Datadog (NASDAQ:DDOG) Posts Better-Than-Expected Sales In Q4 But Stock Drops 14.4%

Cloud monitoring software company Datadog (NASDAQ:DDOG) announced better-than-expected results in Q4 FY2023, with revenue up 25.6% year on year to $589.6 million. The company expects next quarter's revenue to be around $589 million, in line with analysts' estimates. It made a non-GAAP profit of $0.44 per share, improving from its profit of $0.26 per share in the same quarter last year.

Is now the time to buy Datadog? Find out by accessing our full research report, it's free.

Datadog (DDOG) Q4 FY2023 Highlights:

Revenue: $589.6 million vs analyst estimates of $568.3 million (3.8% beat)

EPS (non-GAAP): $0.44 vs analyst estimates of $0.44 (small beat)

Revenue Guidance for Q1 2024 is $589 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2024 is $2.57 billion at the midpoint, missing analyst estimates by 0.8% and implying 20.5% growth (vs 27.3% in FY2023)

Management's operating income guidance for the upcoming financial year 2024 is $545 million at the midpoint, missing analyst estimates by 2.1%

Free Cash Flow of $201.3 million, up 45.7% from the previous quarter

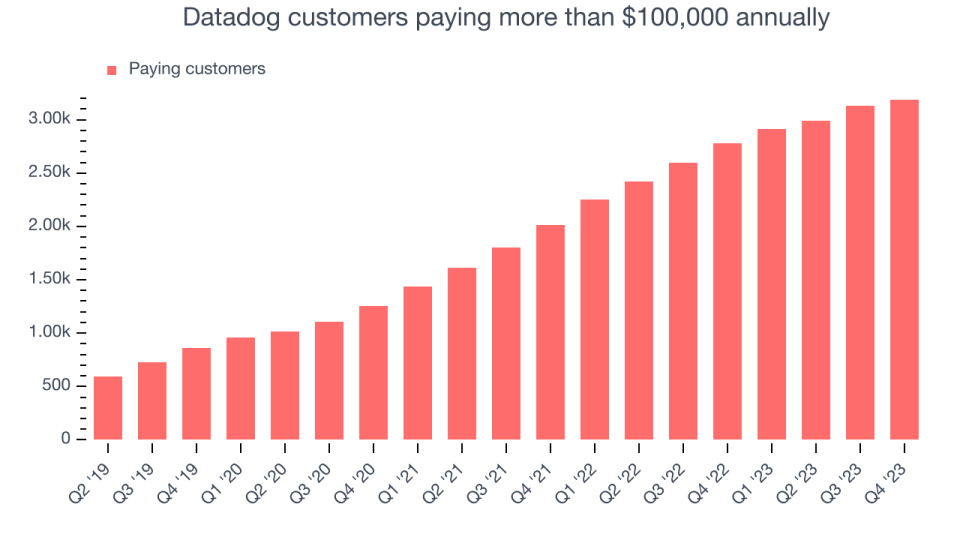

Customers: 3,190 customers paying more than $100,000 annually

Gross Margin (GAAP): 82.2%, up from 79.4% in the same quarter last year

Market Capitalization: $44.31 billion

"We are pleased with our strong execution in fiscal year 2023, with 27% year-over-year revenue growth, $660 million in operating cash flow, and $598 million in free cash flow," said Olivier Pomel, co-founder and CEO of Datadog.

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

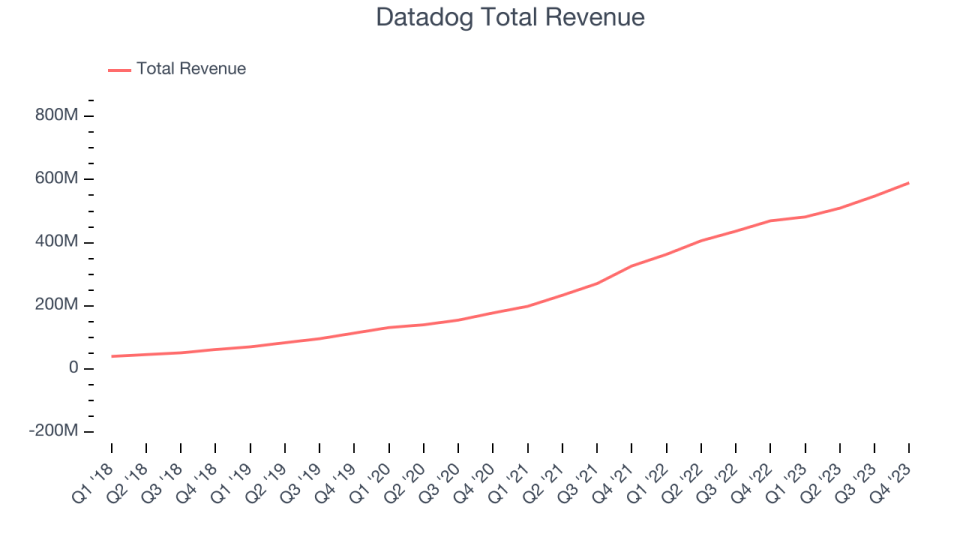

Sales Growth

As you can see below, Datadog's revenue growth has been impressive over the last two years, growing from $326.2 million in Q4 FY2021 to $589.6 million this quarter.

This quarter, Datadog's quarterly revenue was once again up a very solid 25.6% year on year. On top of that, its revenue increased $42.11 million quarter on quarter, a solid improvement from the $38.08 million increase in Q3 2023. Thankfully, that's a slight re-acceleration of growth.

Next quarter's guidance suggests that Datadog is expecting revenue to grow 22.3% year on year to $589 million, slowing down from the 32.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.57 billion at the midpoint, growing 20.5% year on year compared to the 27.1% increase in FY2023.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Large Customers Growth

This quarter, Datadog reported 3,190 enterprise customers paying more than $100,000 annually, an increase of 60 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from Datadog's Q4 Results

We were happy to see that Datadog's revenue and operating income outperformed Wall Street's estimates in the quarter. On the other hand, its new large contract wins slowed. Looking ahead, both full-year revenue guidance and full-year operating income guidance missed Wall Street's estimates. Overall, this was a mixed quarter for Datadog with the outlook weighing on shares. The company is down 14.4% on the results and currently trades at $115.5 per share.

So should you invest in Datadog right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.