David Abrams' Q2 2023 13F Filing Update: Top Trades and Portfolio Overview

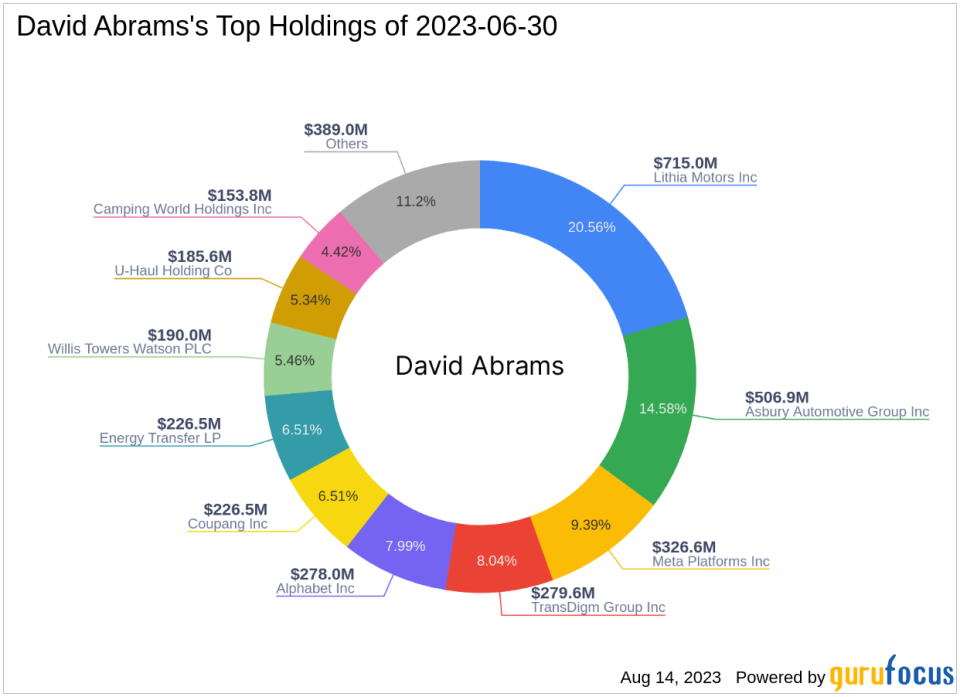

Renowned investment firm, David Abrams, recently disclosed its portfolio updates for the second quarter of 2023, which ended on June 30, 2023. The firm, led by David Abrams (Trades, Portfolio), is known for its value-oriented, long-term investment approach, focusing on undervalued companies with strong fundamentals. The firm's portfolio contained 17 stocks with a total value of $3.48 billion.

Portfolio Composition and Top Holdings

The firm's top holdings for the quarter were LAD (20.56%), ABG (14.58%), and META (9.39%). The portfolio's composition reflects the firm's strategic focus on value investing.

Top Three Trades of the Quarter

Among the firm's most notable trades for the quarter were transactions involving Meta Platforms Inc, Horizon Therapeutics PLC, and TransDigm Group Inc.

Meta Platforms Inc (NAS:META)

David Abrams (Trades, Portfolio)' firm reduced its investment in Meta Platforms Inc (NAS:META) by 1,013,732 shares, impacting the equity portfolio by 6.79%. The stock traded at an average price of $246.21 during the quarter. As of August 14, 2023, META's price was $303.02, with a market cap of $783.15 billion. The stock has returned 68.45% over the past year. GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rating of 10 out of 10. META's valuation ratios include a price-earnings ratio of 35.47, a price-book ratio of 5.82, a PEG ratio of 2.30, a EV-to-Ebitda ratio of 19.71, and a price-sales ratio of 6.64.

Horizon Therapeutics PLC (NAS:HZNP)

The firm established a new position in Horizon Therapeutics PLC (NAS:HZNP), purchasing 890,993 shares, which constituted a 2.64% weight in the equity portfolio. The stock traded at an average price of $105.56 during the quarter. As of August 14, 2023, HZNP's price was $104.29, with a market cap of $23.82 billion. The stock has returned 54.45% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 6 out of 10. HZNP's valuation ratios include a price-earnings ratio of 55.64, a price-book ratio of 4.48, a EV-to-Ebitda ratio of 26.53, and a price-sales ratio of 6.69.

TransDigm Group Inc (NYSE:TDG)

David Abrams (Trades, Portfolio)' firm also reduced its investment in TransDigm Group Inc (NYSE:TDG) by 53,440 shares, impacting the equity portfolio by 1.25%. The stock traded at an average price of $790.05 during the quarter. As of August 14, 2023, TDG's price was $865, with a market cap of $47.78 billion. The stock has returned 31.87% over the past year. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 9 out of 10. TDG's valuation ratios include a price-earnings ratio of 46.13, a PEG ratio of 7.32, a EV-to-Ebitda ratio of 22.08, and a price-sales ratio of 7.90.

In conclusion, David Abrams (Trades, Portfolio)' firm continues to demonstrate its commitment to value investing, making strategic decisions based on the fundamental strength and valuation of companies. The firm's Q2 2023 portfolio updates provide valuable insights into its investment strategy and market outlook.

This article first appeared on GuruFocus.