Daseke seeing ‘flight to safety’ as competitors exit

Flatbed truckload carrier Daseke cut its 2023 outlook on Thursday but said it was hopeful rates would improve as the market becomes more balanced next year.

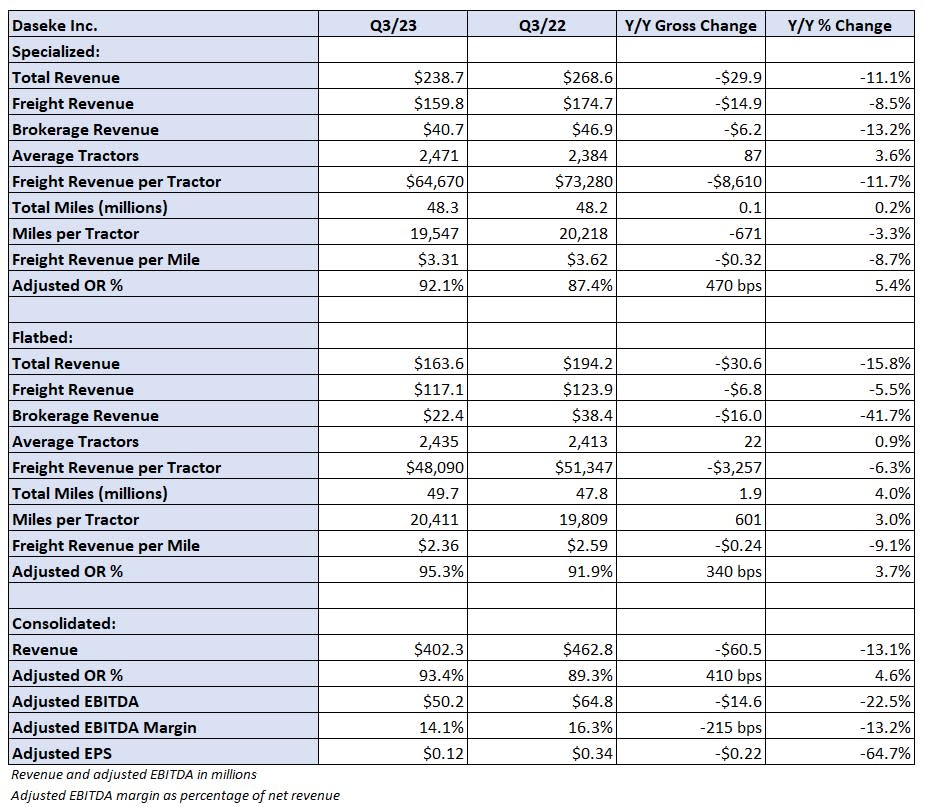

Third-quarter adjusted earnings per share of 12 cents were in line with the consensus estimate but 22 cents lower year over year (y/y). The result excluded 10 cents in items like acquisition and restructuring costs. However, higher interest expense due to rising interest rates and an increase in preferred dividend payments presented a 10-cent headwind.

Consolidated revenue of $402 million was 13% lower y/y but only $5 million lower than in the second quarter. Brokerage revenue across the platform fell by 26%.

Daseke cut its full-year 2023 adjusted earnings before interest, taxes, depreciation and amortization forecast to $185 million to $190 million, down 9% using the midpoints of the current and prior ranges.

Looking to next year, CEO Jonathan Shepko told analysts on a Thursday call that he expects contract rates to be flat in the first half, potentially improving in the back half as supply and demand come into balance. He said brokers and asset-light providers that have been offering lower rates are now struggling to cover loads and some are exiting the market.

“We’re starting to see a flight to safety,” Shepko said.

Daseke’s (NASDAQ: DSKE) specialized TL segment reported an 11% y/y revenue decline. Revenue from freight operations was off 9% as average tractors in service increased 4% but revenue per tractor was down 12%. Revenue per mile declined 9% y/y to $3.31.

Freight and brokerage loads combined were off 7% y/y. Favorable demand trends in verticals like agriculture, mining, automotive and aerospace were noted. However, weaker demand for high-security cargo and freight tied to the construction markets led to the decline.

The specialized segment’s 92.1% adjusted operating ratio was 470 basis points worse y/y and 170 bps worse than the second quarter.

The company’s general flatbed unit reported a 16% y/y decline in revenue to $164 million. Freight revenue was down just 6% but brokerage revenue fell 42%. Revenue per tractor in the quarter was down 6% as revenue per mile fell 9% to $2.36.

The flatbed segment posted a 95.3% adjusted OR, 340 bps worse y/y but only 20 bps worse than the second-quarter result.

Consolidated adjusted EBITDA was $50 million, a 23% y/y reduction. The company said fuel expense was a $5 million drag as surcharges didn’t keep pace in the quarter, and lower gains on equipment sales were a $2 million headwind.

“Through this market pressure test, we are optimizing the efficiency of our organization, and are open to trading size for profitability and resiliency in support of our goal to drive long-term value for our current and potential shareholders,” said Shepko.

The company reduced combined spend on salaries, wages and benefits and purchased transportation by 330 bps y/y as a percentage of revenue. The comp and benefits line was higher y/y (as a percentage of revenue), but Daseke has been transitioning more freight to company equipment and drivers where margins are better.

Sixty-two percent of the company’s combined fleet was operated by company assets and drivers in the period compared to 57% a year ago.

Daseke increased its net capital expenditures budget to a range of $155 million to $160 million, a 13% increase at the midpoint. The company said the OEMs will now be able to deliver all of the equipment it planned on purchasing when the year began. It also pointed to lower gains on equipment sales as a reason for the capex increase.

Daseke expects to be cash flow-positive next year “regardless of the market environment.”

The company reported liquidity of $189 million and total debt of $658 million, a $5 million increase from the second quarter due to increased equipment spending. Gross debt leverage increased from 3.1 times a quarter ago to 3.3 times at the end of the third quarter. Net cash from operations was $34 million in the quarter, the highest level recorded this year.

Shares of DSKE were down 1.3% at 1:05 p.m. EST Thursday compared to the S&P 500, which was off 0.3%.

More FreightWaves articles by Todd Maiden

The post Daseke seeing ‘flight to safety’ as competitors exit appeared first on FreightWaves.