Data Analytics Stocks Q2 Teardown: Health Catalyst (NASDAQ:HCAT) Vs The Rest

Let's dig into the relative performance of Health Catalyst (NASDAQ:HCAT) and its peers as we unravel the now-completed Q2 data analytics earnings season.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

The 5 data analytics stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.6% while next quarter's revenue guidance was in line with consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but data analytics stocks held their ground better than others, with the share prices up 13.3% on average since the previous earnings results.

Weakest Q2: Health Catalyst (NASDAQ:HCAT)

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

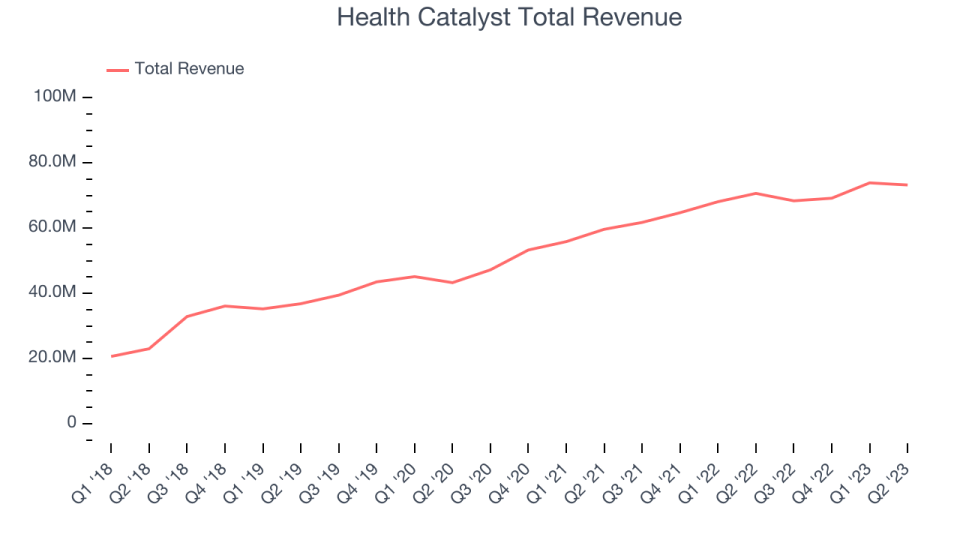

Health Catalyst reported revenues of $73.21 million, up 3.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with a decline in its gross margin and underwhelming revenue guidance for the next quarter.

“For the second quarter of 2023, we are encouraged by our financial results, including total revenue of $73.2 million and Adjusted EBITDA of $3.5 million, with these results beating the mid-point of our quarterly guidance on each metric. Additionally, given that we are tracking slightly ahead of our previous full year revenue and Adjusted EBITDA guidance, we are raising our 2023 revenue and Adjusted EBITDA guidance. We are pleased with our strong first half bookings performance and continued pipeline growth. As a result, we are reiterating our full year 2023 bookings expectations, inclusive of dollar-based retention rate and net new DOS subscription client additions. We are also encouraged to have received multiple additional external recognitions related to our team member engagement once again this quarter,” said Dan Burton, CEO of Health Catalyst.

Health Catalyst delivered the weakest full-year guidance update of the whole group. The stock is down 26.1% since the results and currently trades at $9.57.

Read our full report on Health Catalyst here, it's free.

Best Q2: Alteryx (NYSE:AYX)

Initially created as a way to organise census data for the government, Alteryx (NYSE:AYX) provides software that helps companies automate and analyse their internal data processes.

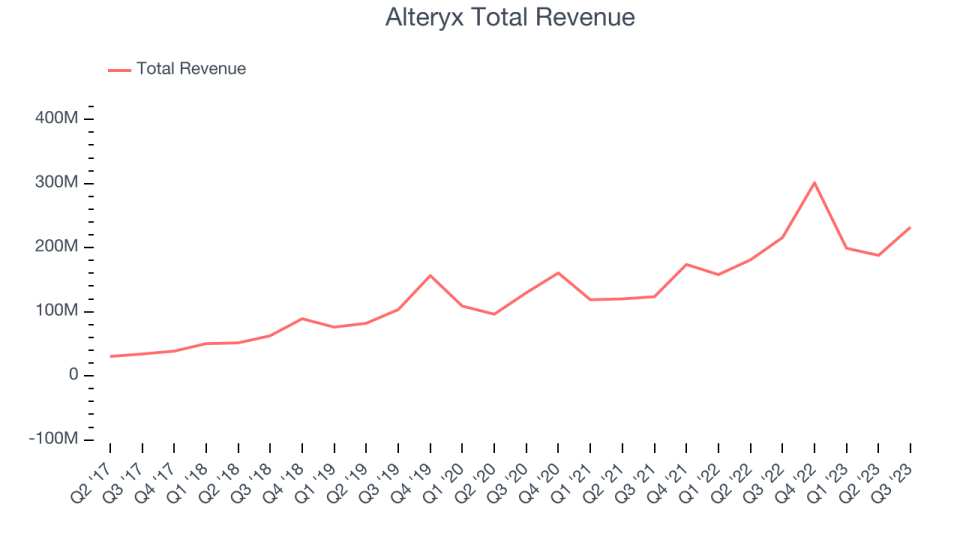

Alteryx reported revenues of $232 million, up 7.6% year on year, outperforming analyst expectations by 10.4%. It was a strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

Alteryx pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 56.3% since the results and currently trades at $47.44.

Is now the time to buy Alteryx? Access our full analysis of the earnings results here, it's free.

Amplitude (NASDAQ:AMPL)

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Amplitude reported revenues of $70.64 million, up 14.6% year on year, in line with analyst expectations. It was a mixed quarter for the company, with strong sales guidance for the next quarter but its net revenue retention rate in jeopardy.

The stock is up 12.9% since the results and currently trades at $12.58.

Read our full analysis of Amplitude's results here.

Palantir (NYSE:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $558.2 million, up 16.8% year on year, in line with analyst expectations. It was a decent quarter for the company, with revenue and EPS exceeding expectations.

Palantir delivered the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 18% since the results and currently trades at $17.6.

Read our full, actionable report on Palantir here, it's free.

Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $79.68 million, flat year on year, in line with analyst expectations. It was a decent quarter for the company, with EPS and operating cash flow topping analysts'estimates. Its revenue and RPO (remaining performance obligations) also slightly beat Wall Street's projections, and its EPS guidance for next quarter came in better than expected.

Domo had the slowest revenue growth among its peers. The stock is up 5.4% since the results and currently trades at $9.98.

Read our full, actionable report on Domo here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned