Davidson Kempner Capital Management LP Reduces Stake in Playa Hotels & Resorts NV

Davidson Kempner Capital Management LP, a prominent investment firm, recently reduced its stake in Playa Hotels & Resorts NV. This article will provide an in-depth analysis of the transaction, the guru's profile, and the traded company's basic information. The data used in this article is accurate as of August 15, 2023.

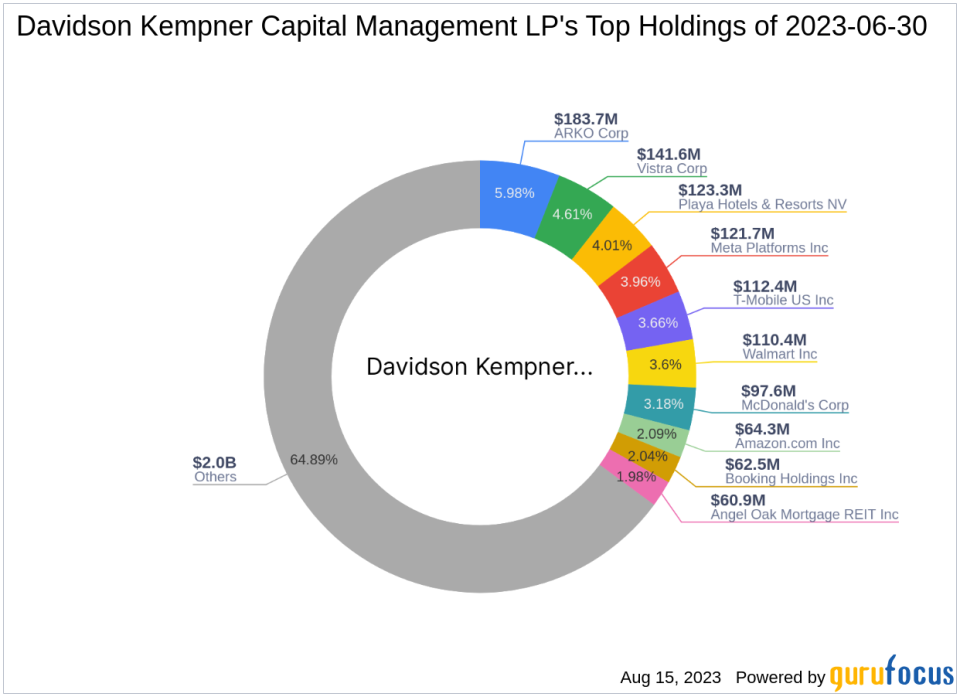

Profile of Davidson Kempner Capital Management LP

Davidson Kempner Capital Management LP is a renowned investment firm based at 65 East 55th Street, New York. The firm holds 277 stocks in its portfolio, with a total equity of $3.07 billion. Its top holdings include Meta Platforms Inc (NASDAQ:META), Playa Hotels & Resorts NV (NASDAQ:PLYA), T-Mobile US Inc (NASDAQ:TMUS), Vistra Corp (NYSE:VST), and ARKO Corp (NASDAQ:ARKO). The firm's top sectors are Consumer Cyclical and Communication Services.

Details of the Transaction

On August 10, 2023, Davidson Kempner Capital Management LP reduced its stake in Playa Hotels & Resorts NV by 400,000 shares, a change of -2.64%. The shares were traded at a price of $7.36 each. After the transaction, the firm holds 14,742,519 shares of Playa Hotels & Resorts NV, representing 3.54% of its portfolio and 9.98% of the company's total shares.

Profile of Playa Hotels & Resorts NV

Playa Hotels & Resorts NV is a Netherlands-based company that operates all-inclusive resorts in prime beachfront locations in popular vacation destinations in Mexico and the Caribbean. The company's segments include Yucatan Peninsula, Pacific Coast, Dominican Republic, and Jamaica. The majority of its revenue comes from the Yucatan Peninsula segment. The company's market capitalization is $1.08 billion, and its current stock price is $7.28. The company's PE percentage is 24.27. According to GuruFocus, the company's GF Value is 11.46, indicating a possible value trap.

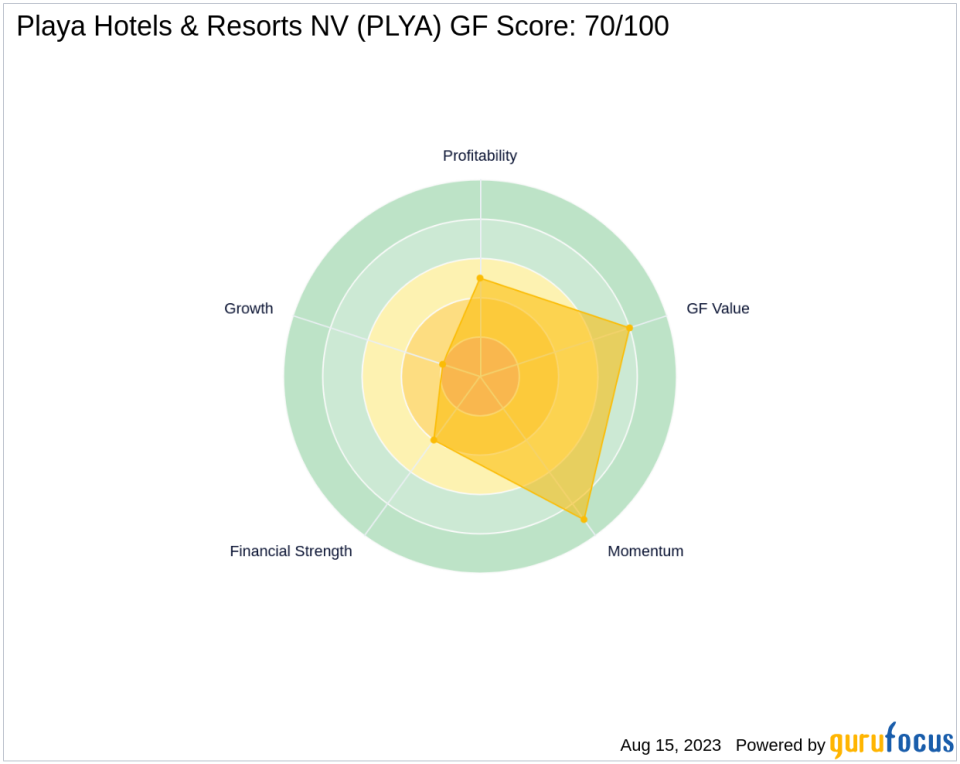

Stock Performance and Rankings

Since its IPO on November 10, 2015, Playa Hotels & Resorts NV's stock has decreased by 24.56%. However, the stock has gained 18.18% year-to-date. The company's GF Score is 70/100, indicating a potential for average performance. The company's Financial Strength is ranked 4/10, its Profitability Rank is 5/10, its Growth Rank is 2/10, its GF Value Rank is 8/10, and its Momentum Rank is 9/10.

Stock Financials and Industry Position

Playa Hotels & Resorts NV's Piotroski F-Score is 7, indicating a healthy situation. The company's Altman Z score is 1.02, suggesting it is in the distress zone. The company's cash to debt ratio is 0.25, and its interest coverage is 1.55. The company operates in the Travel & Leisure industry.

Stock Growth and Momentum

The company's revenue growth over the past three years is 1.70%, and its EBITDA growth is 6.80%. The company's RSI 5 Day is 25.48, its RSI 9 Day is 27.54, and its RSI 14 Day is 30.10. The company's Momentum Index 6 - 1 Month is 6.98, and its Momentum Index 12 - 1 Month is 12.81.

Conclusion

In conclusion, Davidson Kempner Capital Management LP's recent reduction in its stake in Playa Hotels & Resorts NV is a significant move. The transaction has reduced the firm's exposure to the Travel & Leisure industry and may impact the performance of its portfolio. However, given the company's GF Score and other financial indicators, the firm's decision may be a strategic move to optimize its portfolio. Investors should monitor the situation closely for any potential implications.

This article first appeared on GuruFocus.