David Einhorn's Greenlight Capital Boosts Coya Therapeutics Holding

Renowned investment firm Greenlight Capital, led by David Einhorn (Trades, Portfolio), has recently expanded its investment portfolio with the increase to its holding in Coya Therapeutics Inc (NASDAQ:COYA). On December 12, 2023, the firm added 810,959 shares to its holdings, reflecting a significant commitment to the biotechnology company.

David Einhorn (Trades, Portfolio)'s Investment Approach

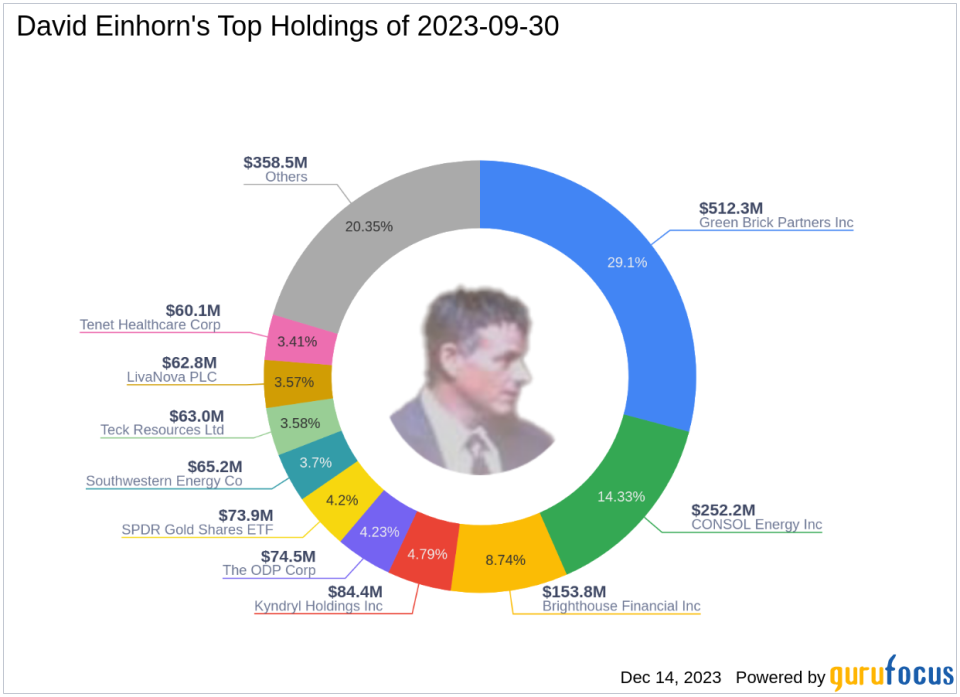

David Einhorn (Trades, Portfolio), the president of Greenlight Capital, is known for a value-oriented investment philosophy that focuses on intrinsic value to achieve consistent absolute returns. Greenlight Capital, founded in 1996, has a history of engaging with management to drive changes that unlock shareholder value. With a diverse portfolio of 39 stocks and a top sector focus on Consumer Cyclical and Energy, Greenlight Capital manages an equity of $1.76 billion. Among its top holdings are Green Brick Partners Inc (NYSE:GRBK), The ODP Corp (NASDAQ:ODP), and Brighthouse Financial Inc (NASDAQ:BHF).

Details of the Trade

The transaction on December 12 saw Greenlight Capital's position in Coya Therapeutics Inc increase by 810,959 shares, resulting in a total holding of 1,279,026 shares. This trade has a 0.32% impact on the portfolio, with the position in COYA now representing 0.5% of Greenlight's holdings and 8.90% of the company's available stock. The shares were acquired at a price of $6.92 each.

Introducing Coya Therapeutics Inc

Coya Therapeutics Inc, a clinical-stage biotechnology firm based in the USA, specializes in developing treatments that modulate the function of regulatory T cells. With a focus on neurodegenerative, autoimmune, and metabolic diseases, COYA is at the forefront of Treg therapy innovation. The company, which went public on December 29, 2022, has a market capitalization of $96.773 million and a current stock price of $6.72, slightly below the trade price of $6.92.

Market and Financial Overview

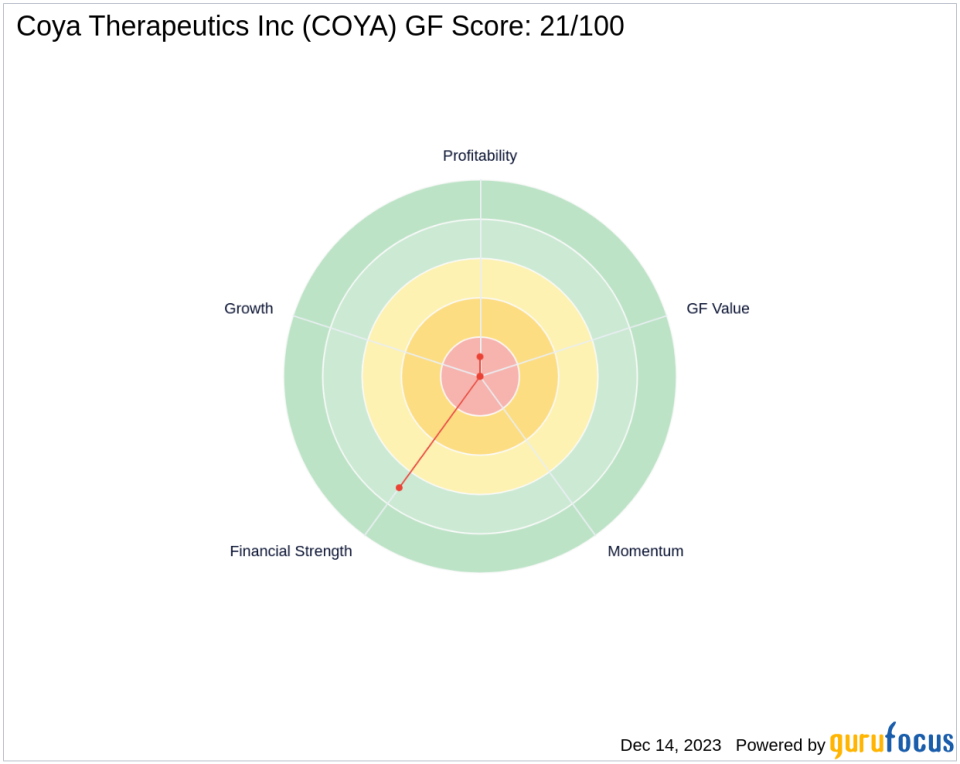

Despite the lack of a GF Value due to insufficient data, Coya Therapeutics Inc's stock has seen a year-to-date increase of 44.52%. Since its IPO, the stock has risen by 38.56%, although it has experienced a slight decline of 2.89% since the trade date. The company's financial strength is indicated by a balance sheet rank of 7/10, but it struggles with profitability, as shown by a rank of 1/10. The growth and GF Value ranks are not applicable, and the stock's GF Score stands at a low 21/100, suggesting potential challenges ahead.

Biotechnology Sector and Industry Analysis

Greenlight Capital's investment in COYA aligns with its strategy of identifying undervalued companies with potential for growth. The biotechnology industry is known for its high-risk, high-reward nature, and Coya Therapeutics Inc's position within this sector will be closely watched by investors. The firm's top sectors include Consumer Cyclical and Energy, indicating a diversified approach to investment.

Comparative Guru Holdings

David Einhorn (Trades, Portfolio)'s Greenlight Capital is currently the largest guru shareholder in Coya Therapeutics Inc, holding a significant 8.90% of the company's shares. This position is a testament to the firm's confidence in COYA's potential and sets a benchmark for other notable investors considering an entry into the stock.

Transaction Analysis and Impact

The recent acquisition by Greenlight Capital is a strategic move that not only diversifies its portfolio but also positions the firm to potentially influence Coya Therapeutics Inc's future direction. With a substantial stake in the company, Greenlight Capital may play an active role in shaping COYA's trajectory, leveraging David Einhorn (Trades, Portfolio)'s activist investment approach. The trade's impact on the portfolio, while modest, reflects a calculated bet on the biotechnology sector and COYA's unique position within it.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.