David Rolfe Buys First Republic Bank, Trims Several Top Holdings

- By Sydnee Gatewood

Wedgewood Partners Chief Investment Officer David Rolfe (Trades, Portfolio) disclosed his portfolio for the third quarter of 2020 last week.

The guru's St. Louis-based firm approaches potential investments with the mindset of a business owner, analyzing a handful of undervalued companies that have a dominant product or service, consistent earnings, revenue and dividend growth, are highly profitable and have strong management teams.

In his shareholder letter for the three-month period ended Sept. 30, Rolfe noted "the stock market continues to take its cue from the unprecedented monetary and fiscal stimulus to thwart the pandemic emanating from Washington, D.C." Discussing other events like the, at the time, upcoming election and the ongoing Covid-19 pandemic heading into the final quarter of the year, the guru said the U.S. is likely to see another surge in cases as we enter cold and flu season, which may lead to further shutdowns.

"If the new year brings heightened risk of federal, state or local business and school shutdowns (and the concomitant political folly that would no doubt ensue), the impact on unemployment (which peaked in May at 14.7% and fell to 7.9% in September), the economy and financial markets will not be immaterial," he wrote.

Taking these developments into consideration, Rolfe established a new position in First Republic Bank (NYSE:FRC), sold out of four stocks and trimmed or added to a slew of other holdings during the quarter. The most significant trade was a 35.42% decrease in the Apple Inc. (NASDAQ:AAPL). Other major transactions included the sale of Nvidia Corp. (NASDAQ:NVDA) as well as a reduction in the Facebook Inc. (NASDAQ:FB) holding and a boost to Microsoft Corp. (NASDAQ:MSFT).

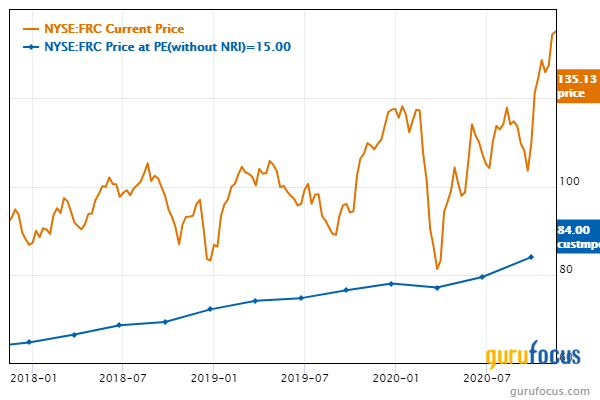

First Republic Bank

The guru invested in 139,827shares of First Republic Bank, dedicating 2.41% of the equity portfolio to the position. During the quarter, the stock traded for an average price of $110.97 per share.

The San Francisco-based bank and wealth management company has a $23.27 billion market cap; its shares were trading around $135.13 on Monday with a price-earnings ratio of 24.13, a price-book ratio of 2.41 and a price-sales ratio of 6.37.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 2 out of 10 also leans toward overvaluation since the share price, price-earnings and price-sales ratios are all nearing 10-year highs.

In his quarterly letter, Rolfe commented on the company's business model and "long history of growth," which are unique in the banking industry.

"The stock's valuation has been at a premium to its so-called banking peers," Rolfe said. "Despite the stock's long history of premium valuation, the Company's growth has long been rewarded as a premium performer versus both its banking peers and the stock market. If the Company continues to execute as we expect over the next years, we expect that the stock will be duly rewarded in kind."

Weighed down by approximately $4.9 billion in new long-term debt, First Republic's financial strength was rated 3 out of 10 by GuruFocus. Regardless, it is at a manageable level. The company's assets are also building up at a faster rate than its revenue is growing, indicating it may be becoming less efficient.

The company's profitability did not fare much better, scoring a 4 out of 10 rating on the back of margins and returns that outperform over half of its competitors. First Republic has a low Piotroski F-Score of 2, however, which suggests operations are in poor shape. It also has a predictability rank of one out of five stars. According to GuruFocus, companies with this rank return an average of 1.1% annually over a 10-year period.

With 1.56% of outstanding shares, Diamond Hill Capital (Trades, Portfolio) is the company's largest guru shareholder. David Carlson (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Ron Baron (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Wallace Weitz (Trades, Portfolio) and Chuck Royce (Trades, Portfolio) also have positions in the stock.

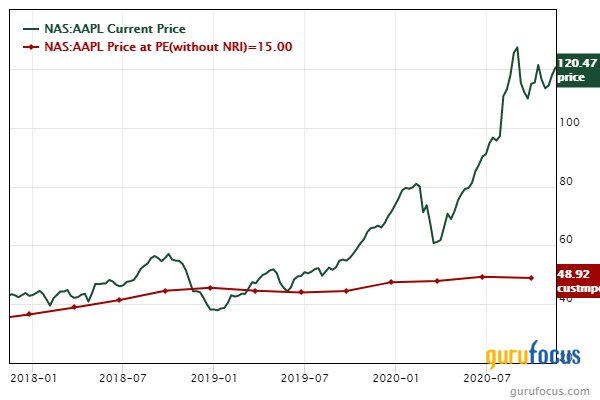

Apple

With an impact of -4.03% on the equity portfolio, Rolfe curbed the Apple holding by 35.42%, selling 260,539 shares. Shares traded for an average price of $109.02 each on a split-adjusted basis during the quarter.

He now holds 475,033 shares total, representing 8.70% of the equity portfolio and it remains the largest holding. GuruFocus estimates Rolfe has gained 80.37% on the investment so far.

The tech company, which is headquartered in Cupertino, California, has a market cap of $2.04 trillion; its shares were trading around $120.16 on Monday with a price-earnings ratio of 36.78, a price-book ratio of 31.15 and a price-sales ratio of 7.67.

According to the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 1 out of 10 supports this assessment since the share price and price ratios are all approaching 10-year highs.

In his letter, Rolfe noted that Apple's sales grew 11% during the most recent quarter "as iPad revenue growth accelerated to its fastest in six years, driven by work from home and distance learning demand." He also expects iPhone demand to increase in the coming quarters as the company "launches a flagship phone capable of running on new high-speed 5G networks around the globe."

GuruFocus rated Apple's financial strength 6 out of 10, driven by comfortable interest coverage and a robust Altman Z-Score of 6.47 that indicates it is in good standing. The company's return on invested capital is also significantly above its weighted average cost of capital, suggesting it is creating value as it grows.

The company's profitability fared even better with a 9 out of 10 rating. While the operating margin is in decline, it is still outperforming versus industry peers. Apple also has strong returns, a high Piotroski F-Score of 7, which suggests business conditions are healthy, and consistent earnings and revenue growth. It also has a 2.5-star predictability rank. GuruFocus says companies with this rank return an average of 7.3% annually.

Warren Buffett (Trades, Portfolio) is Apple's largest guru shareholder with a 5.73% stake. Other top guru investors include Fisher, Pioneer, Spiros Segalas (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Carlson, Tom Gayner (Trades, Portfolio) and Bill Gates (Trades, Portfolio)' foundation trust.

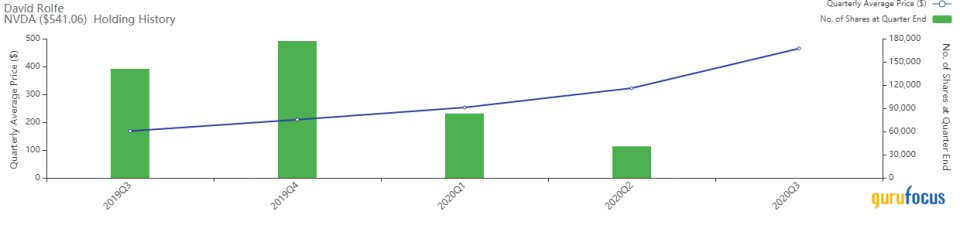

Nvidia

Impacting the equity portfolio by -2.63%, Rolfe divested of his 40,818 remaining shares of Nvidia. The stock traded for an average per-share price of $464.8 during the quarter.

GuruFocus estimates he gained 80.3% on the investment, which was established in the third quarter of 2019.

The Santa Clara, California-based tech company, which designs and manufactures graphics processing units for the gaming and professional markets, has a $335.44 billion market cap; its shares were trading around $541.52 on Monday with a price-earnings ratio of 99.83, a price-book ratio of 24.09 and a price-sales ratio of 25.85.

Based on the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 1 out of 10 also leans toward overvaluation since the share price, price-earnings and price-sales ratios are closing in on 10-year highs.

Rolfe revealed in his letter that the firm sold its position in Nvidia to help fund its purchase of First Republic Bank. While he says it "continues to be an excellent business," he believes "the market has discounted much of Nvidia's potential in the stock's current huge valuation." As such, he "would rather invest in less well-understood opportunities that have similarly dominant franchises but exhibit more attractive valuations."

Nvidia's financial strength was rated 7 out of 10 by GuruFocus, driven by adequate interest coverage and a high Altman Z-Score of 19.99. However, its Sloan ratio suggests poor earnings quality while its assets are building up at a faster rate than revenue is growing. The ROIC eclipses the WACC, however, by a wide margin, so the company is creating value.

The company's profitability fared even better, scoring a 9 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and consistent earnings and revenue growth. It also has a moderate Piotroski F-Score of 6, which indicates business conditions are stable, and a 3.5-star predictability rank. GuruFocus data shows companies with this rank return, on average, 9.3% annually.

Segalas is Nvidia's largest guru shareholder with 0.44% of outstanding shares. PRIMECAP, Pioneer and Fisher also have large positions in the stock.

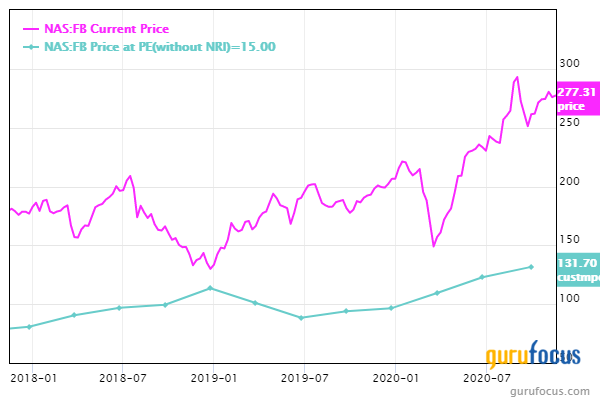

The investor trimmed the Facebook position by 16.98%, selling 37,264 shares. The trade had an impact of -1.43% on the equity portfolio. During the quarter, the stock traded for an average price of $257.89 per share.

Rolfe now holds 182,136 shares total, which account for 7.54% of the equity portfolio and is his fourth-largest holding. According to GuruFocus, he has gained 16.06% on the investment since establishing it in the first quarter of 2018.

The social media giant, which is headquartered in Menlo Park, California, has a market cap of $790.97 billion; its shares were trading around $277.53 on Monday with a price-earnings ratio of 31.62, a price-book ratio of 6.71 and a price-sales ratio of 10.12.

The Peter Lynch chart suggests the stock is overvalued.

Rolfe noted in his quarterly letter that small businesses make up the majority of Facebook's revenue. As a result of the Covid-19 lockdowns, these businesses have been deeply impacted.

"To combat the sudden disappearance of foot traffic, these businesses are initiating or accelerating the adoption of digital customer acquisition strategies provided by Facebook's vast ecosystem, including instant access to over 2 billion daily users," he wrote.

Facebook's financial strength and profitability were both rated 9 out of 10 by GuruFocus. In addition to comfortable interest coverage, the company is supported by a high Altman Z-score of 18.78. The ROIC is also significantly higher than the WACC, indicating good value creation.

The company is also being supported by an expanding operating margin, strong returns that outperform a majority of industry peers and a moderate Piotrsoki F-Score of 6. Revenue per share growth has slowed down over the past 12 months, however.

Of the gurus invested in Facebook, Chase Coleman (Trades, Portfolio) has the largest stake with 0.31% of outstanding shares. Pioneer, Segalas, Steve Mandel (Trades, Portfolio), Frank Sands (Trades, Portfolio), Fisher, Dodge & Cox, Chris Davis (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio), David Tepper (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Bill Nygren (Trades, Portfolio) and many other gurus also have positions in the stock.

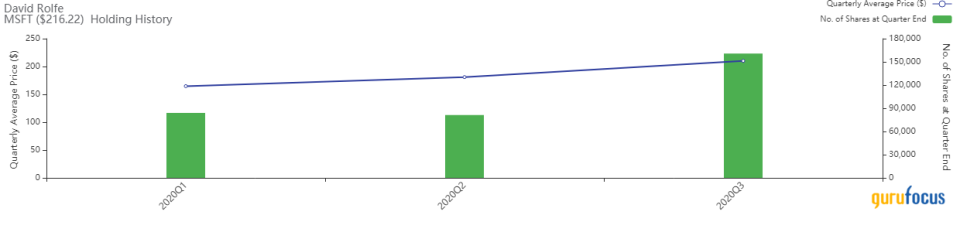

Microsoft

Rolfe boosted his Microsoft holding by 97.67%, buying 79,400 shares. The trade had an impact of 2.64% on the equity portfolio. Shares traded for an average price of $210.04 each during the quarter.

He now holds 160,696 shares total, which make up 5.35% of the equity portfolio and is now his ninth-largest holding. According to GuruFocus data, the guru has gained an estimated 15.48% on the investment since the first quarter of 2020.

The Redmond, Washington-based software company has a $1.64 trillion market cap; its shares were trading around $216.80 on Monday with a price-earnings ratio of 35.02, a price-book ratio of 13.29 and a price-sales ratio of 11.28.

According to the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 1 out of 10 aligns with this assessment since the share price, price-sales and price-book ratios are all near 10-year highs.

GuruFocus rated Microsoft's financial strength 7 out of 10, driven by sufficient interest coverage and a high Altman Z-Score of 7.27. Its assets are building up faster than revenue is growing, though, which suggests it may be becoming less efficient. The ROIC, however, is well above the WACC, indicating good value creation.

The company's profitability scored a 9 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a high Piotroski F-Score of 8. Microsoft has also recorded steady earnings and revenue growth, resulting in a 2.5-star predictability rank.

With a 0.30% stake, Fisher is the company's largest guru shareholder. PRIMECAP, Pioneer, Dodge & Cox, Coleman, Segalas, Mandel, Sands, Andreas Halvorsen (Trades, Portfolio), First Eagle, Grantham, Hotchkis & Wiley, Mairs and Power (Trades, Portfolio), Yacktman Asset Management (Trades, Portfolio) and many other gurus also own the stock.

Additional trades and portfolio performance

Other major transactions Rolfe made during the quarter included a 35.47% boost to the Keysight Technologies Inc. (NYSE:KEYS) holding as well as additions to the Copart Inc. (NASDAQ:CPRT), Bristol-Myers Squibb Co. (NYSE:BMY), CDW Corp. (NASDAQ:CDW) and Motorola Solutions Inc. (NYSE:MSI) positions.

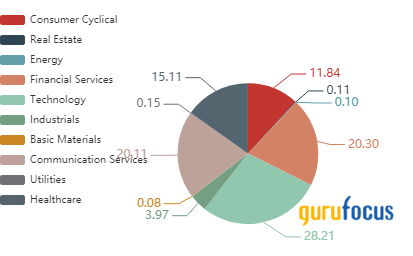

Wedgewood's $632 million equity portfolio, which is composed of 35 stocks, is most heavily invested in the technology, financial services and communication services sectors.

The firm posted a return of 31.96% for 2019, slightly outperforming the S&P 500 Index's 31.49% return.

Disclosure: No positions.

Read more here:

Wallace Weitz Buys Fidelity National, First Republic Bank in 3rd Quarter

Richard Snow's Top 3rd-Quarter Trades

John Rogers' Firm Extends Meredith Subscription

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.