Datadog Stands to Gain as Revenue Growth Accelerates, Margins Expand

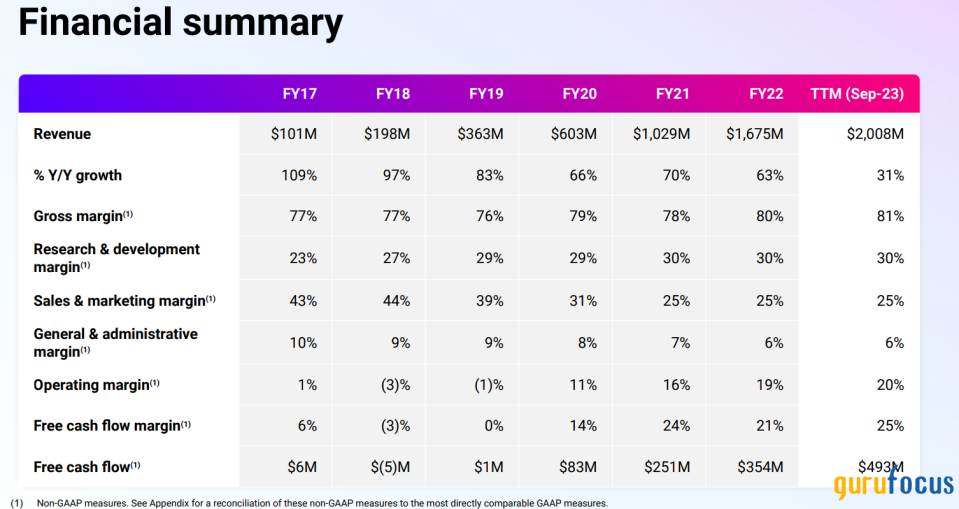

Datadog Inc. (NASDAQ:DDOG) is an observability and security platform that provides end-to-end monitoring and analytics for cloud applications. The company has seen tremendous compounded annual revenue growth of 66% over the last six years. While it had started to see slower usage growth on its platform for some existing customers up until the previous quarter, as companies became more cost-conscious in a tough macro environment, there are emerging signs that usage trends are stabilizing as of the latest quarter. The company saw its remaining performance obligation outpace revenue growth in the third quarter, a sign that revenue growth is on the cusp of reacceleration. At the same time, management is focused on improving overall profitability.

While competition is fierce, I believe the company is well-positioned, given its innovative product pipeline, which has enabled it to drive new customer acquisition as well as deepen product adoption. While there could be short-term volatility in the stock price, as Datadog is richly valued with a significant amount of optimism baked into it, I believe over a five-year investment horizon, there is still room for upside from current levels if the company continues to drive revenue growth in the mid-to-high 20s range.

A primer on Datadog's business model

Datadog is a cloud solutions platform that enables developers and developeroperations teams to monitor their applications and other virtual instances in real-time. By breaking down silos between DevOps and security, Datadog's platform provides real-time insights into software applications and IT infrastructure performance to enable better user experiences, faster problem detection and resolution and more impactful business decisions.

Its product modules include infrastructure monitoring, application performance monitoring, log management, digital experience monitoring, database monitoring, network performance monitoring, incident management, cloud cost management, observability pipelines and cloud security management, among others.

Datadog was also named a leader in the 2023 Gartner Magic Quadrant for application performance monitoring and observability.

The company generates revenue from a subscription-based pricing model. The company is focused on expanding its customer base with a land-and-expand business model, which allows it to sell subscriptions for additional product modules that contain more functionality to existing customers as they expand their footprint and increase usage of Datadog's products.

I believe its go-to-market approach provides immense leverage as it allows the company to create multiple avenues for revenue growth due to the high switching costs of the platform, leading to stronger margins.

Building the bull case

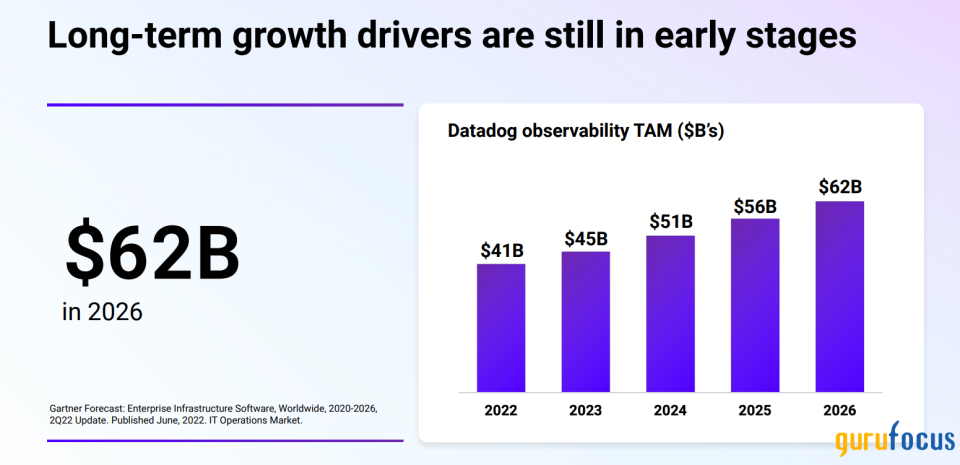

Datadog's land and expand model is driving deeper customer adoption. As per its latest Investor Presentation, the company's total addressable market is expected to grow to $62 billion by 2026. This would represent a compounded annual growth rate of 11% from 2023 to 2026. Meanwhile, the company has been growing its revenue at a CAGR of 66% between 2017 and 2023, based on management's expectations for a revenue target. Moving forward, I believe the company could maintain a revenue growth rate in the mid-to-high 20s range over a five-year period. Should that be the case, Datadog's market share would expand from 4.60% in 2023 to 6.60% in 2026.

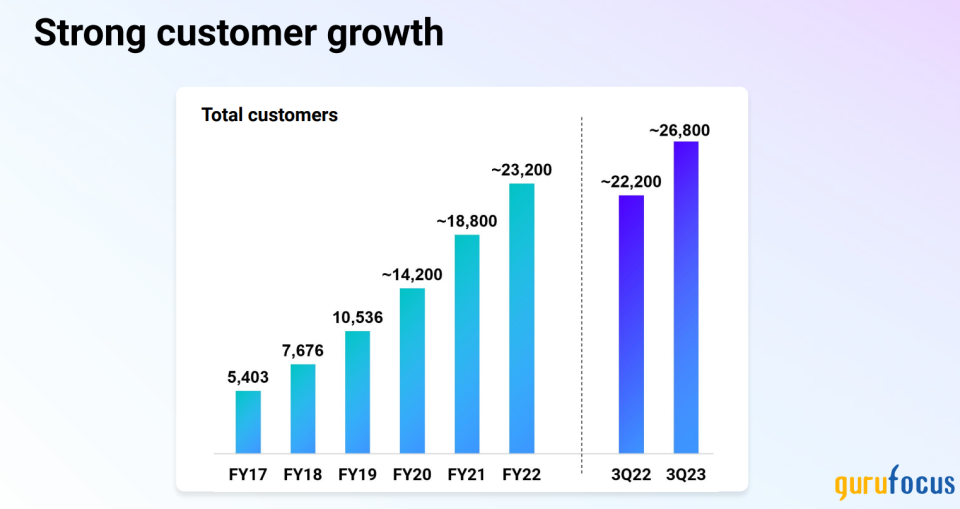

Datadog should be able to achieve a deeper market share as it acquires new customers and deepens its relationship with existing ones to drive higher product adoption. As of the third quarter, Datadog was able to grow its customer base by 20% to 26,800 customers. The trend should remain robust as overall macroeconomic conditions improve in 2024 with easing inflation and interest rates, allowing companies to boost their IT spending once again. As per Gartner, the software and IT services segments are expected to see double-digit growth in 2024, driven by cloud spending at 13.80% and 10.40%, respectively.

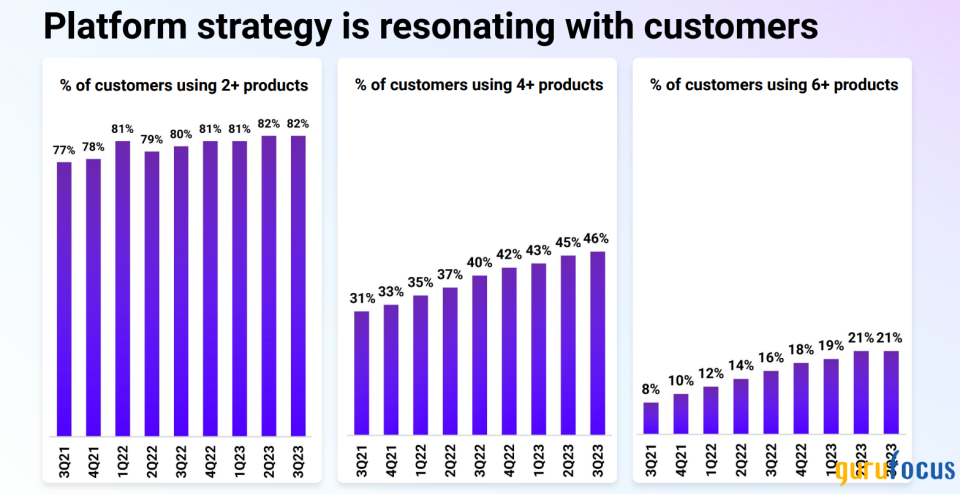

What is also encouraging to see is there is a steady growth in the number of customers contributing more than $100,000 in annual recurring revenue. As of the third quarter, 86% of total ARR was driven by customers with more than $100,000 in spend on the platform. This is reflective of the success of the land and expand model as the company continues to see customers ramp up usage of Datadog's platform, allowing them to drive revenue growth while increasing their operating leverage. As you can see in the chart below, there has been a growing trend in the percentage of customers using a higher number of products over the last three years.

Further, as cloud usage optimization stabilizes, it will further boost revenue growth. After a few quarters of mixed results, Datadog delivered a strong third quarter, where revenue beat consensus estimates by 4.30%. During the earnings call, management indicated they observed early signs of certain enterprise customers beginning to moderate their cloud usage optimization. To provide context, numerous enterprises overspent on their cloud consumption during the post-pandemic period. Starting in 2022, these customers initiated efforts to optimize their cloud usage on major platforms such as Azure and AWS, posing some growth headwinds for Datadog.

These usage-based optimizations seemed to moderate and stabilize toward the end of the second quarter of 2023, and there are indications of improvement in the third quarter, as highlighted by CEO Olivier Pomel. He said:

In Q3, we saw usage growth in existing customers improved compared to Q2. Overall growth in Q3 was relatively consistent throughout the quarter and comparable to levels we've seen in Q1. We are seeing signs that the cloud optimization activity from some of our customers may be moderating. As a reminder, last quarter, we discussed a cohort of customers who began optimizing about a year ago, and we said that they appeared to stabilize their usage growth at the end of Q2.

That trend has held for the past several months with that cohort's usage remaining stable throughout Q3. Overall, we continue to see the impact from optimization in our business, but we believe that the intensity and breadth of optimization we've experienced in recent quarters is moderating. Meanwhile, our new logo activity has remained robust. New logo bookings continue to scale and grow year over year.

With this, I believe we may have reached the bottom of revenue growth deceleration that we witnessed up until the second quarter. While cloud usage optimization is still going on, it is happening to a lesser extent than before, as confirmed by the remaining performance obligation that grew by 30% year over year in the fourth quarter, faster than the actual revenue growth rate. If the trend stabilizes, the usage of Datadog's platform will start to accelerate again. Plus, as businesses begin migrating their workloads to cloud platforms, Datadog can attract more new customers. This should help the company drive revenue growth in the mid-to-high 20s range over the next five years.

Expanding margins further validate Datadog's increasing operating leverage. As of the trailing 12 months, the company reported non-GAAP operating income of $401 million, which would translate to a non-GAAP operating margin of 20%. Taking full-year 2023 guidance into consideration, the company is expected to generate non-GAAP operating income in the range of $453 million to $457 million, which would represent a non-GAAP operating margin of approximately 21.50%, an improvement of 2.50% over the prior year.

The company is able to drive expanding profitability by improving its economies of scale through higher adoption of product modules, as we saw in the last section, and by maintaining sales and marketing spend at a steady rate of 25% of revenue.

Building the bear case

On the negative side, competition remains fierce, which may threaten Datadog's market position. DevOps and SecOps are hotly contested markets that may pose threats to the business. The company faces direct competition from another leading player, Dynatrace (NYSE:DT). Recently, Cisco (NASDAQ:CSCO) has also demonstrated its intentions to compete with Datadog by acquiring Splunk (NASDAQ:SPLK), another incumbent in this space that specializes in on-premise data observability solutions, but has faced challenges in pivoting to the cloud platform model.

Hyperscale cloud companies such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Alphabet's (NASDAQ:GOOG) Google have also launched their own observability tools for their individual clouds. But I do not see this as a threat here given that most cloud customers usually have hybrid cloud setups, which is where Datadog's solutions win since its solutions can work on any cloud platform.

Moreover, I believe Datadog is already much further ahead in its product innovation cycle versus the competition. The company has already launched products and solutions in large language model operations, a relatively nascent market that has exponential room to grow. At a recent Barclays Technology conference, Datadog's chief financial officer mentioned how its customers are already ramping up usage of its artificial intelligence products and tools, mainly in a couple of areas: automatic remediation, real-time resolution of system issues and bugs via Datadog's AI platform and system integrations that help clients monitor and scale AI applications. I believe Datadog has already positioned itself to capture a significant share of the nascent LLMOps market, and I see its competitors catching up to Datadog.

Tying it all together

Datadog is trading at a forward price-sales ratio of 16, taking consensus estimates for revenue growth in fiscal 2024 into consideration. While the company is profitable on a non-GAAP basis, I will base my valuation on my revenue growth estimate since the company management has not provided any guidance on their long-term operating model.

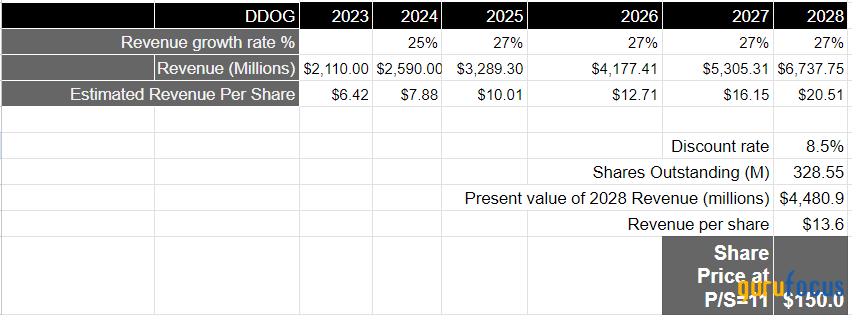

Therefore, if I assume that Datadog grows its revenue in the mid-to-high 20s range over the next 5 years, as the company continues to acquire new customers and deepen production adoption across its existing customer base, coupled with an innovative product pipeline, it should be able to produce approximately $6.98 billion by 2028.

This translates to a present value of $4.50 billion in revenue when discounted at 8.50%, or revenue per share of $13.60. If I take the S&P 500 as a proxy, where its companies have grown their revenues at an average rate of 4.80% with a price-sales ratio of 2.19 over a 10-year period, I would assume Datadog should be trading at 4 to 5 times the forward price-sales multiple of the S&P 500.

That would mean the stock should be trading at approximately $150, representing an upside of 22% from current levels.

Conclusion

Datadog is richly valued, no doubt. However, I think there is a valid reason for it. The company looks poised to gain market share in a large and growing TAM as the trend of cloud usage optimization stabilizes, allowing it to deepen product adoption amongst its existing customers while winning new ones as businesses begin migrating their workloads to cloud platforms. Coupled with a robust product pipeline that solidly positions the company in a competitive market, I believe it will be able to generate revenue growth in the mid-to-high 20s range over the next five years, which would translate to the stock having an upside of 22% to $150.

This article first appeared on GuruFocus.