David Nierenberg Increases Stake in Potbelly Corp

David Nierenberg (Trades, Portfolio)'s Latest Investment Move

On December 20, 2023, David Nierenberg (Trades, Portfolio), through Nierenberg Investment Management Company, made a significant addition to the firm's holdings in Potbelly Corp (NASDAQ:PBPB). The transaction involved the acquisition of 216,005 shares at a trade price of $10.43, increasing the total share count to 2,925,865. This move had a 1.59% impact on the portfolio and raised the position to a substantial 21.56%. Notably, Nierenberg's stake in Potbelly Corp now represents 9.60% of the company's shares.

Who is David Nierenberg (Trades, Portfolio)?

David Nierenberg (Trades, Portfolio) is the founder and president of Nierenberg Investment Management Company, which oversees the D3 Family of Funds. With a focus on long-term capital gains, Nierenberg's investment strategy zeroes in on undervalued, domestic, micro-cap growth companies, occasionally employing activism to unlock value. The firm's portfolio consists of 33 stocks, with top holdings including Potbelly Corp (NASDAQ:PBPB), Cantaloupe Inc (NASDAQ:CTLP), and Mr. Cooper Group Inc (NASDAQ:COOP). Nierenberg Investment Management Company has an equity portfolio valued at $139 million, with a preference for the Financial Services and Energy sectors.

Understanding Potbelly Corp

Potbelly Corp, trading under the symbol PBPB, is a well-known player in the restaurant industry in the USA. Since its IPO on October 4, 2013, the company has specialized in offering a variety of sandwiches, salads, and breakfast items across its numerous locations. With a market capitalization of $315.607 million and a PE ratio of 67.19, Potbelly's financial performance indicators reflect its current market position. However, the stock is considered significantly overvalued with a GF Value of $7.65 and a price to GF Value ratio of 1.41. The company's stock price has seen a year-to-date increase of 95.45%, despite a decline of 62.49% since its IPO.

Trade's Impact on Nierenberg's Portfolio

The recent acquisition of Potbelly Corp shares by David Nierenberg (Trades, Portfolio) has solidified the stock's position as a key component of the portfolio. The 21.56% position size is a testament to Nierenberg's confidence in the company's potential. With 9.60% of Potbelly's shares now under Nierenberg's control, this investment move could signal a strategic interest in the company's future.

Market Performance of Potbelly Corp

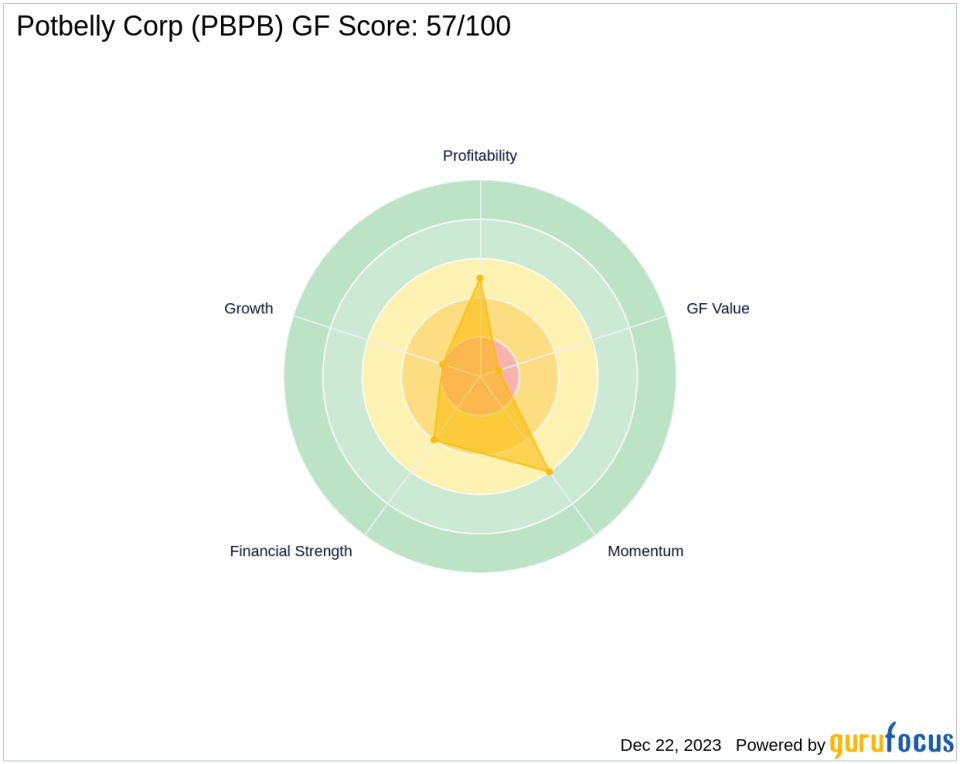

Currently, Potbelly Corp's stock price stands at $10.75, slightly above the trade price of $10.43. The stock has experienced a gain of 3.07% since the transaction date. Despite the positive momentum, Potbelly's GF Score of 57/100 suggests that the stock may have poor future performance potential.

Financial Health and Growth Prospects

Potbelly Corp's financial health and growth prospects are mixed. The company has a cash to debt ratio of 0.16 and an interest coverage of 4.21. Its ROE is an impressive 91.48%, while the ROA stands at 2.02%. However, the company's Growth Rank is low at 2/10, indicating potential challenges in expanding its financial performance. Over the past three years, Potbelly has seen a revenue decline of 3.30%, though EBITDA growth was positive at 5.20%, and earnings growth was strong at 68.80%.

Sector and Industry Analysis

David Nierenberg (Trades, Portfolio)'s investment in Potbelly Corp aligns with the firm's top sector preferences, which include Financial Services and Energy. Within the restaurant industry, Potbelly's unique brand and menu offerings position it to potentially capitalize on market trends and consumer preferences.

Comparative Shareholder Analysis

First Eagle Investment (Trades, Portfolio) Management, LLC is the largest guru shareholder in Potbelly Corp, though the exact share percentage is not disclosed. Comparatively, David Nierenberg (Trades, Portfolio)'s recent transaction has increased the firm's influence in Potbelly, highlighting a strong belief in the company's value proposition.

Conclusion: Analyzing the Transaction's Influence

David Nierenberg (Trades, Portfolio)'s increased stake in Potbelly Corp is a strategic move that may influence the company's direction and stock performance. With a significant portion of the company's shares and a prominent position in the portfolio, Nierenberg's investment decisions will be closely watched by the market. Investors and analysts alike will be keen to see how this transaction plays out in the context of Potbelly's financial health and growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.