Darling Ingredients Inc. Reports Dip in Q4 Net Income Amidst Record Annual Growth

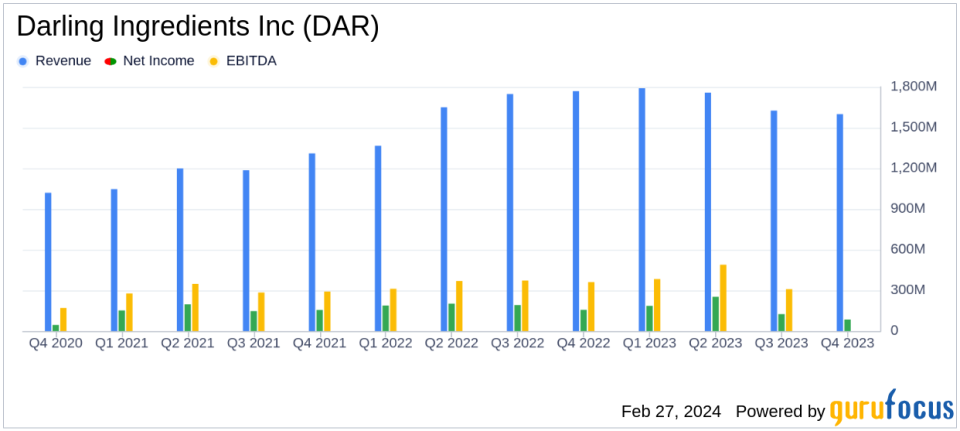

Net Income: Q4 net income fell to $84.5 million, a decrease from the previous year's $156.6 million.

Net Sales: Annual net sales increased to $6.8 billion, up from $6.5 billion in the previous fiscal year.

Diluted Earnings Per Share (EPS): FY 2023 EPS was $3.99, down from $4.49 in FY 2022.

Adjusted EBITDA: FY 2023 combined adjusted EBITDA reached $1.61 billion, surpassing the $1.54 billion of FY 2022.

Dividends: Received $163.6 million in cash dividends from Diamond Green Diesel joint venture.

Stock Repurchase: Repurchased $52.9 million of common stock during the fiscal year.

Debt and Leverage: Total debt stood at $4.4 billion with a leverage ratio of 3.26X as of year-end.

Darling Ingredients Inc (NYSE:DAR) released its 8-K filing on February 27, 2024, detailing its financial performance for the fourth quarter and fiscal year 2023. The company, a global leader in developing and producing sustainable ingredients for the pharmaceutical, food, pet food, fuel, and fertilizer industries, reported a decrease in net income for the fourth quarter but achieved its 6th consecutive record year in terms of combined adjusted EBITDA.

Company Overview

Darling Ingredients Inc operates across three primary segments: feed ingredients, food ingredients, and fuel ingredients, with the majority of its revenue stemming from North America. The company's operations include the transformation of animal by-products into a variety of specialty ingredients and the conversion of used cooking oil and bakery remnants into feed and fuel ingredients. Darling Ingredients also provides grease trap services for food businesses and sells equipment for the collection and delivery of cooking oil.

Financial Performance and Challenges

The company's net income for the fourth quarter of 2023 was $84.5 million, or $0.52 per diluted share, a decrease from the $156.6 million, or $0.96 per diluted share, reported in the fourth quarter of 2022. This decline was primarily attributed to a decrease in Darlings share of Diamond Green Diesel (DGD) earnings. Despite the quarterly dip, the company's full-year performance remained strong with net sales rising to $6.8 billion from $6.5 billion in the previous year. The net income for the fiscal year was $647.7 million, or $3.99 per diluted share, compared to $737.7 million, or $4.49 per diluted share, in fiscal year 2022.

One of the challenges highlighted in the report was the decrease in Darling's share of DGD earnings, which could indicate potential volatility in the renewable diesel segment. However, the company's diversified business model and its strategic focus on sustainability have helped to mitigate the impact of commodity price fluctuations and maintain a trajectory of growth.

Financial Achievements and Importance

The company's financial achievements, including the increase in annual net sales and the growth in combined adjusted EBITDA, underscore its ability to expand and generate value in the Consumer Packaged Goods industry. The receipt of $163.6 million in cash dividends from DGD and the repurchase of $52.9 million of common stock reflect the company's strong cash flow and commitment to delivering shareholder value.

Key Financial Metrics

Important metrics from the financial statements include the combined adjusted EBITDA of $1.61 billion for fiscal year 2023, which is a key indicator of the company's operational efficiency and profitability. The leverage ratio of 3.26X and the capital expenditures of $555.5 million for the fiscal year demonstrate the company's financial management and investment in growth. These metrics are crucial for investors as they provide insights into the company's financial health and strategic direction.

"Darling Ingredients had another great year with its 6th record year of growth in volumes and combined adjusted EBITDA," said Randall C. Stuewe, Darling Ingredients Chairman and Chief Executive Officer. "Our vertically integrated business continues to demonstrate that Darling Ingredients can deliver strong earnings that offsets commodity volatility."

Analysis of Company's Performance

The company's performance in fiscal year 2023 reflects its resilience and adaptability in a challenging economic environment. While the decrease in quarterly net income is a concern, the overall annual growth and the record combined adjusted EBITDA highlight the company's strong operational capabilities and strategic initiatives. Darling Ingredients' focus on sustainability and its diversified portfolio continue to position it well for future growth.

Darling Ingredients remains optimistic about its performance in 2024, with a commitment to driving shareholder results and leveraging its robust business model to navigate market uncertainties.

For a more detailed analysis of Darling Ingredients Inc's financial results, including segment financial tables and consolidated balance sheets, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Darling Ingredients Inc for further details.

This article first appeared on GuruFocus.