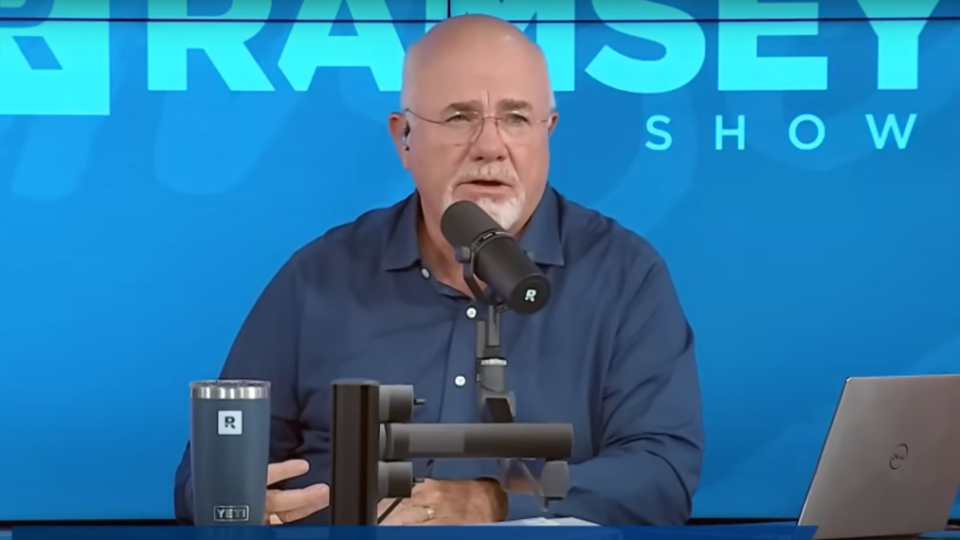

Dave Ramsey Shares He Went Bankrupt And 'Lost Everything' Years Ago While Empathizing With Caller Struggling With $380K Of Debt Who Makes $57,000 A Year — 'You've Been Sold A Fake Dream If You Think Bankruptcy Is Gonna Fix it'

Listeners of "The Ramsey Show" often find themselves nodding along to stories that could be their own. The stories feature all-too-common scenarios of financial distress with the teller seeking a glimmer of hope. In a particularly compelling segment, John from Texas shared his overwhelming battle against debt — a tale that resonates with many.

At age 28, with a wife, a 9-month-old daughter and working toward a doctorate, John’s financial load is crushing: $300,000 in student loans, $40,000 in personal loans, $26,000 in credit card debt and more.

Don't Miss:

Breaking records, mortgage loans generated $12.25 trillion of household debt nationwide – What are the other major categories of debt?

The average American has $65,100 in their savings account — How do you compare?

With an annual household income of $57,000, John, under advice from his parents, contemplated filing for Chapter 7 bankruptcy. His attorney suggested delaying the filing to see whether the post-election period might bring changes that could allow for student loans to be discharged through bankruptcy — a strategy that the show's host Dave Ramsey vehemently disagreed with.

“You’ve been sold a fake dream if you think bankruptcy is gonna fix it,” Ramsey said.

Ramsey’s guidance was imbued with personal lessons from his own financial downfall.

“The thing is the debt is always not the problem; it’s always the symptom of what’s going on, including when I lost everything and went bankrupt 30 years ago. So I know how scared you guys are and this is a huge pileup on you guys,” Ramsey said.

This reflection not only shows the depth of Ramsey’s empathy but also his firsthand understanding of the fear and stress that accompany severe financial distress.

Trending: Around 56% Of Americans Feel Behind On Saving For Retirement – Will you make enough each month?

He also critiqued John’s heavy investment in his education as a risky bet on future income, a gamble that has not paid off and has led to an overwhelming debt burden. This observation is a cautionary note on the risks of accruing significant debt on the premise of potential future earnings, particularly through advanced education.

The discussion with John is emblematic of broader issues facing many Americans, highlighted by the surge in bankruptcy filings in 2023. According to the Administrative Office of the U.S. Courts, bankruptcy filings rose 16.8% last year. The uptick reflects a nation still grappling with financial instability and searching for viable paths out of debt. Ramsey’s conversation with John offered individualized advice and shed light on the systemic challenges of managing debt and navigating financial recovery in an uncertain economic climate.

While Ramsey’s advice to John emphasized halting borrowing and expediting his Ph.D. to boost earning potential, those facing similar challenges may benefit from consulting a financial advisor. Managing financial challenges and planning for retirement are intricate matters that warrant professional guidance. A financial adviser can provide personalized advice, exploring options beyond individual consideration, encompassing debt management, retirement savings and prudent financial decisions.

Read Next:

Average retirement income in America has been revealed – Will you make enough each month?

For many first-time buyers, a house is about 3 to 5 times your household annual income – Are you making enough?

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Shares He Went Bankrupt And 'Lost Everything' Years Ago While Empathizing With Caller Struggling With $380K Of Debt Who Makes $57,000 A Year — 'You've Been Sold A Fake Dream If You Think Bankruptcy Is Gonna Fix it' originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.