David Abrams Adjusts Portfolio, Meta Platforms Sees Notable Reduction

Insights from David Abrams (Trades, Portfolio)' Latest 13F Filing Highlight Key Investment Changes

David Abrams (Trades, Portfolio), the seasoned investor behind Abrams Capital Management, has revealed his latest investment moves in the fourth quarter of 2023 through a recent 13F filing. With a reputation for a value-oriented investment philosophy, Abrams has honed his skills over a decade working alongside Seth Klarman (Trades, Portfolio) at Baupost before founding his own Boston-based firm in 1999. Abrams Capital Management is known for its opportunistic and fundamental approach, focusing on long-term investments in a select portfolio of equities, debt, and other asset classes.

Key Position Reduces

During the quarter, David Abrams (Trades, Portfolio) made the decision to trim positions in three stocks, with Meta Platforms Inc (NASDAQ:META) and Teva Pharmaceutical Industries Ltd (NYSE:TEVA) experiencing the most significant cuts. The reduction in Meta Platforms by 216,924 shares marked a 23.36% decrease in holdings and a 2.15% impact on the portfolio. Meta's stock, which traded at an average price of $325.65, has seen a 46.03% return over the past three months and a 32.25% year-to-date increase. Teva's shares were reduced by 1,969,597, a 24.72% decrease, affecting the portfolio by 0.66%. Teva's average trading price was $9.34, with a 36.94% three-month return and a 15.04% year-to-date gain.

Reduced Meta Platforms Inc (NASDAQ:META) by 216,924 shares, resulting in a -23.36% decrease in shares and a -2.15% impact on the portfolio. The stock traded at an average price of $325.65 during the quarter and has returned 46.03% over the past three months and 32.25% year-to-date.

Reduced Teva Pharmaceutical Industries Ltd (NYSE:TEVA) by 1,969,597 shares, resulting in a -24.72% reduction in shares and a -0.66% impact on the portfolio. The stock traded at an average price of $9.34 during the quarter and has returned 36.94% over the past three months and 15.04% year-to-date.

Portfolio Overview

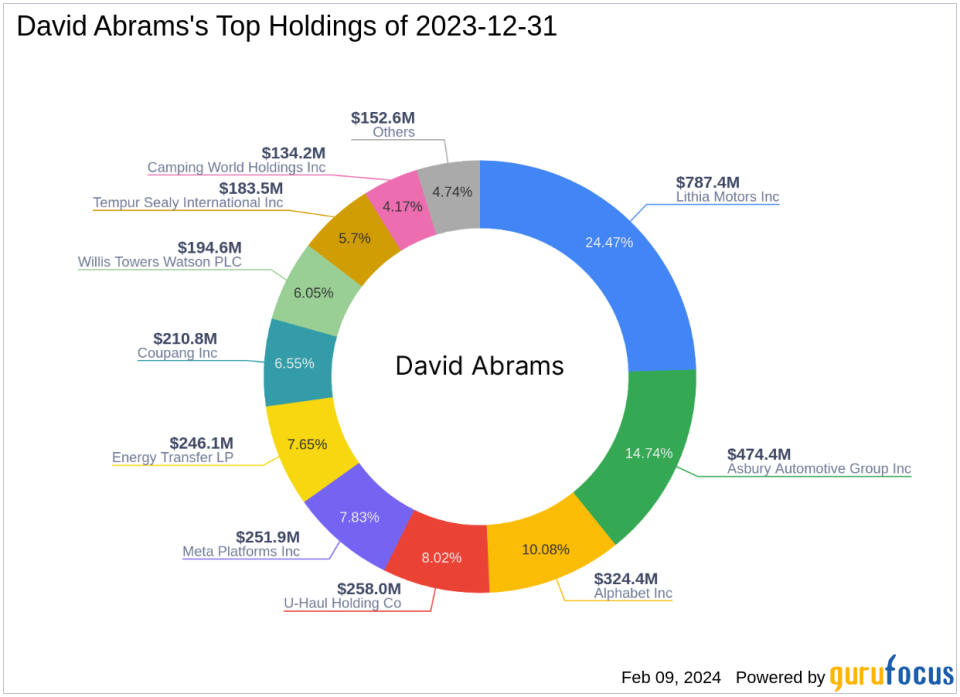

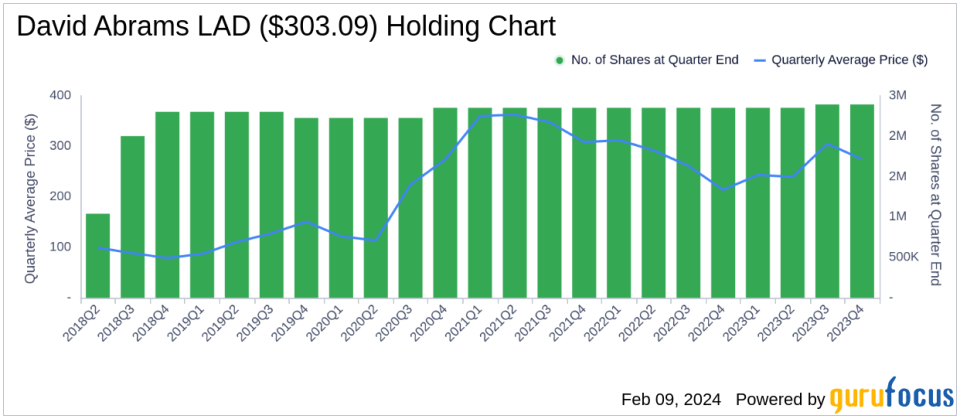

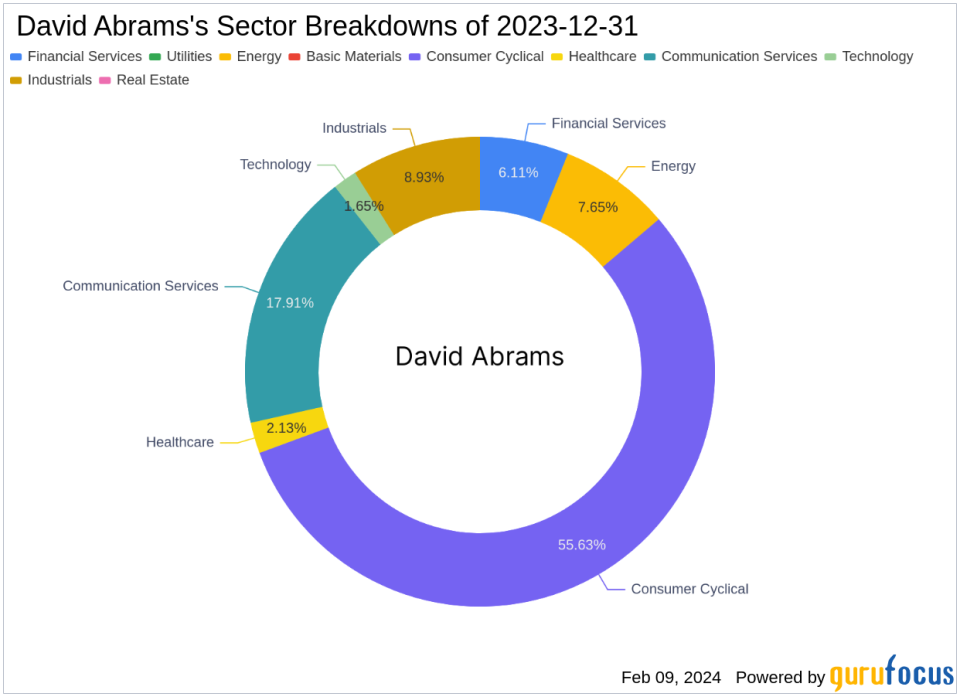

As of the fourth quarter of 2023, David Abrams (Trades, Portfolio)'s portfolio comprised 15 stocks, with significant positions in Lithia Motors Inc (NYSE:LAD), Asbury Automotive Group Inc (NYSE:ABG), Alphabet Inc (NASDAQ:GOOGL), U-Haul Holding Co (NYSE:UHAL.B), and Meta Platforms Inc (NASDAQ:META). These top holdings represent a diverse range of industries, with the portfolio's main concentrations in Consumer Cyclical, Communication Services, Industrials, Energy, Financial Services, Healthcare, and Technology sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.