 43.1% of the authorized repurchase amount allocated for the program has been utilized. These repurchases have been carried out through an intermediary in two ways: in the open market at prevailing prices and through privately negotiated transactions. The company has repurchased 7.28 million American Depositary Shares (ADSs) for roughly $301.7 million as part of this ongoing program, with an average cost of $41.42 per ADS.

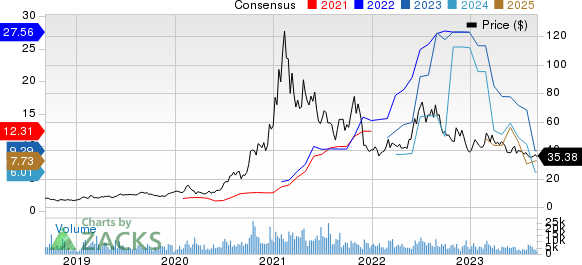

DAQO New Energy Corp. Price and Consensus

DAQO New Energy Corp. price-consensus-chart | DAQO New Energy Corp. Quote

In August, the company ramped up its share repurchase efforts by acquiring 3.11 million ADSs at an average cost of $36.22 per ADS, amounting to approximately $112.9 million. This increased activity reflects the company's confidence in its strong performance and the bright prospects within its industry. Despite these positive indicators, the company perceives its shares as undervalued. As a result, it has committed to persistently repurchasing ADSs whenever the market prices fall below its expectations.

Notably, the company's financial position remains robust, boasting a substantial cash balance of $3.2 billion and a combined total of $4 billion in cash and banknote receivables at the close of the second quarter of 2023. It has generated an operating cash inflow of $786 million during the first half of 2023.

Given this solid financial foundation, the company is steadfast in its commitment to pursuing the share repurchase program, having an upper limit of $700 million, throughout 2023. The execution of this program will be contingent upon various factors, including the company's evolving business landscape, prevailing market conditions, and adherence to corporate governance and regulatory requirements, including potential blackout periods.

Shares of Daqo have lost 48.4% in the past year against a 10% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Daqo currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, Akzo Nobel N.V. AKZOY and Hawkins, Inc. HWKN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48, indicating a year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 85.7% in the past year.

The consensus estimate for Akzo Nobel’s current-year earnings is pegged at $1.44, indicating year-over-year growth of 67.4%. In the past 60 days, AKZOY’s current-year earnings estimate has been revised upward by 2.9%. The company’s shares have rallied 24.9% in the past year.

The consensus estimate for Hawkins’ current-year earnings is pegged at $3.40, indicating year-over-year growth of 18.9%. HWKN beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have rallied 63.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Akzo Nobel NV (AKZOY) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report