David Einhorn's Greenlight Capital Adjusts Portfolio, Green Brick Partners Sees Major Cut

Insights from Greenlight Capital's Latest 13F Filing for Q3 2023

David Einhorn (Trades, Portfolio), the president of Greenlight Capital, is renowned for his value-oriented investment strategy and his activist role in the companies he invests in. Founded in 1996, Greenlight Capital focuses on North American equities and corporate debt offerings, aiming for consistent returns and capital preservation through intrinsic value. Einhorn's latest 13F filing for the third quarter of 2023 reveals strategic moves that reflect his investment philosophy amidst the current market conditions.

New Additions to the Portfolio

David Einhorn (Trades, Portfolio)'s Greenlight Capital made a notable new buy in the third quarter:

DHT Holdings Inc (NYSE:DHT) was added to the portfolio with 2,024,820 shares, representing 1.18% of the portfolio and a total value of $20.86 million.

Significant Increases in Existing Positions

Einhorn's Greenlight Capital increased its stakes in 21 stocks during the quarter, with significant additions to:

SPDR Gold Shares ETF (GLD), adding 203,325 shares for a total of 431,224 shares. This 89.22% increase in share count had a 1.98% impact on the portfolio, valued at $73.93 million.

Kyndryl Holdings Inc (NYSE:KD), with an additional 1,139,360 shares, bringing the total to 5,588,126 shares. This 25.61% increase in share count is valued at $84.38 million.

Exiting Positions

The third quarter also saw Greenlight Capital exit several positions:

Black Knight Inc (BKI) was completely sold off, with 1,336,800 shares divested, impacting the portfolio by -3.74%.

Capri Holdings Ltd (NYSE:CPRI) was liquidated, with all 1,646,136 shares sold, resulting in a -2.77% portfolio impact.

Noteworthy Reductions

David Einhorn (Trades, Portfolio)'s fund reduced its holdings in several companies, with the most significant reductions being:

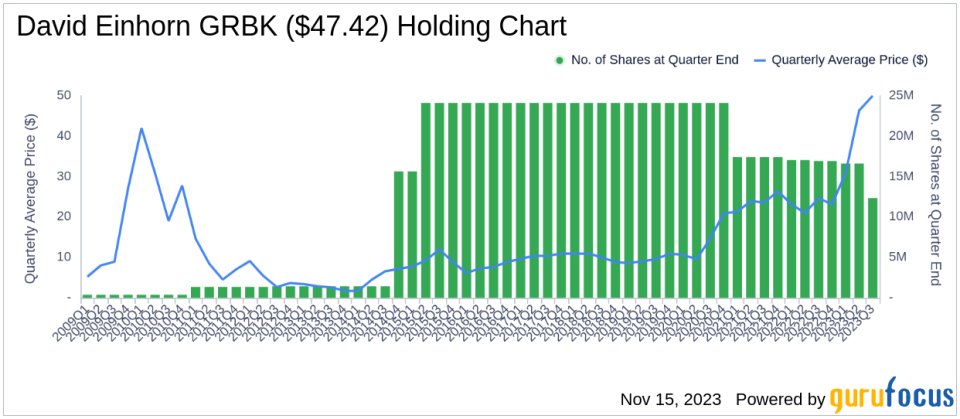

Green Brick Partners Inc (NYSE:GRBK) saw a reduction of 4,258,125 shares, a -25.65% decrease in shares, and an -11.34% impact on the portfolio. The stock traded at an average price of $49.98 during the quarter and has seen a -12.39% return over the past three months, despite a 94.06% year-to-date return.

CONSOL Energy Inc (NYSE:CEIX) was reduced by 441,554 shares, a -15.52% decrease, impacting the portfolio by -1.4%. The stock's average trading price was $81.68 during the quarter, with a 22.96% return over the past three months and a 57.79% year-to-date return.

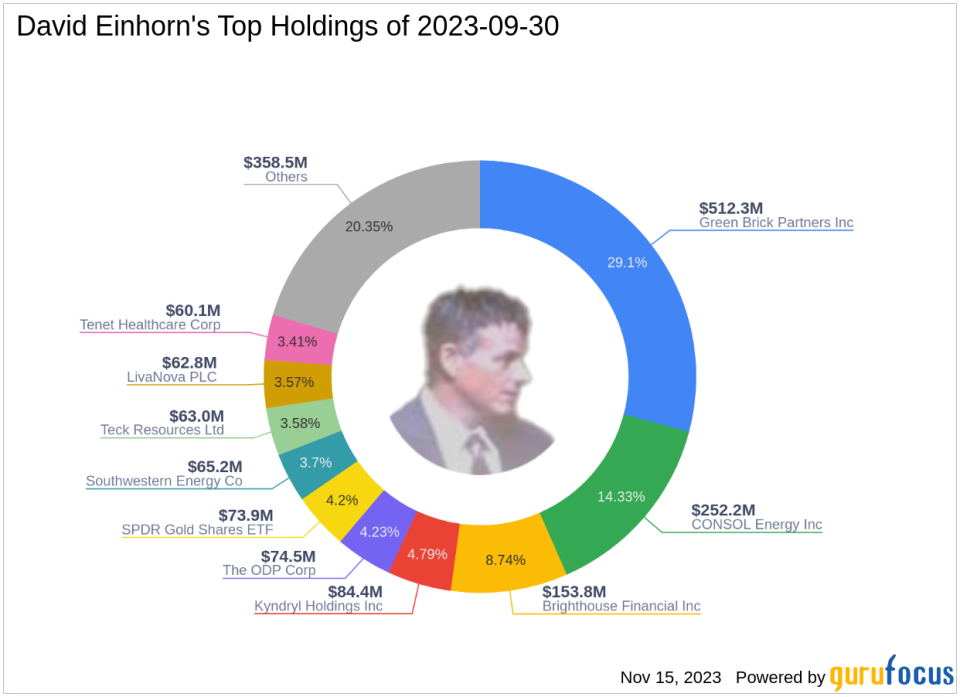

Portfolio Overview

As of the third quarter of 2023, David Einhorn (Trades, Portfolio)'s portfolio comprised 39 stocks. The top holdings were 29.1% in Green Brick Partners Inc (NYSE:GRBK), 14.33% in CONSOL Energy Inc (NYSE:CEIX), 8.74% in Brighthouse Financial Inc (NASDAQ:BHF), 4.79% in Kyndryl Holdings Inc (NYSE:KD), and 4.23% in The ODP Corp (NASDAQ:ODP). The investments are primarily concentrated across eight industries: Consumer Cyclical, Energy, Financial Services, Healthcare, Technology, Basic Materials, Industrials, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.