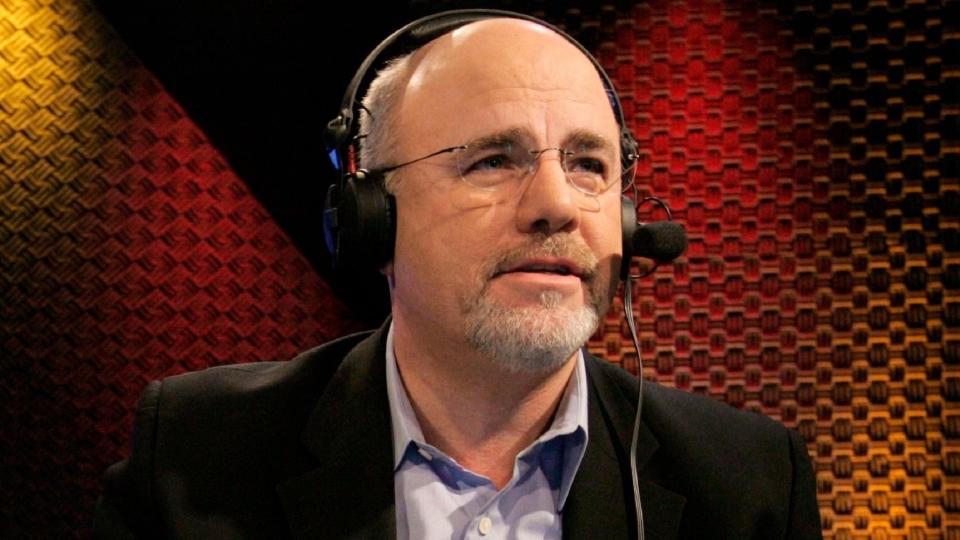

Dave Ramsey: 6 Ways You Can Become a Millionaire While Earning an Average Salary

Noted financial personality Dave Ramsey is direct and to the point when it comes to advice. As he consistently notes in his podcasts, YouTube videos and website postings, becoming a millionaire, even on an average salary, is doable. You just have to do the hard work and take the steps required to make it happen.

Also: Ramit Sethi Shares 3 Tips for Becoming Rich on an Average Salary

Learn: 3 Things You Must Do When Your Savings Reach $50,000

In a Sept. 6, 2023, post to his Ramsey Solutions website, the popular pundit once again outlined how it can be done. Here are the highlights.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

Avoid Debt at All Costs

Regardless of your financial goals, debt is a killer. One of Ramsey’s most-repeated axioms is that you absolutely must get out of debt if you want to truly build wealth. As Ramsey puts it, every time you go into debt, you dig a deeper financial hole.

According to Ramsey’s research, 90% of millionaires have never even taken out a business loan, and 73% have never carried a credit card balance in their entire life. It’s hard to argue with the real facts and figures that Ramsey quotes. If millionaires avoid debt like the plague, it seems like a good strategy to undertake yourself.

Check Out: Robert Kiyosaki Reveals His 2024 Master Plan and His Advice for Becoming a Millionaire

Work With an Advisor

In this day and age, paying zero commissions seems to be all the rage. But it might surprise you to learn that, in Ramsey’s survey, a whopping 68% of millionaires said they work with financial advisors. This is because wealth building is more than just trading stocks for no commission.

Millionaires need advice on how to diversify their holdings, maximize their tax breaks, plan their estates and so on. Even when it comes to stock trading, most do-it-yourselfers struggle to succeed, so it may very well be worth it to pay an expert to be on your side.

Stop Overspending

It goes without saying that in your quest to become a millionaire, you should reduce your discretionary spending as much as possible. To Ramsey, spending your hard-earned cash on things you don’t really need is the antithesis of what you should be doing to generate wealth.

Ramsey’s research shows that nine out of 10 millionaires spend less than they earn, and 93% still use coupons. So the path to riches truly seems to be reducing spending as much as possible. Ramsey suggests that you comparison shop so you can spend less on things like insurance and cable/satellite bills.

Additionally, Ramsey recommends you really cut down on gifts, restaurants and subscriptions to things such as magazines, streaming service and gym memberships if you really want to get ahead of your budget.

Prioritize Savings

It’s hard to get ahead financially unless you really prioritize it. In this consumer-oriented society, it’s far too easy to get caught up in spending instead of saving. That is why Ramsey emphasizes that you really have to keep saving and investment as your goal. Rather than being distracted by “keeping up with the Joneses” or always getting the latest new thing, Ramsey says you must dedicate yourself to your goal of becoming a millionaire instead.

Thanks to the power of compound interest, every dollar you invest instead of spend has the potential to be worth $3, $4 or even more. Instead of worrying about what you don’t have, Ramsey suggests you focus on your lifelong goals, which for most people involves spending more time with friends and family, not having the latest and greatest material goods.

Start Early, and Never Stop Investing

Simple mathematics tells us that the earlier you save and the more consistent you are with investing, the better off you are financially in the long run. As Ramsey outlines it, if you invest just $300 a month starting at age 25, if you can earn 11% per year, you’ll be a millionaire by age 57.

But, if you wait until you’re in your 40s and 50s, reaching that goal becomes much more difficult. If you can train yourself to begin investing at an early age, not only will you benefit from a longer runway, you’ll also become more used to setting aside a portion of your income for your long-term benefit.

Boost Your Income

It’s hard to become a millionaire just by saving. The more you can boost your income, the easier your path to millionaire status will become. Although Ramsey notes that one-third of millionaires never earned six-figure incomes, the fact remains that the more money you make, the more room you should have in your budget to spend and invest to reach millionaire status.

Asking for a raise or picking up a side hustle are just two ways that you might be able to generate more income.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: 6 Ways You Can Become a Millionaire While Earning an Average Salary