David Herro Buys Amadeus IT Group, Boosts Lloyds Banking

- By Sydnee Gatewood

David Herro (Trades, Portfolio), manager of Harris Associates' Oakmark International Fund, disclosed his second-quarter portfolio earlier this week.

The guru, who also manages the Chicago-based firm's International Small Cap and Global Select funds, looks for value opportunities among foreign mid- and large-cap companies that are trading at a significant discount to his estimate of intrinsic value. His goal is to generate long-term capital appreciation by patiently waiting for the gap between the stock price and intrinsic value to close.

Based on these criteria, Herro established three new positions during the three months ended June 30, as well as trimmed or added to a slew of other holdings. His most notable trades included a new stake in Amadeus IT Group SA (XMAD:AMS), a boost to the Lloyds Banking Group PLC (LSE:LLOY) investment and reductions of the Bayer AG (XTER:BAYN), Naver Corp. (XKRX:035420) and Ashtead Group PLC (LSE:AHT) holdings.

Amadeus IT Group

The guru invested in 5.29 million shares of Amadeus IT Group, allocating 1.31% of the equity portfolio to the stake. The stock traded for an average price of 45.69 euros ($54.61) per share during the quarter.

The Spanish company, which provides information technology services for the global travel and tourism industry, has a market cap of 21.1 billion euros; its shares closed at 46.91 euros on Monday with a price-earnings ratio of 56.52, a price-book ratio of 4.87 and a price-sales ratio of 5.03.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 2 out of 10 also supports this assessment.

GuruFocus rated Amadeus' financial strength 5 out of 10. Although the company has issued approximately 2.2 billion euros in new long-term debt over the past three years, it is at a manageable level due to adequate interest coverage. The Altman Z-Score of 2.69 also indicates the company is under some pressure since it has recorded a loss in operating income and assets are building up at a faster rate than revenue is growing.

The company's profitability scored an 8 out of 10 rating, driven by margins and returns that outperform over half of its competitors. Amadeus also has a moderate Piotroski F-Score of 4, which suggests operations are stable, and a predictability rank of 3.4 out of five stars that is on watch as a result of a decline in revenue per share. According to GuruFocus, companies with this rank typically return an average of 9.3% annually over a 10-year period.

Herro holds 1.18% of the company's outstanding shares.

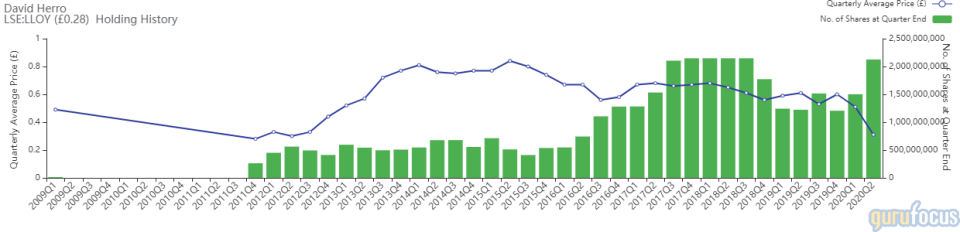

Lloyds Banking Group

With an impact of 1.15% on the equity portfolio, the investor boosted his stake in Lloyds Banking Group by 41.57%, buying 624.3 million shares. During the quarter, shares traded for an average price of 0.31 pounds (42 cents) each.

Herro now owns 2.12 billion shares of the bank total, which represent 3.91% of the equity portfolio. GuruFocus estimates he has lost 16.81% on the investment since the fourth quarter of 2011.

The British bank has a market cap of 20.07 billion pounds; its shares closed at 0.28 pounds on Monday with a price-earnings ratio of 93.33, a price-book ratio of 0.41 and a price-sales ratio of 0.77.

According to the Peter Lynch chart, the stock is overvalued.

Weighed down by a cash-debt ratio of 0.74, Lloyds' financial strength was rated 3 out of 10 by GuruFocus. The weighted average cost of capital is also significantly higher than the return on invested capital, indicating it is destroying value for shareholders.

The company's profitability did not fare much better, scoring a 4 out of 10 rating on the back of negative margins and returns that underperform a majority of industry peers. Lloyds also has a low Piotroski F-Score of 2, suggesting operations are in poor shape, and a one-star predictability rank. GuruFocus says companies with this rank return an average of 1.1% annually.

The guru owns 3% of the bank's outstanding shares.

Bayer

Impacting the equity portfolio by -1.10%, Herro curbed his Bayer stake by 38.64%, selling 3.52 million shares. The stock traded for an average per-share price of 61.25 euros during the quarter.

The guru now owns 5.6 million shares, which account for 1.97% of the equity portfolio. GuruFocus data shows he has lost an estimated 28.58% on the investment since establishing it in the first quarter of 2018.

The German pharmaceutical and life sciences company has a market cap of 54.56 billion euros; its shares closed at 55.54 euros on Monday with a price-book ratio of 1.52 and a price-sales ratio of 1.25.

Based on the median price-sales chart, the stock appears to be undervalued. The GuruFocus valuation rank of 8 out of 10 supports this analysis.

GuruFocus rated Bayer's financial strength 3 out of 10 on the back of low debt ratios and an Altman Z-Score of 0.52, which warns there could be a risk of going bankrupt.

The company's profitability scored a 6 out of 10 rating despite having negative margins and returns that are underperforming a majority of competitors. Bayer has a moderate Piotrsoki F-Score of 5, but the one-star predictability rank is on watch due to declining revenue per share over the past five years.

With 0.57% of outstanding shares, Herro has the largest position in Bayer among the gurus. The Causeway International Value (Trades, Portfolio) Fund also owns the stock.

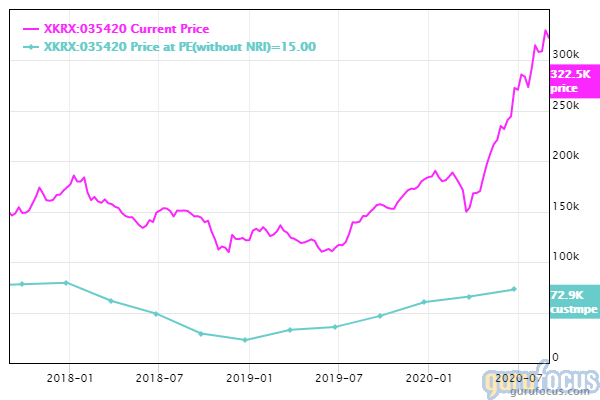

Naver

The investor sold 1.4 million shares of Naver, trimming the stake by 43.63%. The transaction had an impact of -1.06% on the equity portfolio. The stock traded for an average price of 214,727 won ($181.12) per share during the quarter.

Herro now owns 1.8 million shares of Naver, representing 1.91% of the equity portfolio. GuruFocus data shows he has gained around 81.33% on the investment since the fourth quarter of 2018.

The South Korean development company, which operates a search engine, has a market cap of 46.8 trillion won; its shares closed at 322,500 won on Monday with a price-earnings ratio of 66.41, a price-book ratio of 6.78 and a price-sales ratio of 6.61.

The Peter Lynch chart and GuruFocus valuation rank of 2 out of 10 both suggest the stock is overvalued since the share price and price-sales ratio are both near multiyear highs.

Naver's financial strength was rated 7 out of 10 by GuruFocus. Although the company has issued approximately 1.13 trillion won in new long-term debt over the past three years, it is still at a manageable level due to sufficient interest coverage. It has a robust Altman Z-Score of 5.83 even though assets have been building up faster than revenue has grown. The WACC also surpasses the ROIC, indicating value is being destroyed.

Despite a declining operating margin, the company's profitability fared even better with a 9 out of 10 rating. Naver is being supported by strong returns that outperform a majority of industry peers as well as a moderate Piotroski F-Score of 5 and a one-star predictability rank.

Of the gurus invested in Naver, Herro has the largest stake with 1.24% of outstanding shares. The Matthews Pacific Tiger Fund (Trades, Portfolio) also owns the stock.

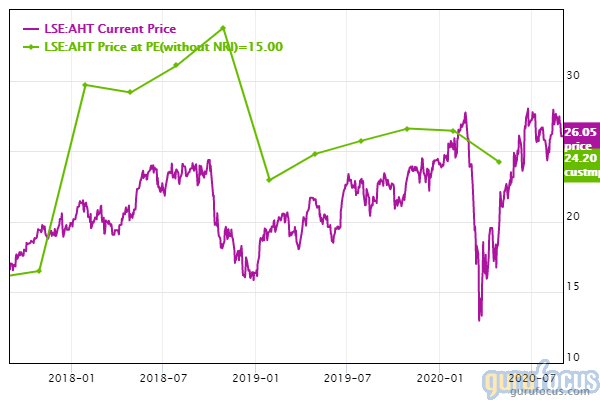

Ashtead Group

Herro sold 8.25 million shares of Ashtead Group, reducing the stake by 41.42%. The trade impacted the equity portfolio by -0.97%. Shares traded for an average price of 22.34 pounds each during the quarter.

Accounting for 1.87% of the equity portfolio, Herro now holds 11.67 million shares total. GuruFocus data shows he has gained an estimated 58.62% on the investment since the third quarter of 2015.

The British company, which leases industrial equipment, has a market cap of 11.7 billion pounds; its shares closed at 26.05 pounds on Monday with a price-earnings ratio of 16.15, a price-book ratio of 3.94 and a price-sales ratio of 2.36.

According to the Peter Lynch chart, the stock is slightly overvalued. The GuruFocus valuation rank of 4 out of 10 also leans toward overvaluation since the share price and price-sales ratios are approaching multiyear highs.

GuruFocus rated Ashtead's financial strength 4 out of 10. Even though the company has issued approximately 1.8 billion pounds in new long-term debt over the past three years, it is still at a manageable level due to adequate interest coverage. The Altman Z-Score of 2.2, though, indicates the company is under some pressure.

Despite seeing a decline in the operating margin, the company's profitability scored a 9 out of 10 rating. Ashtead is supported by strong returns that outperform a majority of competitors, a moderate Piotroski F-Score of 6 and consistent earnings and revenue growth. It also has a 2.5-star predictability rank. GuruFocus says companies with this rank typically return 7.3% on average annually.

Herro has a 2.6% stake in the company, making him its largest guru shareholder. Bestinfond (Trades, Portfolio) also has a position in the stock.

Additional trades and portfolio performance

During the quarter, the guru also entered new positions in Compass Group PLC (LSE:CPG) and Alibaba Group Holding Ltd. (HSKE:09988). While the majority of the trades made were reductions, he did also add to a couple holdings, including Intesa Sanpaolo (MIL:ISP) and Axis Bank Ltd. (BOM:532215).

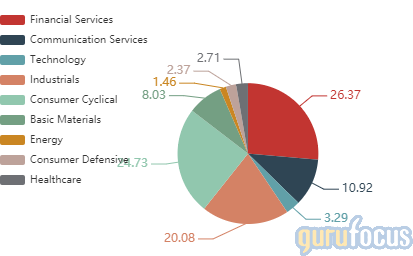

Herro's $21.02 billion market cap, which is composed of 64 stocks, is most heavily invested in the financial services, consumer cyclical and industrials sectors.

The investor wrote in his quarterly letter that the fund returned 24.4% during the quarter, outperforming the MSCI World except U.S. Index's 15.3% return.

Disclosure: No positions.

Read more here:

Mario Cibelli Takes a Bite of Simply Good Foods, Dumps 2 Other Food Distributors

Top 5 Trades of Donald Smith's Firm

The Top 5 Trades of George Soros' Firm

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.